Although Lorenz & Partners make every effort to provide correct and up to date information in our newsletters and brochures, we cannot take responsibility for the accuracy of the information provided. The information contained in this newsletter is not meant to replace a personal consultation with a qualified lawyer. Liability claims regarding damage caused by the use or misuse of any information provided, including information which is incomplete or incorrect, will therefore be rejected, unless this misinformation is deliberate or grossly negligent.

I. Introduction

International taxation is quite complex and depends on many specific conditions such as local laws, applicability of Double Taxation Agreements (“DTAs”) etc. This newsletter will therefore explain the mechanisms of taxation of dividends using Hong Kong and Germany as examples for distributing countries and Thailand being the example for a receiving country. The principles we explain can generally be applied to other jurisdictions and constellations, however, details may vary.

II. Local Law

A dividend received is generally taxable income according to Section 40 (4) (b) of the Thai Revenue Code (“RC“). In case a Thai tax resident or Thai company receives a dividend from a company operating under foreign law (“foreign company“) a foreign dividend may be taxable in Thailand subject to the following laws:

1) Withholding Tax deducted by the source country (“Dividend Tax”)

A dividend distributed from a foreign company can be subject to local withholding tax in the source country. However, some countries do not apply such withholding tax.

Example:

– The local withholding tax rate on dividends paid by a German company is 25%.

– The local withholding tax rate on dividends paid by a Hong Kong company is 0%.

– The local withholding tax rate on dividends paid by a Thai company is 10%.

In some countries, such as Switzerland and Belgium, withholding tax rates on paid out dividends are up to 35% and 30%, respectively.

2) Double Taxation Agreements

The local withholding tax rate on foreign dividends imposed by the source country can be limited by Double Taxation Agreements (“DTAs”) between Thailand and the source country.

a) Article 10 of the DTA Thailand – Hong Kong (effective since 1 January 2006) limits the withholding tax rate on dividends paid by a Hong Kong company at 10%. Currently, this article is not relevant because the local withholding tax rate on dividends in Hong Kong is 0% and the Thai local rate is 10%.

b) Article 10 (2) (b) of the DTA Thailand – Germany (effective since 1 January 1967) limits the withholding tax rate on the gross amount of the dividend to 15% for Thai shareholders owning at least 25% of the voting shares, and at 20% in other cases.

Accordingly, the withholding tax on a dividend distributed from

Germany to a shareholder in Thailand would be reduced from 25% to 20% or 15% respectively, depending on the amount of shares held.

3) Foreign Tax credit for juristic person and individuals Thai tax resident

a) Foreign Tax Credit for juristic person

According to Section 3 of the Royal Decree 300 B.E. 2539, (effective since 24 September 1996) tax paid in a foreign country can, in principle, be offset against corporate income tax in Thailand. Therefore, a Thai company paying withholding tax in Germany on dividends from Germany can offset this amount against its local corporate income tax. A Thai company receiving dividends should thus always request a proper withholding tax certificate as proof of the tax paid in the foreign country.

b) Foreign Tax credit for individuals

There is no specific foreign tax credit provision for an individual Thai tax resident under Thai law. However, Articles 22 or 23 (Method for elimination of Double Taxation) of the DTAs between Thailand and the contracting states allow the taxpayer to offset the foreign tax paid against his income tax in Thailand.

The Revenue Department in its rulings 0702/2689 B.E. 2552 and 0706/7556 B.E.2547 clarified that the DTA provisions allow foreign tax credit for

individual Thai residents, although the local law has no such provisions. Even though this is systematically wrong, it has become common practice.

III. Individual Thai tax resident as a shareholder

1) Thai tax residency and taxable income

Any person staying in Thailand for a period of 180 days or more and bringing assessable income into Thailand is considered a Thai Tax Resident (“180 Day Rule”) under Section 41 para. 2 and 3 of the RC.

A dividend paid from a foreign company to an individual Thai tax resident is taxable if it is transferred to Thailand in the same year that it was paid.

Foreign withholding tax on that dividend (if any) can be offset against personal income tax in Thailand.

2) Non-taxable income

If an individual Thai tax resident receives dividends from a foreign company and does not transfer that dividend to Thailand in the year it was paid, that foreign dividend income is not taxable in Thailand. It is therefore advisable to have dividends paid into a bank account abroad and only bring it into Thailand in the following tax year or later.

3) Other countries’ tax residency rules

In general, a person can be a tax resident in more than one country if his status and economic activities have triggered multiple tax resident rules. In the same manner it is possible to be tax resident in no country and be therefore not under the protection of any DTA. A person can easily be tax resident in 4 countries in any given year if:

a) U.S.A.: A person becomes a tax resident by simply holding US citizenship (Worldwide income basis)

b) Germany: A person becomes a tax resident by simply having the possibility to use an apartment or house OR by staying over 6 months in Germany

c) France: A person becomes a French tax resident by having his personal centre of living or a centre of economic interests in France.

