Although Lorenz & Partners always pays great attention on updating information provided in newsletters and brochures we cannot and do not take responsibility for the completeness, correctness or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation with a qualified lawyer. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent.

I. Introduction

“Cross-shareholding” is a form of a business relationship that enables the shareholding between two or more companies in a way, that each company involved owns shares in the other company.

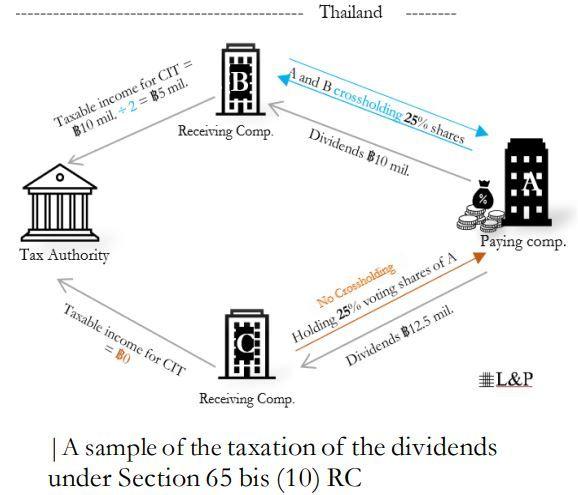

Depending on the shares’ volume, there are differences in the taxation of the dividends, Thai mainly based on Section 65 bis (10) of the Revenue Code (“RC”). The tax impacts will be explained in the following chapters.

II. Capital reserve

5% of the net profit up to 10% of the registered capital must be reserved and booked as capital reserve. The remaining profit when distributed as dividend, is generally subject to a withholding tax of 10%.

III. Section 65 bis (10) RC

1. IF holding less than 25% of the shares of the related company

“A limited company organized under Thai law may include as revenue only half of dividends received from limited companies organized under the Thai law (…)”

The company receiving the dividend only has to include 50% of the received dividend as income in its annual tax filing. If the receiving company generates a profit, the 10% withholding tax (withheld by the paying company and submitted to the Revenue Department) can be credited by the receiving company against its payable corporate income tax (so-called “tax credit”). If the company does not generate any profit in the years, it receives dividend for the related company, the withholding tax already paid can be reclaimed in principle, but the process is (very!) complex in practice.

2. If holding equal to or more than 25% of the shares of the related company

An exemption applies in the following case:

“The following limited companies organized under Thai law are not required to include any part of such dividends or share of profits as revenue:

(a) […]

(b) […] any limited company […] that holds at least 25 percent of the total shares with voting rights in the limited company paying dividends, provided that the limited company paying dividends does not hold any share in the limited company receiving the dividends whether directly or indirectly. […]”

the following conditions have to be met:

➢ The receiving company holds no less than 25% (meaning equal or more than 25% of all shares distributed.) of the shares in the company paying the dividend;

➢ the shares are shares with (any) voting rights1 ; and

➢ the company paying the dividend does not hold any share in the company receiving the dividends; (i.e., NO cross shareholding)

➢ the receiving company shall have the shares for at least 3 months prior to receiving the dividend and must keep them for at least 3 months after receiving

them before selling them. If these conditions are met, the receiving company does not have to include the dividend as income and no withholding tax applies.

The following sample illustrates the differences in the taxation of the dividends received by Company A and Company B.

Cross-Shareholding status – When does it matter?

With regards to the last condition (the paying company does not hold any shares in the receiving company), the crucial question is what the consequences are if at the date of the dividend distribution, there is no “cross shareholding” but there was “cross shareholding” in the same fiscal year during which the dividend distribution occurs.

The Revenue Department usually applies the fiscal year to disqualify the exemption dividend rule if the “cross-shareholding” happens in the same fiscal year as the dividend distribution.

The Supreme Court (Supreme Court Decision No. 5733/2544), however, disagrees with the Revenue Department’s interpretation and rules that the “cross-shareholding” must happen at the date of the dividend distribution date, and not only in the same fiscal year as the dividend distribution.

IV. Problem of Cross-Shareholding

If any of the above conditions are not met, the basic case (first sentence of Section 65 bis (10) RC) applies, i.e., the receiving company has to include half of the dividends as income in its annual tax filing.

If both “cross-shareholding” companies have to pay taxes on the received dividend from the other related company s, it will go in circles:

➢ A pays dividend to B;

➢ B has to include half of such dividends received from A into its taxable income and pay tax on such income;

➢ IF B decides to pay out dividend in the same year to Part A, this will increase Party A’s taxable profit;

➢ A has to include half of such dividends received from B into its income and pay tax on such income;

➢ and so on.

V. Tax Exemption for Source Dividends

Usually, the tax exemption rule only applies to dividends received from a company set up under Thai law. The benefit from this rule is not given if the paying company is set up under foreign laws, even if it is carrying on business in Thailand, e.g., via a branch office.

The Revenue Department issued Royal Decree No. 442 in order to provide an exemption on corporate income tax for source dividend to a Thai company that receives dividend income from the foreign company under the following conditions:

(1) The limited company or a public limited company established under Thai law holds shares of at least 25% of the voting rights in the foreign company.

(2) The Thai company holds such shares for a period of not less than six months from the date of obtaining such shares until the date of receiving the dividend.

Moreover, the Revenue Department issued the following further conditions regarding tax payments for and on dividends that could be exempted from corporate income tax:

(3) A dividend must derive from net profits taxable in the country of the dividend payer, and such tax rate must be not less than 15% of net profit. (already in compliance with the new OECD minimum tax requirements.)

(4) Important: Regardless of whether the country of the dividend payer has any legislation to reduce or exempt the net profit.

The rationale according to Royal Decree No. 442 is to encourage Thai businesses to invest in foreign countries.

The rationale behind the 15% tax rate threshold is that the Revenue Department does not want to encourage Thai investors to invest in tax havens or low-tax countries and to be compliant with OECD regulations. However, even in Thailand: many businesses with BOI incentives do not have to pay any profit tax or withholding tax when paying out dividend, resulting from the BOI promoted business for up to 8 Years. It remains to be seen whether this will be compliant

with the OECD’s minimum tax requirements.

VI. Result

“Cross-shareholding” may naturally occur in groups of companies, but also provides an interesting approach to minimize restrictions of the Thai Foreign Business Act.: Two Thai companies hold 51% of each other’s shares respectively, and the remaining 49% of the shares of both companies are held by a non-Thai investor. Since the majority of both Thai companies’ shares are held by a Thai company, both companies are considered Thai-owned and thereby do not fall under the Foreign Business Act, although the foreign investor effectively controls both companies.

However, if “cross-shareholding” is given, the abovementioned tax impacts must be taken into consideration.