I. Introduction

The law governing the imposition of income based taxation in Hong Kong is contained in the Inland Revenue Ordinance (“IRO”), Chapter 112 and its subsidiary legislation, the Inland Revenue Rules (“IRR”), and in various orders made by the Chief Executive in Council. Every assessment issued under the IRO is related to a year of assessment. The year of assessment in Hong Kong is from 01 April to 31 March.

The IRO regulates three (3) distinct taxes on income, namely the Profits Tax, the Salaries Tax and the Property Tax. There are no taxes on other incomes such as capital gains, or rental income.

Hong Kong (like some other Commonwealth countries) adopts a territorial basis of taxation. Only profits which have a source in Hong Kong are taxable in Hong Kong. Profits sourced elsewhere are not subject to Hong Kong tax (but may be taxable as permanent establishment in other jurisdictions). This means that a person who carries on a business in Hong Kong but derives profits from another place is not required to pay tax in Hong Kong on those profits.

Section 14 IRO:

(1) Subject to the provisions of this Ordinance, profits tax shall be charged for each year of assessment at the standard rate on every person carrying on a trade, profession or business in Hong Kong in respect of his assessable profits arising in or derived from Hong Kong for that year from such trade, profession or business.

The principle itself is quite clear, but its application in certain cases can be contentious. This newsletter is designed to clarify the territorial principle of taxation. Please note that this newsletter will focus on the taxation of corporations as this is the most popular corporate format in Hong Kong.

II. Taxation Rates in Hong Kong

On 29 March 2018, the Inland Revenue (Amendment) (No. 3) Ordinance 2018 came into force introducing a two-tiered profits tax rate regime. The new regime applies to both corporations and unincorporated businesses. It will commence from the year of assessment 2018/19 (i.e., on a taxpayer’s financial year ending between 1 April 2018 and 31 March 2019). Under the two-tiered profits tax rate regime, the profits tax rate for the first HKD 2 million of assessable profits will be lowered to 8.25% (half of the rate specified in Schedule 8 to the IRO for corporations and 7.5% (half of the standard rate) for unincorporated businesses (mostly partnerships and sole proprietorships). Assessable profits above HKD 2 million will continue to be subject to the rate of 16.5% for corporations and standard rate of 15% for unincorporated businesses.

Only one entity in each group of companies is eligible for the tiered rates regime. As the main objective of the regime is to reduce the tax burden of small and medium-sized enterprises and start-up enterprises, the restriction was introduced to avoid a group splitting income amongst numerous entities in order to enjoy the lower tax rate. There is an extensive definition of “connected entity” in the legislation which is designed to ensure that a group of connected taxpayers can benefit from the reduction only in respect of one of such connected taxpayers. For this purpose, the group will need to identity which entity will benefit from the reduction and to make an election accordingly. The election, once made, is irrevocable in respect of a particular year of assessment.

An entity means –

(a) a natural person;

(b) a body of persons; or

(c) a legal arrangement, including –

(i) a corporation;

(ii) a partnership; and

(iii) a trust.

If a natural person carries on more than one sole proprietorship business, the person is taken to be a separate entity in relation to each sole proprietorship business.

An entity is a connected entity of another entity if –

(a) one of them has control over the other;

(b) both of them are under the control of the same entity; or

(c) in the case of the first entity being a natural person carrying on a sole proprietorship business – the other entity is the same person carrying on another sole proprietorship business.

Generally, an entity has control over another entity if the first-mentioned entity, whether directly or indirectly through one or more than one other entity,

(a) owns or controls more than 50% in aggregate of the issued share capital of the latter entity;

(b) is entitled to exercise or control the exercise of more than 50% in aggregate of the voting rights in the latter entity; or

(c) is entitled to more than 50% in aggregate of the capital or profits of the latter entity.