For example, a US citizen lives for many years with his family in France. In a given year he also works in Thailand for more than 180 days of that tax year and has unrestricted access to an apartment in Germany where he has some of his personal belongings. In this specific year this person is a Tax resident in 4 countries and must file his personal tax return in all 4 countries.

To determine the tax residency under a specific DTA, it is necessary to follow the respective article in the applicable DTA which contains a tie breaker rule (usually Art. 4).

IV. Corporate Income Tax on dividends in Thailand

According to Section 65 of the Thai RC, foreign or local dividends are assessable income of a Thai company that must be included in the calculation of Corporate

Income Tax (“CIT“). To this general rule, there are CIT exemptions on dividends as follows:

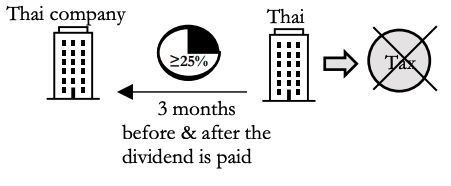

1) CIT exemption on dividends paid by a Thai company

Section 65 bis (10) of the RC provides CIT exemption for dividends paid by a Thai company to a Thai company shareholder, subject to the following criteria:

a) During the 3 months preceding and following the dividend payment, the Thai company owns 25% or more of the voting shares.

b) The dividend payer does not directly or indirectly own shares in the dividend receiver (no cross shareholding).

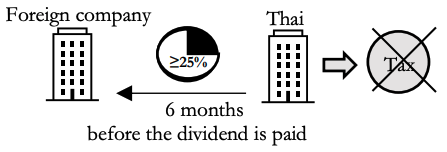

2) CIT exemption on dividends paid by a foreign company

Section 4 of the Royal Decree 442 B.E. 2548 (effective since 24 November 2005) establishes the following criteria for CIT exemption

a) In the 6 months preceding the dividend payment, the Thai company owns not less than 25% of the voting shares; and

b) The foreign company (the dividend payer) pays CIT of no less than 15% in its home country

V. Case study

1) Dividends paid from a Hong Kong company

(assuming that the company paid only CIT of 7.5% on its earnings in HK.)

a) A Thai company owns 30% of the voting shares in a Hong Kong company for a period of over 6 months before the dividend is paid.

Answer: Even though the Thai company owned more than 25% of the voting shares for over 6 months prior to the dividend payment, because the CIT rate in Hong Kong is less than 15%, the dividend paid from the Hong Kong company is not tax-exempt in Thailand and must be included in the Thai company’s tax calculation in that accounting period.

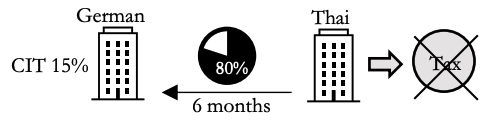

2) Example: Dividend paid from a German company

a) A Thai company owns 10% of the voting shares in a German company for a period of 6 months before the dividend is paid (the German effective and paid CIT is 28 %). The German company has withheld 20% withholding tax on the amount of the dividend (limited by Article 10 (b) 2. of DTA Thailand and Germany).

Answer: The Thai company must include this dividend in its tax calculation because the percentage of shares in the German company is less than 25%. However, the Thai company can offset the 20% withholding tax (tax credit) against the payable Thai CIT in Thailand in that tax year (Section 3 of the Royal Decree 300 B.E. 2539 [ 1996]).

b) A Thai company owns 80% of the voting shares in a German company for the period of over 6 months before the dividend is paid. The German company has withheld 15% tax on the amount of the dividend (Limited by Article 10 (b) 1. of DTA Thailand and Germany).

Answer: The derived dividend is exempt from CIT in Thailand (Section 4 of the Royal Decree 442 B.E. 2548 [2005]). In this case, the Thai company cannot offset the 15% withholding tax from the German company against the payable CIT.

However, the German withholding tax is a deductible expense for the Thai company’s CIT calculation of that tax year according to the ruling of the Revenue Department 0706/2003 B.E. 2550 [2007].

VI. Conclusion/ Summary

1) Tax exemption for individuals:

A dividend paid to a Thai tax resident is not taxable in Thailand if it is brought into Thailand after the year it was paid. Foreign withholding tax on a dividend paid by an individual can only be offset against Thai income tax for the same year.

2) CIT exemption on foreign dividend

A Thai company is eligible for tax exemption on dividends paid by a foreign company if it holds 25% of the voting shares or more for a period of at least 6 months prior to the dividend payment, AND the dividend payer pays CIT in its country at a rate of not less than 15% of the net profit.

3) Foreign withholding tax on dividends

a) Foreign tax credit: If a foreign dividend is not exempt from CIT, foreign withholding tax on that dividend can be offset against the CIT in Thailand for that tax year.

b) Deductible expense for CIT: If a Thai company gains a tax exemption on a foreign dividend and that dividend was subject to the foreign withholding tax, the foreign withholding tax can be used as a deductible expense for the CIT calculation in Thailand of that tax year.