This newsletter provides information regarding real estate transactions in Thailand.

The Department of Lands (hereafter “DOL”), under the responsibility of the Ministry of Interior, is the competent administrative body for every real estate transaction. DOL can be found in every province of Thailand. The below transaction shall be made at the nearest office where the land is located.

I. Scope of the Transaction

The DOL is the only competent agency for the following transactions:

1. Registration of land ownership

2. Registration of condominium

3. Registration of juristic act

a. Sale and purchase of lands and buildings

b. Transfer of lands and buildings

c. Inheritance

d. Mortgage

e. Lease

4. Land Survey

II. Foreigner’s Rights

1. General Overview

Subject to the ratified treaties and the Land Code B.E. 2497, foreigners (including companies where more than 49% of the shares are held by foreigner shareholders) may acquire land after they applied for and obtained a special approval by the Minister of Interior (Sec.86 Land Code). The size of the land which may be permitted depends on the purpose of use as shown below (1 Rai equals 1600 sqm):

- Residence (per family) 1 Rai

- Commercial Use 1 Rai

- Industrial Use 10 Rai

- Agricultural Use (per family) 10 Rai

- Religious Use 1 Rai

- Public Charity 5 Rai

- Cemetery (per family) ½ Rai

However, the use of the land is limited to the specified purpose. Should the foreigner whish to change the purpose of the land use, such foreigner shall re-register the land. Upon such change, the proportion of land may have to be reduced; the owner must distribute the excessive land within 1 year. There are other cases in which the land has to be distribute within 1 year (e.g. unlawful acquisition, change of nationality, inheritance).

2. Incentives

Despite requesting for a special approval, foreigners may acquire land for residence purposes when investing in Thailand:

- Purchase of bond issued by the Thai government, Bank of Thailand or state enterprises

- Investment in a mutual fund for immovable property

- Investment in shares of a company promoted by the Board of Investment

- Investment in a business promoted by the Board of Investment

However, the investment capital must be at least THB 40,000,000 and must be maintained for 3 consecutive years. The residence area must be located in Bangkok, Pattaya or in a municipality specified for residence purposes under the law of Town and Country Planning.

III. Fee

1. Government Fee

The registration of the following transactions is subject to 2% of the appraised value (“AV”: value appraised by the DOL):

- Sale

- Trade

- Gift

- Transfer for debt/share payment, court order

- Inheritance

The registration that is subject to 1 % of the AV is as follows:

- Lease

- Inheritance of leasing right

- Servitudes

- Usufruct

- Superficies

- Habitation right

- Any other encumbrance

- Mortgage

2. Withholding Tax

a) Natural Person

The calculation of the withholding tax due by a natural person can be divided in three different steps.

First: To calculate the yearly net assessable income derived from the sale of property by using the following formula:

(AV– Lump-Sum deduction)/years of ownership

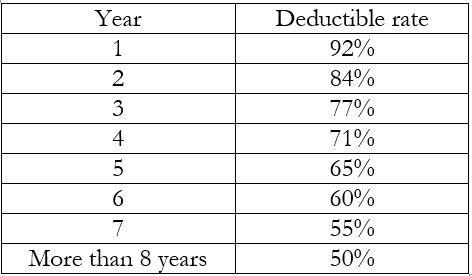

The lump-sum deduction depends on the years of ownership as follows:

Nevertheless, in case of inheritance or gift, the transferor may deduct the expenses in the flat amount of 50%.

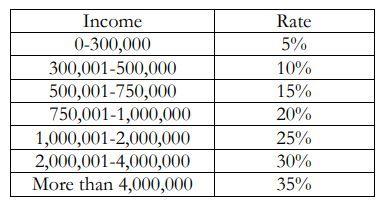

Second: To determine the rate of the yearly tax to be withheld as shown in the table below:

Third: To calculate the tax to be withheld for the whole period of ownership by multiplying the yearly tax to be withheld by the number of years of ownership.

Example:

The transferor of the land (neither acquired by inheritance nor gift) held this land for 5 years and agrees to sell the land in the amount of THB 2,800,000. The AV is THB 2,500,000.

Calculation:

1.The yearly net assessable income is

(2,500,000-1,625,000)/5 = 175,000

(2,500,000×65%)

2. Income tax per year is THB 8,750

(175,000×5%)

3 The total tax to be withheld is THB 43,750 (8,750×5)

b) Juristic entity

The withholding tax will be calculated at the rate of 1% of the AV or the actual selling price, whichever is higher.

Note: The capital gain (if any) incurred from the transfer of the land is subject to the corporate income tax at the rate of 20 %.

- c) Withholding tax exemption

The following types of registration are exempted from the withholding tax:

- Lease, amendment of lease agreement which increases the lease value

- Transfer of the inheritance in respect of the leasing right

- Servitudes

- Usufruct

- Superficies

- Habitation right

- Any other encumbrance

- Mortgage

3. Stamp Duty

Any registration regarding immovable property is subject to stamp duty amounting to 0.5% of the AV or of the actual selling price, whichever is higher.

Nevertheless, in case the transferor is subject to any specific business tax, the stamp duty shall not apply. Please note that the registration regarding the mortgage is also not subject to stamp duty.

4. Specific Business Tax

The Specific Business Tax (SBT) is collected at the rate of 3.3% of the AV or the actual selling price, whichever is higher, for the sale of the land which includes trading, gift, hire-purchase or distribution.

The SBT is due in the following cases:

- immovable property sold by the authorised persons of the land arrangement laws

- units sold by the operator of a registered condominium

- sale of buildings which are built to be sold, including sale of land where the said buildings are located

- sale of land which is not mentioned in no. 1, 2 or 3 only in case of sale in part for the purpose of building public utility

- sale of immovable property that the seller has for the business operation pursuant to Article 77/1 of the Revenue Code

- sale of immovable property that is not mentioned in No. 1, 2, 3, 4, or 5, made within 5 years after acquisition.

The sale is not subject to SBT in the following cases:

- sale of immovable property more than 5 years after the acquisition

- sale or expropriation under the expropriation laws

- sale of immovable property acquired by inheritance

- sale of immovable property which is a residence of the seller whose name has been registered in the house register of said residence for at least 1 year. In case the acquisition of the land and the building is not made at the same time, the seller must possess the land or the building for at least 5 years, whichever comes later;

- transfer of ownership or possession right to legitimate child, excluding adopted child

- transfer of ownership or possession right by inheritance to legitimate heir

- transfer of ownership or possession right to government authority