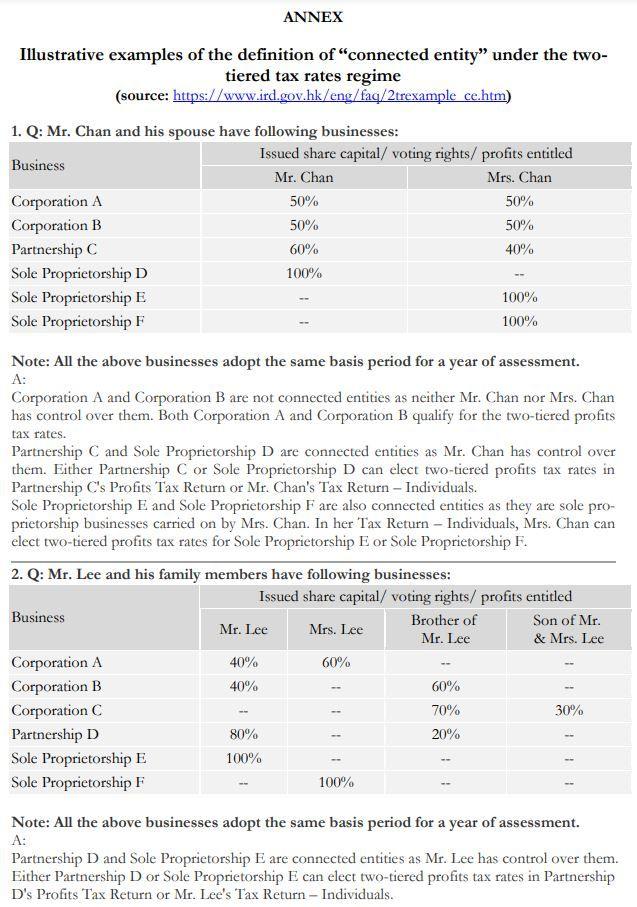

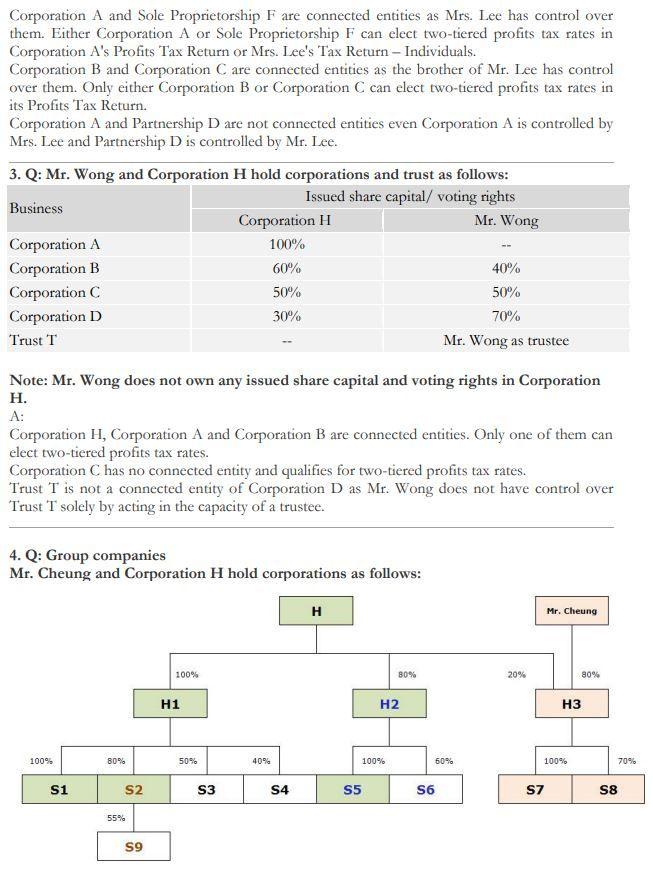

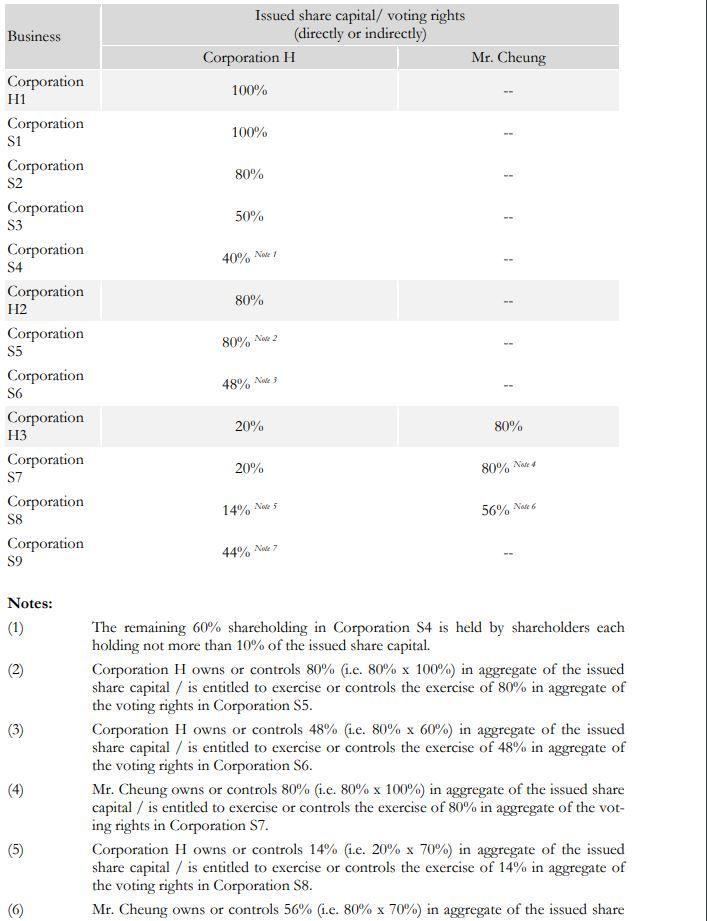

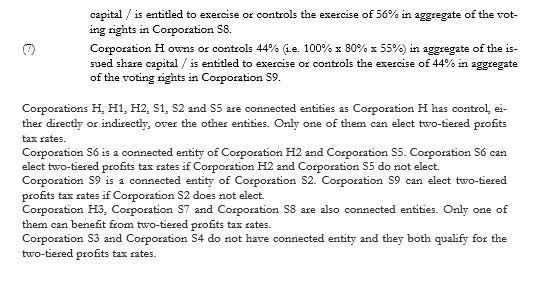

An illustrative example of the definition of “connected entity can be found in the ANNEX.

III. Profits Tax Overview

1. Profits Tax Liability

Under the IRO, a person is chargeable to Profits Tax under the following conditions:

- The taxpayer must carry on a trade, profession or business in Hong Kong; and

- The profits to be taxed arise from such trade, profession or business carried on by the person in Hong Kong; and

- The profits arise in or are derived from Hong Kong.

The first two conditions are straightforward. The third condition needs to be elaborated further.

2. Proof of Origin of Profits

The basic principles for proving the source of profits have been considered by the Courts of Hong Kong many times and can be summarised as follows:

- The question of the origins of profits is a practical matter of fact. There is no universal rule. Whether profits arise in or are derived from Hong Kong depends on the nature of the profits and of the transactions which give rise to such profits.

- The broad guiding principle states that the tax authorities will evaluate the place of the source of profits and what the taxpayer has done to earn these profits. In other words, the proper approach is to ascertain the operations which produced the relevant profits and where those operations took place (Operations Test). The source of profits must be attributed to the operations of the taxpayer which produced them and not to the operations of other members of the taxpayer’s group.

- The distinction between Hong Kong profits and offshore profits is made by reference to gross profits arising from individual transactions.

- The place where day to day investment/business decisions take place generally does not determine the source of the profits. It is not the deciding factor.

- The relevant operations do not comprise the whole of the taxpayer’s activities. The focus is on establishing the geographical location of the taxpayer’s profit-producing transactions as distinct from activities antecedent or incidental to those transactions.

