I. Reasons for the Dissolution of a Company

According to Sec. 1236 CCC a company is dissolved:

- In the case, if any, provided by its regulations;

- If formed for a period of time, by the expiration of such period;

- If formed for a single undertaking, by [reaching] the termination of that undertaking;

- By a special resolution to dissolve;

- By the company becoming bankrupt.

According to Sec. 1237 CCC a limited company may also be dissolved by the court on the following grounds:

- If default is made in filing the statutory report or holding the statutory meeting, unless the court directs that the statutory report be filed or the statutory meeting is held, as it may deem fit;

- If the company does not commence its business within a year from the date of registration or suspends its business for a whole year;

- If the business of the company can only be carried on at a loss and there is no prospect of its fortunes being retrieved;

- If the number of the shareholders is reduced to one;

- If there are any other reasons which render the company unable to maintain its operation.

II. Dissolution and Liquidation Process

Sec. 1247-1273 CCC are the applicable provisions in the event of liquidation of a private limited company in Thailand.

In case the company shall be dissolved by a special resolution, this resolution has to be passed by a majority of not less than three-fourth of votes present (Sec. 1194 CCC). The process will be as follows:

- The directors or the shareholders of the company have to ask for a special shareholders’ resolution to start the dissolution process. Therefore, invitations for such kind of meeting have to be sent out to all shareholders. Notice of the summoning of the general meeting for dissolution shall be published at least once in a local newspaper and sent by post with acknowledgement of the receipt to every shareholder whose name appears in the register of the shareholders not later than 14 days before the date fixed for the meeting (Sec. 1175 CCC) unless a longer notice period is required by the Articles of Association of the company. The invitation must mention the topic “dissolution of the company”.

- At the general meeting at least one-fourths of the total shares must be present to achieve a quorum. The present shareholders who are eligible to vote have to vote in favour for the dissolution and pass the resolution by a majority of not less than three-fourth of votes present (Sec. 1194 CCC).

- In the same meeting, the shareholders shall appoint the liquidator(s) and auditor(s). The directors shall become the liquidators unless otherwise provided by the Articles of Association of the company. The dissolution of the company and the name of the liquidator must be registered at the Company and Partnership Office, Commercial Registration Department, Ministry of Commerce within 14 days after the date of dissolution by the liquidator (Sec. 1254 CCC).

- The liquidator has the following duties:

- To settle the affairs of the company, pay back the debts and sell out all assets of the company (Sec. 1250 CCC);

- To notify the public by advertisement at least once in a local newspaper that the company is dissolved and that its creditors must apply for payment to the liquidator(s), and send a similar notice by registered letter to each creditor whose name appears in the books or documents of the company within 14 days after the date of dissolution or after the date of appointment (Sec. 1253 CCC);

- To deposit the amount due to a creditor as described by the provisions of the CCC concerning deposit in lieu of performance, if he does not apply for payment (Sec. 1264 CCC);

- To apply to the Court to have the company declared bankrupt, if he finds that after all of the contributions or shares have been paid, the assets are still insufficient to meet the liabilities (Sec. 1266 CCC);

- As soon as possible, make a balance sheet and have it examined and certified by the auditors, and he must summon a general meeting (Sec. 1255);

- To summon the general meeting in order to approve the balance sheet and/or to approve the report of the liquidation (Sec. 1256 CCC);

- To file a report every 3 months on the progress of the liquidation and deposit that report at the Registration Office, showing the situation of the accounts of the liquidation. Such report shall be open gratuitously for inspection to the shareholders or creditors (Sec. 1267 CCC);To summon a shareholders’ meeting at the end of every year from the beginning of the liquidation and lay before this meeting a report of his activities and detailed account of the situation, if the liquidation takes more than one year (Sec. 1268 CCC);

- To pay all costs, charges and expenses properly incurred in the liquidation in preference to other debts (Sec. 1263 CCC). The assets of the company may be divided among the shareholders, if they are not required for performing all the obligations of the company (Sec. 1269 CCC).;

- As soon as the company liquidation process is completed, to provide an account of the liquidation showing how the liquidation has been conducted and the property of the company has been disposed of. The liquidator shall summon a general meeting for the purpose of providing the account and give an explanation (Sec. 1270 CCC).;

- After the accounts are finally approved, to register the proceedings of the meeting with the Company Registrar within 14 days. Such registration is considered as the end of the liquidation process. The company ceases to exist as a legal entity.

III. Liquidation and Taxes

Upon submitting an application for dissolution, the Revenue Department, as the creditor for tax liability, is entitled to object the dissolution of the company if it believes that the company has any outstanding tax liability.

The company must return the company’s taxpayer card to the Revenue Department within 60 days from the date at which the Ministry of Commerce accepts the registration of the dissolution (the “dissolution date”, see II, 3.). In addition, if the company is registered for VAT, it must also give notice of the cessation of its business and return the VAT registration certificate to the Revenue Department within 15 days from the dissolution date (sec. 85/15 Revenue Code).

The corporate income tax return for the period ending on the dissolution date must be filed within 150 days with the Revenue Department together with the adopted and audited financial statements for the period.

Under the Revenue Code, the Revenue Department has the power to investigate tax returns for a period of two years. It can extend the investigation to a period of up to five years in case there is any evidence or suspicion of tax evasion. The scope of examination will depend on the facts and how well the company has complied with the tax regulations in the past.

In case the company had controversies with the tax authorities during the last years, it should consider leaving the company dormant for a period of at least two years before entering into the dissolution process, so that the tax prescription period of two years expires. Even though the company is dormant, it still has the duty to file corporate income tax returns, have the accounts audited annually, and submit the audited financial statements to the Ministry of Commerce.

In case the entire business and assets are not transferred, the VAT on outstanding assets is due on the dissolution date even if the assets have not yet been sold or transferred.

In case there is any outstanding input tax not yet due on the dissolution date, the company cannot claim such input tax invoice before receiving the related tax invoices from its suppliers. In addition, the company cannot claim the input tax received after the dissolution, because it is no longer an entrepreneur for VAT purposes. Therefore, the company should arrange to receive all outstanding input tax before the dissolution date.

IV. Liquidation and Severance Payments

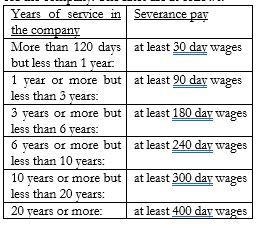

The dissolution has to be considered as a termination of employment for which the employees must be compensated according to Sec. 118 of the Labour Protection Act. The amount of severance payment is dependent upon the time the employee has been working for the company. The rates are as follows:

The period of employment includes holidays, leave days and days on which the employer has been given order to stop working. The payment is calculated at the average wage rate during the last 30 days before termination. In addition to this, the employer must pay remuneration in lieu of the unused annual leave to which the employee is entitled.

The company must withhold personal income tax for its employees. The severance payment and remuneration for unused annual leave must be included in the computation of the personal income withholding tax.

V. Liquidation and Liability of Directors

According to Sec. 1169 CCC, claims against the directors for compensation for injury caused by them to the company may be entered by the company or by any of the shareholders. Such claims may also be raised by the creditors of the company in so far as their claims against the company remain unsatisfied. However, these claims cannot be asserted after the liquidation of the company is completed.