Although Lorenz & Partners always pays great attention on updating information provided in newsletters and brochures we cannot take any responsibility for the completeness, correctness or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation with a qualified lawyer. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent.

I. Introduction

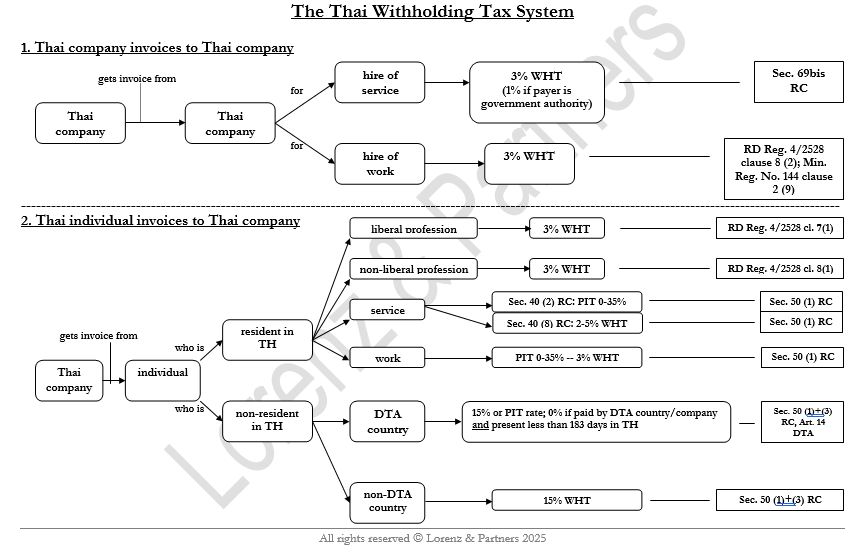

A Thai Company which pays to an individual or company is generally obliged to withhold (income) tax based on the provision of the Revenue Code of Thailand and remit the amount to the Revenue Department. Details of this procedure are described as follows.

II. Individual Taxpayer

- Payment of salary and wages:

The withholding tax rate is progressive, depending on the amount of salary or wage paid (0-35%). - Payment for services received (e.g. fees, brokerages, meeting fees, and commission fees):

The withholding tax rate is progressive, depending on the amount (0-35%) or

15% if the recipient of income is a foreigner who does not stay in Thailand over 180 days. - Payment of interest:

15% of the payment. - Payment from dividends:

10% of the payment. - Payment of rent:

5% of the payment. - Payment for a liberal profession (e.g. laws, arts of healing, engineering, and architecture):

3% of the payment or 15% of the payment if the recipient of income is a foreigner who does not stay in Thailand over 180 days. - Payment from a contract of work and labour, whereby the contractor provides essential material besides tools:

3% of the payment - Payment from royalties:

The withholding tax rate is progressive, depending on the amount of royalty paid (0-35%) or

15% if the recipient of income is a foreigner who does not stay in Thailand over 180 days.

At the end of the year, each taxpayer has to submit a tax computation to the Revenue Department. This tax computation needs to contain all income generated during the year. On this basis, the total personal income tax is calculated by the Revenue Department, considering the tax already withheld during the year, which is deducted from the calculation. Depending on how much tax was withheld, a payback or an additional payment might be possible.

However, if an individual taxpayer earns income in form of interest or dividends, he has the right to choose whether this payment is to be considered in his tax computation.

III. Thai Corporate Taxpayer

A Thai Company submitting payments to another Thai Company is generally not required to withhold income tax. The important exemptions are:

- Payment for services provided (e.g. fees, brokerages, meeting fees, and commission fees):

3% of the payment. - Payment of interest:

1% of the payment paid to a Thai Company;

1% of the payment paid to a Thai bank only for bond interest and debenture interest. - Payment of dividends:

0% or 10%

See our Newsletter No. 72. - Payment of rent:

5% of all rental payments made; or

10% of rental payments made to associations and foundations. - Payment for a liberal profession (e.g. laws, arts of healing, engineering, and architecture):

3% of the payment. - Payment to contractors who provide essential materials besides tools:

3% of the payment. - Payment of royalties:

3% of the payment. - Payment made by Government Agency:

1% of the payment. - Payment for the sale of goods:

0% of the payment.