- The absence of a business presence overseas does not generally mean that all of the profits of that particular business arise in or are derived from Hong Kong. However, in the vast majority of cases where the principal place of businessis located in Hong Kong and there is no business presence overseas, profits earned by that business are likely to be chargeable to Profits Tax in Hong Kong.

3. Profits of Trading Companies

(1) Totality of facts

The question of the origin of profits derived from trading of goods has caused the most controversy in the past. Generally, the determining factor is the place where the sales contract is effected.

As the Court of Appeal noted, the totality of facts must be considered in determining where the taxpayer earned the profits:

“... the question where the goods were bought and sold is important. But there are other questions: For example: How were the goods procured and stored? How were the sales solicited? How were the orders processed? How were the goods shipped? How was the financing arranged? How was payment effected?”[1]1.

“Effected” does not only mean that the contracts are legally executed. It also covers the negotiation, conclusion and performance of the contracts.

(2) Relevant and irrelevant facts

In considering the relevant facts, the nature and quality of the activities matter more than their quantity. The cause and effect of such activities are the most relevant factors.

Facts which are not directly related to the trading activities are considered irrelevant in determining the origin of profits. For example, renting office premises, recruiting staff, the setup of an office, accounting etc.

(3) When are profits taxable in Hong Kong? (General Practice)

The question of source of profits is a practical matter of fact.

- If the sales/purchase contracts are effected in Hong Kong, then the profits are taxable there.

- If the contract is effected outside Hong Kong, then the profits are not taxable in Hong Kong.

- If either the sale or purchase contract is effected in Hong Kong, then the initial presumption is that the profits are taxable there. However, the totality of facts need to be examined to determine the source of profits.

- If the purchaser is a Hong Kong citizen or company (including the Hong Kong buying office of an overseas customer), the sale contract will usually be seen as having been concluded in Hong Kong.

