Although Lorenz & Partners always pays great attention on updating information provided in newsletters and brochures, we cannot take responsibility for the completeness, correctness or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation with a qualified lawyer. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent.

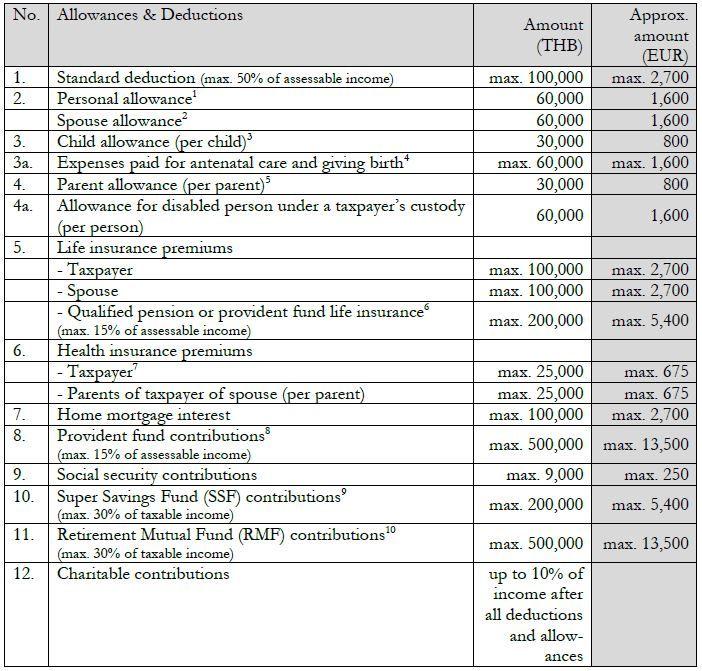

Any income received for an employment carried out in Thailand or from a Thai employer is subject to personal income tax in Thailand (unless an applicable Double Taxation Agreement provides otherwise). This newsletter shall provide information on the tax-deductible allowances available to taxpayers for the year 2020 who are subject to personal income tax. The overview is limited to deductions and allowances related to income from employment.

In addition to the abovementioned general allowances and deductions, employees who receive a travel allowance (so-called “per diem”) should note that such travel allowances will be taxable if they exceed certain amounts, but reimbursement of expenses against receipts remains tax free.

1 The personal allowance is up to THB 190,000 for elderly taxpayers aged 65 years and above and disabled taxpayers aged below 65 years. 2 If election of combined income is made and the marital status exists throughout the tax year. 3 An allowance of THB 30,000 each is given for up to three legitimate or adopted children (in the case of an adopted child, the allowance is given to the adoptive parents only). The allowance applies to children who are minors, or adjudicated incompetent or quasi incompetent, or who are not more than 25 years old and studying in a university or other educational institution at the university level. This allowance is given only if the child does not have assessable income in the preceding year in excess of THB 30,000. The full allowance will be granted even if the conditions referred to above have not been fulfilled for the whole year. Additional THB 30,000 are granted for the second child onwards that is born in or after 2018. 4 Additional THB 30,000 for the second child onwards that is born in or after 2018. 5 If the parent is over 60 years old and has annual income of less than THB 30,000. 6 Combined total of provident fund, SSF and RMF: max. THB 500,000. 7 Combined total with life insurance premiums of taxpayer: max. THB 100,000. 8 Combined total of provident fund, SSF and RMF: max. THB 500,000. 9 The income earner must hold investment units in a super savings fund continuously for a period of not less than 10 calendar years (including the year of purchase and the year of sale), except where the income earner redeems investment units because of disability or death. Combined total of provident fund, SSF and RMF: max. THB 500,000. 10 The income earner must buy investment units in a retirement mutual fund at least once a year and must not suspend the buying of investment units for more than 1 continuous year. The buying of investment units must be in total not less than 3% of the income received in each year, or not less than THB 5,000 per year. The income owner must hold the investment units for not less than 5 years from the date of the first purchase, and cannot redeem the said investment units before the age of 55 years. Combined total of provident fund, SSF and RMF: max. THB 500,000.