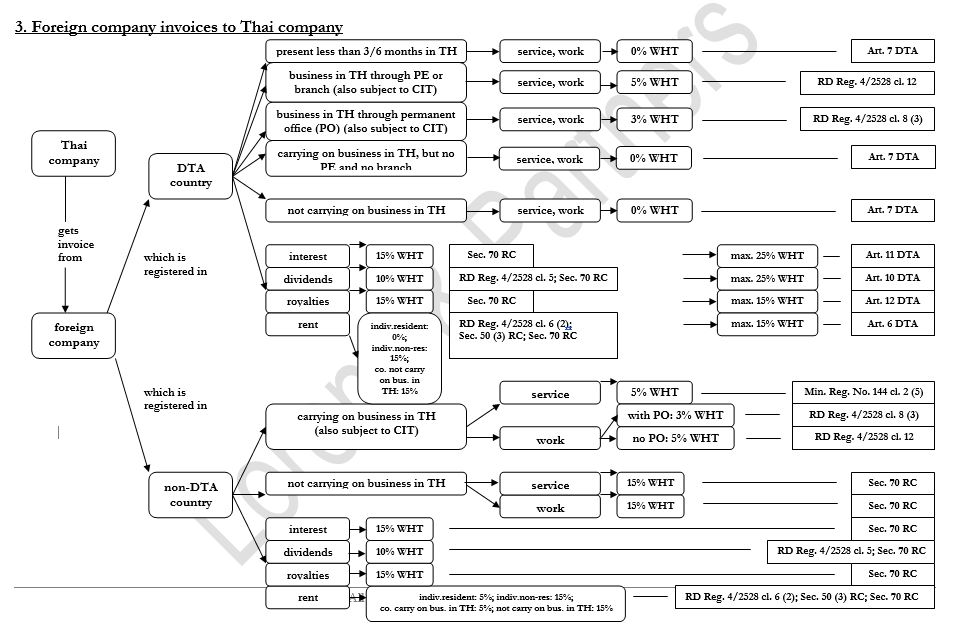

IV. Foreign Company  in case of “not carrying on business in Thailand”

in case of “not carrying on business in Thailand”

A foreign company which does not carry on business in Thailand (by having a branch office, employment, a representative or go-between in Thailand) but derives income in Thailand is generally subject to Thai Income Tax (Revenue Code Sec. 40) and payers to such companies are thus required to withhold income tax. Important withholding tax rates are described below by category of income:

- Payment for services provided (e.g. fees, brokerages, meeting fees, and commission fees):

15% of the payment. - Payment of interest:

15% of the payment. - Payment of dividends:

10% of the payment. - Payment of rent:

15% of the payment. - Payment for a liberal profession (e.g. laws, arts of healing, engineering, and architecture):

15% of the payment - Payment of royalties:

15% of the payment.

However, the withholding tax rate might be lower due to a double taxation agreement between Thailand and a foreign country (“DTA” – compare list of contracting states as annexed).

a) Compared to the other tax rates, the tax payable on dividends is rather low at 10%. The reason for this can be found in the tax policy of the Thai Government. Since the Corporate Income Tax is already at the rate of 20%, dividends shall not be subject to a full taxation again.

b) If a foreign company rents property to a Thai Company, the Thai Company is generally required to withhold tax at the rate of 15% on rental payments.

c) On the other hand, if a foreign company is carrying on business in Thailand by renting property to a Thai Company, such Company has to withhold tax at the rate of 5% on the rent payment. Additionally, the foreign company has to pay corporate income tax at the rate of 20% on its net profits from rental business.

d) Under most DTAs (e.g. between Thailand and Germany), the withholding tax rate on interest is reduced from 15% to 0% if the lender is a (German) bank. The rate on capital gains is also reduced to 0% if the seller of a Thai company’s stock is a German company.

V. Foreign Company  in case of “carrying on business in Thailand”

in case of “carrying on business in Thailand”

Foreign companies which are carrying on business in Thailand (by having a branch office, employment, representative or go-between in Thailand and deriving income in Thailand) are generally subject to Thai Income Tax (Revenue Code Sec. 40) and payers to such companies are thus required to withhold income tax. Important withholding tax rates are described below by category of income:

- Payment for services provided (e.g. fees, brokerages, meeting fees, and commission fees):

5% of the payment. - Payment of interest:

1% of the payment. - Payment of dividends:

10% of the payment. - Payment of rent:

5% of the payment. - Payment for a liberal profession (e.g. laws, arts of healing, engineering, and architecture):

3% of the payment. - Payments to contractors who provide essential materials besides tools:

5% of the payment; or

3% of the payment if such a foreign contractor has a permanent branch office in Thailand.

According to Departmental Instruction No. Paw 8/2528, the foreign contractor shall be treated as having a permanent branch office in Thailand only if:

a) He owns an office in Thailand, or

b) He carries on other business in Thailand besides engaging in contract works,g. the purchase and sale of goods, or

c) He has a provident fund set up for the benefit of his employees in Thailand.

Generally, the provident fund is voluntarily set up by the employees and the employer in order to promote savings, so that employees retired or dismissed from work would have a means of living without depending on state’s welfare or families. The provident fund can be established by at least one employer and one employee. The law requires the fund to be managed by a Fund Management Company that is neither the employee nor the employer. For the employee, the contribution is deducted from wages at the rate not less than 2% but not exceeding 15%. For the employer, the contribution is made at the rate not less than the contribution from the employee but not exceeding 15% of wages.

- Payment of royalties:

3% of the payment. - Repatriation of profits:

10% of the payment made from the branch in Thailand to the foreign company.

Additionally, foreign companies which carry on business in Thailand are required to pay corporate income tax at a rate of 20% on their net profit resulting from doing business in Thailand but can use the tax withheld as credit against income tax due.

Countries having entered into a DTA with Thailand

(as of January 2025):

| Armenia | Czech Republic | Italy | Oman | Sri Lanka |

| Australia | Denmark | Japan | Pakistan | Sweden |

| Austria | Estonia | Kuwait | Philippines | Switzerland |

| Bahrain | Finland | Laos | Poland | Taiwan |

| Bangladesh | France | Luxembourg | Romania | Tajikistan |

| Belarus | Germany | Malaysia | Russia | Turkey |

| Belgium | Hong Kong | Mauritius | Seychelles | Ukraine |

| Bulgaria | Hungary | Myanmar | Singapore | UAE |

| Cambodia | India | Nepal | Slovenia | UK |

| Canada | Indonesia | Netherlands | South Africa | U.S.A. |

| Chile | Ireland | New Zealand | South Korea | Uzbekistan |

| China | Israel | Norway | Spain | Vietnam |

| Cyprus |