- If the effecting of the purchase and sale contract does not require travelling outside Hong Kong but is carried out in Hong Kong by telephone, or other electronic means including the Internet, the contract will be considered as having been effected in Hong Kong.

- Trading profits are regarded as being either wholly taxable or wholly non- taxable in Hong Kong. Apportionment is not appropriate.

4. Manufacturing Profits

(1) The place of manufacture

Concerning manufacturing businesses, the Profits Tax liability under Hong Kong Law is not determined by where the contract has been effected. Instead, the source of profits for a manufacturing business is the place where the goods are manufactured. The profits arising from the sale of goods manufactured in Hong Kong are fully taxable there. Where goods are manufactured partly in Hong Kong and partly outside Hong Kong, the liability for Hong Kong Profits Tax will be apportioned accordingly. The place where the manufactured goods are sold is not relevant.

(2) Manufacturing under a processing or assembling arrangement with an entity in Mainland China

Since many Hong Kong businesses have subsidiaries in Mainland China, it is also common for a Hong Kong manufacturer to enter into a processing or assembling arrangement with an entity in Mainland China. Under such an arrangement, the Hong Kong manufacturer normally provides the materials, technical know-how, management, production skills, design, skilled labour, training, supervision, etc. The Mainland entity provides the factory premises, land and labour for processing, manufacturing or assembling the goods.

Strictly speaking, the Mainland entity is a separate sub-contractor distinct from the Hong Kong manufacturer. Therefore, the question of apportionment in respect of the latter’s profits should not arise. The Inland Revenue Department (“IRD”) is, however, adopted a practical approach and to allows apportionment of profits on the sale of the goods concerned on a 50/50 basis. Thus only 50% of the profits are assessed as sourced in Hong Kong. This recognises the role played by the Hong Kong manufacturer in the Mainland manufacturing activities.

(3) Manufacturing by an independent sub-contractor in Mainland China

If the manufacturing work is contracted to an independent sub-contractor in Mainland China and paid for on an arm’s length basis, and if there is minimal involvement on the part of the Hong Kong business in the manufacturing work, then the manufacturing in Mainland China is not regarded as having been carried out by the Hong Kong business. The profits of that manufacturing entity are therefore not taxable in Hong Kong.

However, the profits made by the Hong Kong business on the sale of the manufactured goods (as trading profits) will be fully taxable in Hong Kong.

5. Sale and Purchase Commissions

When a business earns commission by securing buyers or supplier for products, the activity which gives rise to the commission income is the arrangement of the business to be transacted between the principals. The source of income is the place where the activities of the commission agent are performed. If such activities are performed in Hong Kong, the source of the income is Hong Kong.

It is important to note that factors such as the place where the principals are located, how they are identified by the commission agent and the place where incidental activities are performed prior or subsequent to the earning of the commission are not generally relevant in determining the source of the commission income.

In the event that the commission income is earned by a person carrying on business in Hong Kong but the activities which give rise to the commission are performed entirely outside Hong Kong, then the commission is not taxable in Hong Kong. Basically, only commission income earned from activities performed in Hong Kong is taxable in Hong Kong (“place of performance”).

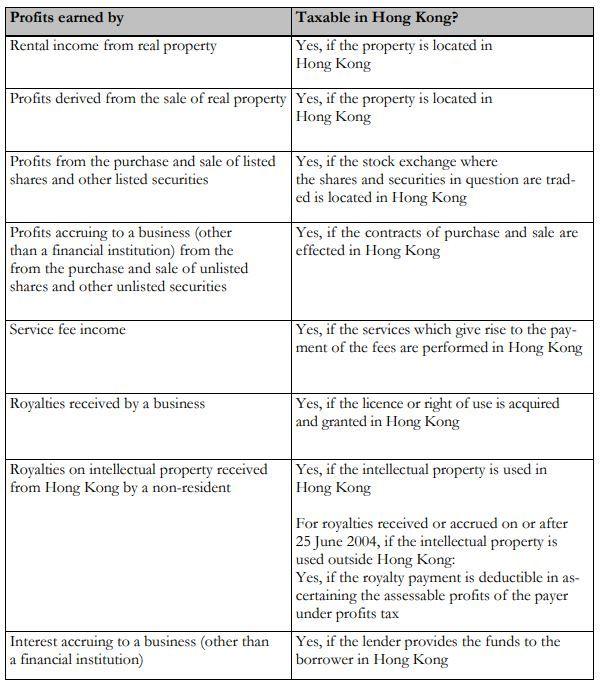

6. Treatment of Other Forms of Profit

[1] Magna Industrial Company Limited v. CIR (1996).