_________________________________________________________________________________

DEPARTMENTAL INSTRUCTION

No. Paw. 59/2538

Subject: Personal income tax: Travelling per diem excludible in computing personal income tax under Section 42 (1) of the Revenue Code. To provide the Revenue officers with a guideline in practices including giving advice to payers of income and the income receivers in the form of travelling per diem in the case of performing duties occasionally outside the office or place of business, being an assessable income excludible in computing income tax under Section 42 (1) of the Revenue Code, the Revenue Department gives an instruction as follows: Clause 1. The travelling per diem which an employee, a holder of post or office or a provider of services receives because of travelling occasionally to perform duties within or outside the country, and is excludible in the computation of personal income tax, shall be subject to the following conditions: (1) The travelling per diem is bona fide spent by such person necessarily and exclusively for performing his duties and wholly spent for such purposes. (2) If such person receives per diem at the rate not higher than the top per diem rate the government pays to its officials under the royal decree governing per diem for official travelling in or outside the country, as the case may be, in the nature of a lump sum payment, such per diem shall be treated as bona fide spent by such person necessarily and exclusively for performing his duties and wholly spent for such purposes without having to possess a record to prove the payment. (3) If such person receives per diem at a rate higher than under (2) and has no documental record to prove that the per diem has been bona fide spent by him necessarily for performing his duties and wholly spent for such purpose, only that part of the per diem which does not exceed the rate mentioned under (2) shall be treated as to have been so spent. Clause 2. The travelling for performing the duties under Clause 1 must be evidenced by a record showing the approval of the employer or the payer of income for performing the duties outside the office or place of business. Such record shall also specify the nature of the duties to perform and the duration of the performance. Clause 3. All the regulations, directives, instructions or rulings that are contrary to or in conflict with this instruction shall be repealed. Clause 4. This instruction shall be effective on and from the 1st day of January B.E. 2539. Given on the 25th Day of December B.E. 2538 Captain Suchart Chaovisit Director-General of Revenue

_________________________________________________________________________________

Notification of the Director-General of the Revenue Department on Income Tax (No. 123) Re: Prescription of the Filer of Return to Give Information under Section 17 (2) of the Revenue Code

________________________________________________________________________________

For the purpose of tax collection, the Director-General of the Revenue Department prescribes (by virtue of Section 17 (2) of the Revenue Code as amended by the Act on Amendment of the Revenue Code (No. 25) B.E. 2525 (A.D. 1982)) that any person having the duty to deduct income tax at source under the Revenue Code and file a return has to give information to the assessment officer together with particulars, as follows:

Clause 1. The Notification of Director-General of the Revenue Department on Income Tax (No. 39), Re: Requirement of a Person Whose Duty is to File a Return to Give Information under Section 17 (2) of the Revenue Code, dated April 14, B.E. 2534 (1991) shall be repealed.

Clause 2. Any payer of assessable income under Section 40 (1) of the Revenue Code who has the duty to deduct income tax at source according to Section 50 (1) of the Revenue Code and submit a return according to Section 59 of the Revenue Code shall give information and show details on foreign income earners at least in the particulars as appeared in the form hereto attached, in the following cases:

(1) When the payment to the foreigner is the income of the month of January of any year; (2) When the payment to the foreigner whose work starts during the tax year; and (3) When the payment to the foreigner finishes during the tax year.

Clause 3. The form showing information and details according to Clause 2 shall be filed together with the Phor.Ngor.Dor. 1 of January of every tax year, or the month when the foreigner starts working during the tax year, or the month where the foreigner finishes his work during the tax year, as the case may be.

Clause 4. This Notification shall be enforceable on and from 1st January B.E. 2546 (2003). The form showing information and details on foreign income earner for the month of January B.E. 2546 (2003) may be filed together with the Phor.Ngor.Dor. 1 Form of the month of January B.E. 2546 (2003), February B.E. 2546 (2003), or March B.E. 2546 (2003).

Notified on 25th December 2002

Supharat Khawatkun

LORENZ & PARTNERS Co., Ltd.

27th Floor Bangkok City Tower

179 South Sathorn Road, Bangkok 10120, Thailand

Tel.: +66 (0) 2-287 1882

Email: [email protected]

www.lorenz-partners.com