*David Liu, [email protected], a prominent tax practitioner in China, has reviewed our article and provided us with practical insight.

Although Lorenz & Partners always pays great attention on updating information provided in newsletters and brochures we cannot take responsibility for the completeness, correctness, or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation with a qualified lawyer. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent.

I. Introduction

On 29 December 2015, the new double taxation agreement (DTA) between Germany and China was ratified in Germany and has been applicable since 1 January 2017.

In this context a new provision regarding the taxation of license fees was introduced in Art. 12 para. 2 of the DTA. According to this provision, the withholding tax on royalties for the “use or right to use industrial, commercial or scientific equipment” shall now be 10% of 60% of the gross amount of the royalties payable (thus the effective tax rate is 6%). This new provision represents a change to the previous DTA, as up to then, royalties were generally taxed at 10% of the gross amount and there was no differentiation between different types of royalty.

Considering the increasing importance of intangible assets in international business transactions, there is a need for clear rules on the taxation of royalties and, in particular, on the adequacy of intra-group transfer pricing vis-à-vis cross-border licensing transactions.

The following Newsletter uses the example of the DTA China-Germany to illustrate the international taxation practice for royalties and the resulting difficulties of differentiation.

II. Historical background

In view of the increasing intensification of economic relations between Germany and China over the past 20 years, negotiations on a new DTA were started in 2007 with a view to renew the old agreement of 1985 and adapt it to the current economic conditions.

The adjustments made to the DTA relate in particular to the location of taxation, withholding taxation and cooperation between the tax authorities.

III. The taxation of royalties under Art. 12 DTA China-Germany

Art. 12 para. 1 of the DTA China-Germany clarifies that the royalties collected by the licensor (= “beneficial owner”) are taxable in its state of residence.

At the same time however, the source state has the right to tax such royalties arising in the source state (e.g., the licensee is a resident of the source state) – but limited to 10% of the gross amount of the outgoing royalties.

In this respect, the regulation represents a deviation from the 2017 OECD Model Tax Convention (OECE MTC), which is the basis for the more than 3,000 bilateral DTAs worldwide. The MTC does not provide for any withholding tax on royalties in the source state. Thus, in many DTAs Germany entered into with other states, the right to tax royalties is vested solely in licensor’s state of residence, in other words, 0% applies to outgoing royalties in the source state. This is the case, for example, in the DTAs between Germany and Switzerland, Austria, France, the USA, Japan and other countries (in total in 30 different DTAs with Germany).

The taxation rules contained in Art. 12, paras. 2, 3 of Art. 12 of DTA China-Germany are different from the 30 DTAs to which Germany is a party, and critical to China-Germany cross-border technology licensing transactions. According to Article 12, royalties payable by a licensee in China to a licensor in Germany shall be subject to a 10% withholding tax; moreover, a differentiation is made between different types of licenses and different tax rates will apply.

Art. 12 para. 3 defines the types of royalties as follows:

“The term ‘royalties’ as used in this Article means:

a) payments of any kind received as a consideration for the use of, or the right to use, any copyright of literary, artistic or scientific work, including cinematograph films, and films or tapes for radio or television broadcasting, any patent, trade mark, design or model, plan, secret formula or process, or for information (know-how) concerning industrial, commercial or scientific experience, and

b) payments of any kind received as a consideration for the use of, or the right to use, any industrial, commercial or scientific equipment.”

Unlike the “ordinary” royalties listed in para. 3 lit. a) (copyrights, trademarks, designs, etc.), the royalties listed in para. 3 lit. b) may now be taxed in the source state at a maximum of 6%.

This differentiation is important insofar as it represents a deviation from the general license concept under the OECD-MTC. The OECD-MTC deliberately does not differentiate between different types of royalties.

This is because such a differentiation can lead to numerous delimitation difficulties in individual cases, as will be shown below on the basis of different regulatory complexes.

1. Legal situation in Germany

In Germany, income from the transfer of rights as well as profits from the sale of rights (license income) which are exploited in a German permanent establishment or which are entered in a German register are subject to limited tax liability according to §§ 49 para. 1 no. 2 lit. f, 50a para. 1 no. 3, para. 2 sentence 1 of the German Income Tax Act (Einkommensteuergesetz, EStG).