7. Summary (for Trading Profits)

For any Hong Kong business activity, it is crucial to understand and strictly follow the abovementioned guidelines in order to assure the generation of offshore profits.

-

a) Current practice by the Commissioner of IRD and the Board of Review

When deciding about the source of profits of any business, the Commissioner of the IRD will take all relevant facts into consideration, not only the place where the sales contract is effected (totality of facts approach), see above. Factors are for example:

The business

- has no real office in Hong Kong;

- has an overseas office in which the company’s directors and staff are working;

- has no staff in Hong Kong, and its staff and directors rarely come to Hong Kong, g. about 6 days per annum;

- negotiates and concludes contracts with suppliers and customers outside Hong Kong;

- has no Hong Kong suppliers and customers;

- does not ship through Hong Kong and arrangement of shipment is not done in Hong Kong; and

- does not physically inspect the goods in Hong Kong.

If the Hong Kong business does not meet the criteria mentioned above, then the following business structure should be adopted:

- the suppliers and customers should be located outside Hong Kong;

- travelling executives (i.e. Hong Kong staff) should be sent to suppliers to effect the contract there instead of in Hong Kong itself;

- regarding customers in other countries, the Hong Kong business should send travelling executives to the customer’s overseas location to effect the sale contracts the

Essentially, the travelling executives must be genuinely authorized and capable of concluding contracts outside of Hong Kong on behalf of the Hong Kong business in order for the contracts to qualify as being effected outside Hong Kong. If it is clear that both contracts (purchase and sales) are effected outside Hong Kong then the profits are not taxable in Hong Kong. (However, please be aware that the negotiation of contacts in another country might trigger a taxable permanent establishment in this other country.)

If a Hong Kong business does have a real office in Hong Kong, then it must be considered whether the said office only prepares or accepts invoices (not orders) to or from a non-Hong Kong customer or supplier on the basis of sale or purchase contracts which have already been effected outside of Hong Kong,. If this is the case, then the profits will not be taxable in Hong Kong. Also, pure accounting activities done in Hong Kong do not implicate a profit tax liability.

Finally, if the effecting of the purchase and sale contracts does not require travel outside Hong Kong but is instead carried out in Hong Kong by telephone, e-mail, fax etc., then the Commissioner of the IRD deems that these contracts have been effected in Hong Kong and therefore the profits will be taxable.

-

b) Latest Hong Kong Judgment clarifying the “source of profits” rules

In a decision from the Court of Final Appeal in ING Baring Securities (Hong Kong) Ltd. v Commissioner of Inland Revenue (“ING”), issued on 5 October 2007, the court clarified which factors should be given the highest significance by the Board of Review and the Commissioner of the IRD when determining the “source of profits”. The court stated that only the part of the company’s operations which produced the profit in question should be considered. It can be inferred from the decision that the court no longer supports the Commissioners “totality of facts” approach.

Regarding commission income, the court referenced the 1938 Indian judgment in “Commissioner of Income Tax v. Chunilal Metha”. This case concerned a broker whose profits consisted of both brokerage fees earned for executing contracts for clients and profits arising from trading transactions executed on his own behalf which connected the purchase and sale of commodities in New York. The broker’s business was conducted entirely from Bombay. He employed brokers in New York to execute the trade transactions. The court concluded that the profit was not earned in the place where he gave instructions to the brokers (i.e. India) but in the place where they (the brokers) carried them out which was overseas.

By applying the same reasoning to ING, the Court of Final Appeal ruled in favour of the taxpayer, saying that the crucial step in earning the profit was executing the sale and purchase transaction and as this took place outside Hong Kong no tax applied.

The court highlighted the following points:

- The operations test remains good law which means that these principles are the most crucial and relevant for determining the source of profits;

- The proximity of the activities to the derived profits is still essential;

- The fact that an activity is essential to the taxpayer’s business does not itself make it legally relevant to determining the source of profits;

- A Hong Kong business does not need a business entity outside of Hong Kong for a non-Hong Kong source of profit to be determined;

- The activities of any entity or person (agent/principal) acting on the taxpayer’s instructions and to the taxpayer’s account will be included in the activities of the taxpayer regardless of whether the entity or person profits from the activity.

The Court of Appeal reconfirmed the broad guiding principle in CIR v. Li & Fung (Trading) Ltd. (2011).

IV. Conclusion

All examples outlined in this newsletter should be viewed accordingly. In practice, every case needs to be considered in the light of its own particular circumstances and facts. There is no simple legal test that can be employed.

We believe that the information provided was helpful for you.

If you have any further questions, please do not hesitate to contact: