Although Lorenz & Partners always pays great attention on updating information provided in newsletters and brochures we cannot take responsibility for the completeness, correctness or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation with a qualified lawyer. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent.

This paper provides an overview of the taxation of capital gains arising from the sale of shares in a Thai private companies, Thai listed companies, and foreign companies.

It outlines the applicable

- withholding tax (W/T) and

- corporate income tax (CIT) or

- personal income tax (PIT) obligations

for both

- individuals and

- juristic persons

considering whether the seller is

- a resident or

- non-resident,

and whether

Double Taxation Agreement (DTA) applies

or not

Usually, if a dividend is paid, the payer must withhold W/T from the amount being paid out, submit it to the local Revenue Department and issue a withholding tax certificate to the recipient of the dividend.

If all is made according to the laws, the W/T paid can be used by the recipient as tax credit.

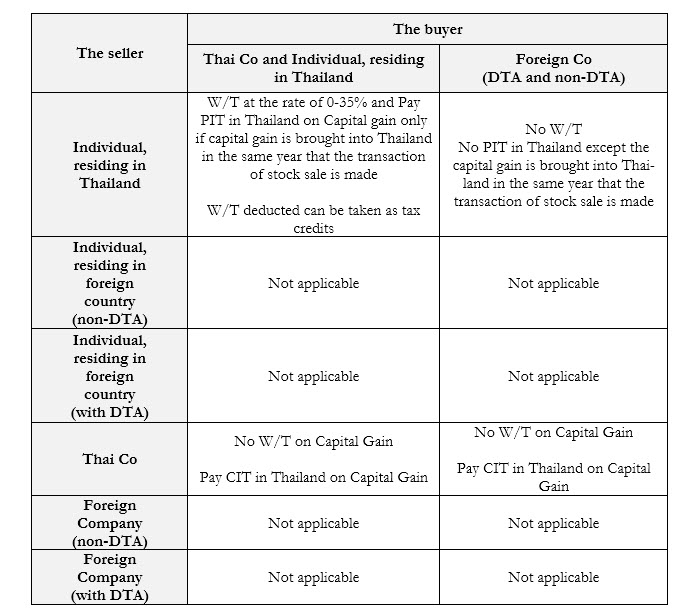

Capital Gain in Thailand on the Profit from the Sale of Shares of a

Thai Private Company

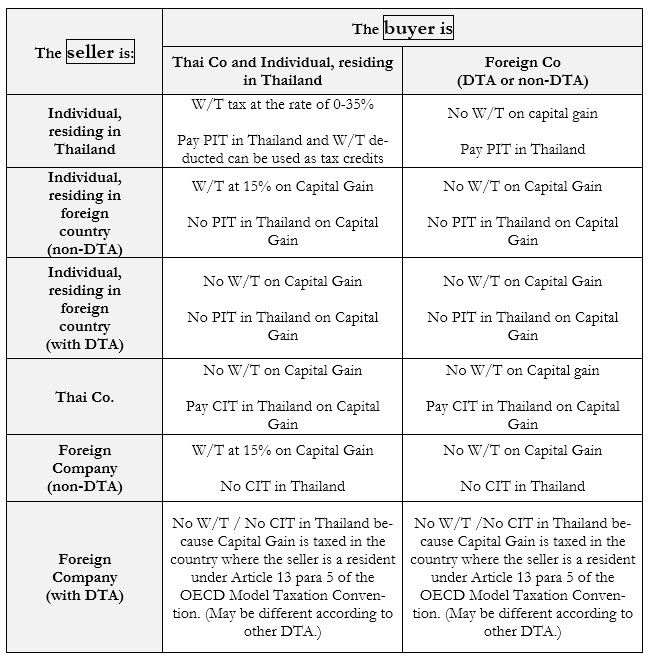

Capital Gain in Thailand on the Profit from the Sale of Shares of a

Thai Listed Company

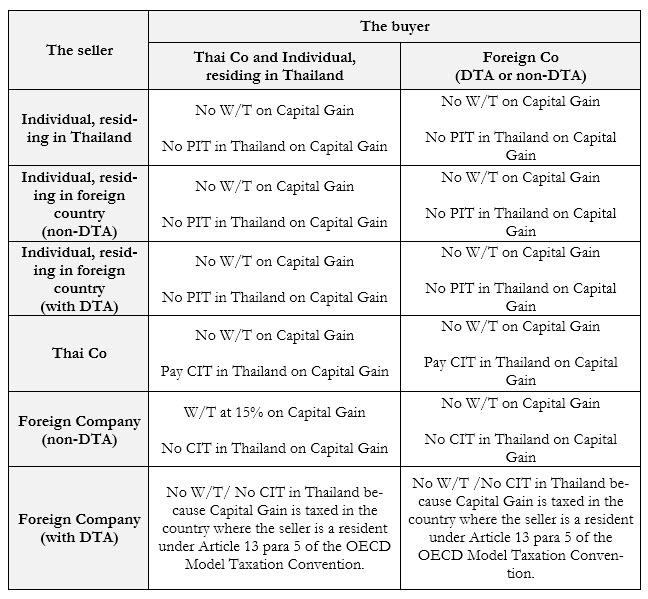

Capital Gain in Thailand on the Profit from the Sale of Shares of a

Foreign Private Company