Income tax or corporation tax is levied on the income from the transfer of rights (but not on the sale) at the time of payment by deducting tax at a rate of 15% (see §§ 50a para. 1, no. 3, para. 2, sentence 1 EStG).

In contrast, German tax law does not explicitly provide for remuneration paid for the use of “equipment”, so that no differentiation is made in this respect under German law.

2. OECD-MTC

The OECD MTC originally contained a provision according to which royalties also included remuneration “for the use of or the right to use industrial, commercial or scientific equipment” (i.e. as in the DTA China-Germany).

However, in the 1992 version of the OECD-MTC, remuneration for use of such equipment was deliberately removed from the definition of royalties and has since been treated as business profits as defined in Art. 7 of the OECD-MTC, with the consequence that these are in principle only taxed in the state of residence. This is in the interest of the taxpayer, as such equipment is often associated with refinancing costs. The deduction of these costs reduces the assessment basis for the crediting of foreign taxes.

3. China’s reservations on the OECD-MTC

The problem now is that China (like other developing countries) has declared that it will not follow the standard interpretation of the OECD-MTC with regard to the taxation of royalties:

“Albania, Armenia, […], the People’s Republic of China, […] Thailand and Vietnam reserve the right to include in the definition of royalties payments for the use of, or the right to use, industrial, commercial or scientific equipment.”

The Chinese tax administration stated that the influence of the OECD-MTC is reflected in “the fact that many non-member countries or regions, (including China) have also expressed their reservations or comments on some provisions of the MTC and the Commentary, i.e. reflecting their respective official positions”.

In particular, China has reserved the right to introduce a definition of royalties in DTAs concluded with other countries that also includes the use or right to use industrial, commercial or scientific equipment. The intention was to allow China to tax the outgoing royalties while not applying the higher 10% withholding tax rate, to take sufficient account of the increasing economic importance of the temporary cross-border leasing of commercial or industrial equipment.

China’s reservations to the OECD-MTC point out that although leasing (or the pure rental of technical equipment) of industrial, commercial and scientific equipment used to be of minor importance, it has developed over the last two decades into an important national and international business form that fulfils very different economic functions in a variety of often complex contexts. It has become a recognized economic sector in most industrialized countries. It is therefore hardly surprising that from the point of view of the Chinese tax authorities it makes sense to withhold tax on payments made to non-resident licensors for the use of, or the right to use, industrial, commercial and scientific equipment by Chinese licensees.

4. Legal situation in China

Due to the reservations regarding Art. 12 OECD-MTC, China withholds tax at an effective rate of 6% on the royalties payable by Chinese licensees to non-resident licensors for the use of industrial, commercial or scientific equipment.

Although taxation practices may vary from one locality to another in the different regions of China, the implementation of bilateral tax treaty provisions is fairly uniform, leaving no room for different interpretations in respect of this effective 6% withholding tax.

What is important now is that the Chinese tax authorities use the total amount of the temporary transfer of equipment as the basis for calculating the withholding tax payable. However, the total amount is not divided into individual components.

Furthermore, it must be taken into account that Chinese VAT (Value-Added Tax) is usually also payable on the royalties, and such VAT is usually withheld by the licensee from the total price and paid to the Chinese tax authorities, unless otherwise agreed. This represents a clear deviation from the German VAT system, because in China it is the service provider (licensor) who has to pay the VAT – and not, as is common in other countries, the Chinese licensee in the so-called reverse charge procedure. It is even more astonishing that the Chinese licensee can still claim an input tax deduction despite this procedure (although it does not have to pay any VAT itself).

In our view, both the use of the total amount as the basis for withholding tax on payments for the transfer of equipment and the Chinese VAT are systemically wrong and deviate greatly from German (and also global) taxation practice. It is therefore strongly advisable to contractually agree with the Chinese licensee in advance that the latter must pay the VAT to the Chinese tax authorities in the reverse charge procedure (in addition to the net amount).

In addition, it should be specifically agreed that the Chinese customer also has to pay the license withholding tax to the tax authorities, whereby only the license amount should be used as the basis for calculation.

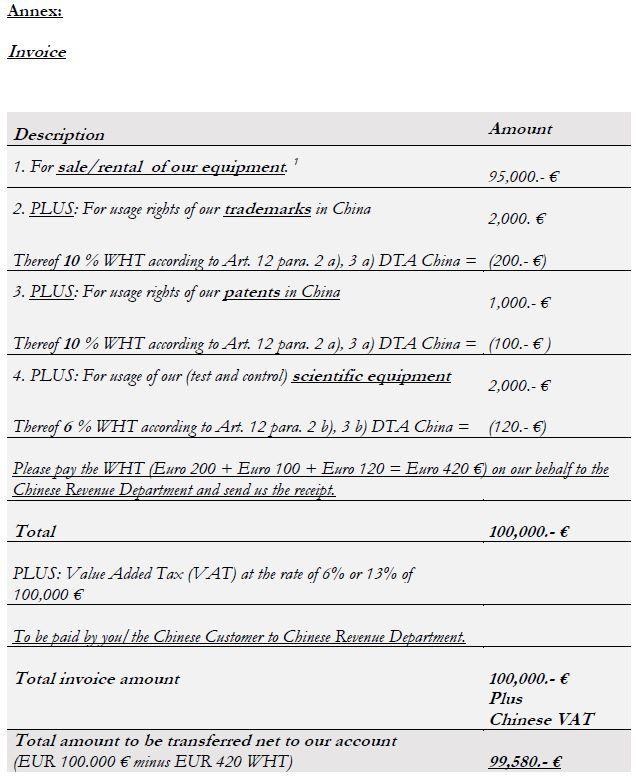

In this respect, the invoicing company should make a very clear distinction in the invoice to the Chinese customer between:

- Mere leasing / rental / sales costs

- Fee for the use of the trademark (which is subject to a 10% withholding tax)

- Fee for the use of the patent registered in China by the foreign patent holder (which are subject to a 10% withholding tax)

- Fee for the use of industrial, commercial or scientific equipment (which is subject to an effective 6% withholding tax)

- Plus Chinese VAT (additional 3, 6, 9 or 13% depending on the case)

We therefore strongly advise, to discuss in advance with the client exactly, what will be invoiced, how much of it will be royalties and on what base amount the Chinese withholding tax will be withheld, and who should pay the Chinese VAT.

In particular, it should be clarified by when which net amount in which currency will be paid to the account of the service provider in order to avoid unpleasant surprises. In this context, clear calculation basis should be set out that comply with the OECD transfer pricing methods.

Even if the Chinese tax authorities should consider this differently, only a prior and detailed contractual agreement offers a basis for argumentation. Particularly if no agreement is reached in this regard, it is advisable to clarify in advance with the German tax authorities how the cross-border licensing arrangement is taxed in China and whether or to what extent any tax withheld in respect of the license payment can be used as foreign tax credit to offset against German tax payable in respect of the same license payment in a specific case.

In the annex you will find a sample invoice, which is intended to illustrate how an invoice should be issued. This should be discussed with the Chinese licensee in order to avoid incorrect amounts or calculation criteria being used as a basis for tax deduction.

The VAT rate may vary depending on the type of goods or services. The standard rate is 13% whereas the rate for leasing and royal-ties is 6% (see our L&P Newsletter on Chinese VAT). In the invoice, the specific determination of the VAT should be left to the Chinese customer, as we do not believe it is appropriate for the German licensor to decide how much VAT is to be paid exactly to the Chinese tax authority. After all, it is an input VAT that the Chinese licensee can use to offset its output VAT.

IV. Difficulties of differentiation

Example:

A German company (Licensor) leases a complex, industrial machine to a company based in China (Licensee) for a total price of 100,000 euros, including the provision of personnel.

The machines contain at the same time:

1. Know-how in the form of software, which is used on an ongoing basis, but is generally only provided for a limited period of time;

2. Patents, which are also registered in China by the German licensor;

3. The Chinese customer may use the trademark, which is also registered in China by the German licensor;

4. Finally, scientific equipment is made available for a limited period of time for testing and control purposes.

However, the Licensor charges the Licensee a lump sum instead of breaking100,000 euros down into how much is attributable to the use of know-how, patents, trademark and scientific equipment respectively.

From the point of view of a German company, the question arises which taxation is to be expected considering the German legal situation as well as the international legal situation according to the DTA China-Germany. The situation therefore becomes more untransparent if no concrete agreements have been reached between the licensor and licensee with regard to the various components of the business relationship (leasing of machinery, license agreement with regard to software, know-how, trademarks, etc.).

In such cases, there is a risk that the Chinese tax authorities will withhold tax at a rate of 6% or 10%, regardless of whether the German licensor has realized a net gain from the transaction.

The main problem here is that the gross amount of the so-called “royalties” is used as the basis for imposing the Chinese withholding tax and VAT. In our example, there would be no differentiation between rental income, provision of staff and transfer of know-how (which is actually to be expected). Instead, the total amount of EUR 100,000 would simply be taxed at 6% or 10% and, if applicable, Chinese VAT would be deducted from this amount in the absence of a prior agreement between the licensor and licensee that the licensee shall bear and paid the VAT.

If the German licensor’s profit margin is low, Chinese withholding tax may even wipe out the entire profits built into the royalties, leaving the German licensor breaking even or making a loss. Another complicating factor is the VAT payable by the licensor.

For the foreign licensor, the only option in such cases is to use the input tax deduction (from which the Chinese licensee benefits) as a basis for negotiation with the contractual partner in advance. This is because foreign companies that are not based in China cannot register for VAT purposes and are therefore not entitled to a refund of input VAT.

At the same time, the profit of the German licensor would also be taxed (unlimited) in Germany. In this context, Art. 23 para. 2 lit. b (iii) DTA China-Germany provides for a foreign tax credit option. However, it cannot be ruled out that the German tax authorities may consider the income tax withheld by China in respect of the royalty payments to be excessive (in view of the tax calculation basis) and therefore not allow the entire amount of the withholding tax paid to China to be credited against German income tax payable in respect of the same payments received by the German licensor.

The only way to prevent this or to counteract it is to make contractual agreements in advance that differentiate payments for different items as precisely as possible (see point III.).

In this context, the question is why Germany agreed such a disadvantageous clause (for German companies) with China. After all, Germany was apparently aware of the problem and tried to avoid it in other DTAs. It cannot be ruled out that China’s economic influence may have played a role here.

V. Implications for practice

As a rule, remuneration for the use or the right to use industrial, commercial or scientific equipment (e.g. in the case of the sale of a complex machine) is not subject to withholding tax under the OECD-MTC.

However, the example of the new DTA agreed between Germany and China and China’s reservations under OECE MTC in this regard clearly show that deviations in international taxation practice are quite possible. Despite an existing DTA, delimitation difficulties can arise if the term “license” is interpreted and defined differently at the international level.

It is therefore particularly important to negotiate a binding agreement on separately listing different components of cross-border licensing transactions, the taxation of royalties, and which party should bear the withholding tax, VAT or similar turnover tax imposed by the source state.

In particular, attention should be paid to:

what is specifically sold or transferred (and what is not);

under what conditions (especially at what prices) this is done;

whether licenses in the form of trademarks, know-how etc. are transferred; and

what percentage of the total transaction is accounted for by the licenses and on what basis this is calculated.

In addition, as regards MNC intra-group licensing agreements, a transfer pricing study should be at an early stage to avoid the source state’ challenge of the amount of royalties payable and deductible by the Chinese subsidiary licensee.

This can help to increase the chance that the tax withheld in China will be recognized in Germany. Therefore, when drafting the contract, it is extremely important to follow the wording of the DTA and to take into account the source state’s reservations under the OECD-MTC.

We hope that the information provided in this newsletter was helpful for you.

If you have any further questions, please do not hesitate to contact us.

LORENZ & PARTNERS Co., Ltd.

27th Floor Bangkok City Tower

179 South Sathorn Road, Bangkok 10120, Thailand

Tel.: +66 (0) 2-287 1882

Email: [email protected]

www.lorenz-partners.com