Although Lorenz & Partners always pays great attention on updating information provided in newsletters and brochures, we cannot take responsibility for the completeness, correctness or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation with a qualified lawyer. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent.

I. Introduction

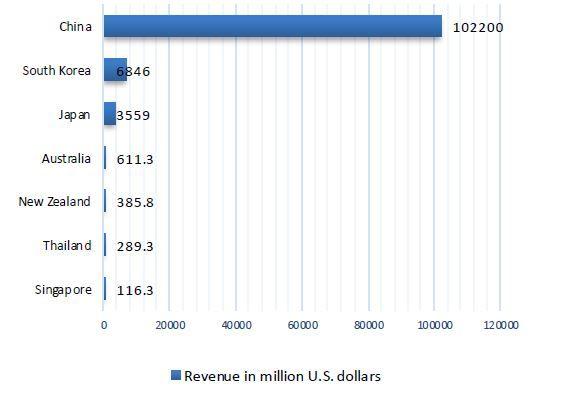

With a revenue of over 100 billion US dollars in 2021, China led the Asia-Pacific region in revenue generated by the market for electric vehicles. Tab-1 below shows its dynamic demand for electric vehicles (EV).

|Tab-1 Electric vehicles (EV) market revenue in the Asia-Pacific region in 2021 (in million U.S. dollars)

Source: Statista

Relying on the geographical location in Southeast Asia, Thailand is implementing policies to become Southeast Asia’s EV manufacturing hub. On 13 June 2022, the Thai Board of Investment (BOI) approved a US$1.03 billion worth of investment applications in a manufacturing project to manufacture battery electric vehicles (BEV). The applicant is a joint venture between Taiwan’s Foxconn and Thailand’s partially state-owned oil and gas giant PTT.

The BOI updates from time to time the incentives for investment in electric vehicles, accessories and related infrastructure. This newsletter will give a glance to the projects granted BOI promotion benefits for the production of electric vehicles and electric vehicle batteries, and what BOI incentives they can apply for.

II. BOI-approved projects for EV manufacturing and BOI incentives

1. BOI-approved projects for EV manufacturing

EV manufactures obtained BOI promotion benefits including BMW, Mercedes-Benz, Great Wall, Saic Motor and the joint venture of Ford and Mazda.

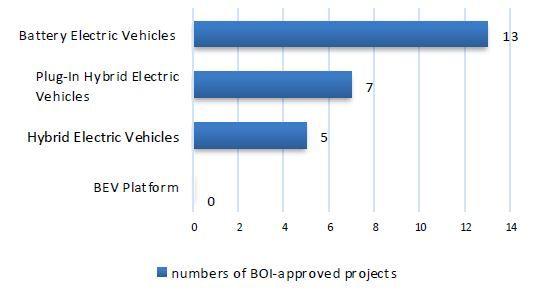

As of 31 May 2022, the BOI has approved incentives for some 25 EV production projects. This includes:

– 13 projects wholly or partly manufacturing battery electric vehicles (BEV);

-12 projects wholly or partly manufacturing Plug-In Hybrid Electric Vehicle (PHEV) or Hybrid Electric Vehicle (HEV).

However, there are currently no BOI-approved projects manufacturing BEV platforms.

|Tab-2 Statistics of BOI-approved project for EV manufacturing

Source: BOI

2. BOI incentives and requirements

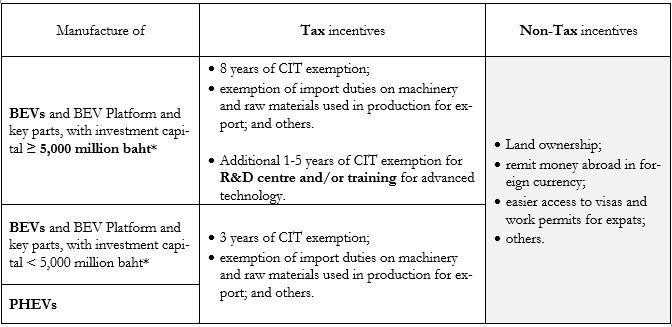

The BOI incentives depend on the type of electric vehicles and investment capital as illustrated in Tab-3 below.

The BOI also encourages investors to start the manufacturing as soon as possible. All approved manufacture of EV must be started within 3 years from the date the BOI promotion certificate is issued.

Meanwhile, if the BEVs manufacturer can start manufacturing in 2022, additional 2 years of CIT exemptions shall be granted.

III. BOI-approved projects for EVB and spare parts manufacturing

1. BOI-approved projects for EVB, EV charging stations and other EV parts

BOI-approved manufactures of batteries for electric vehicles (EVB), EV charging stations and other EV parts include the ones from Saic Motor, Honda, Toyota, and SWS Motors.

| |Source: BOI |

* The investment capital above excludes land costs and working capital.

As the BOI announced on 13 June 2022, the BOI has granted promotion benefits to 16 production projects of batteries for electric vehicles with a total investment of just THB 4.82 billion.

This shows that the manufacturing industry of EV parts is just in its infancy phase. Nevertheless, this industry will develop along with the EV manufacturers.

The conditions of the promotion are similar as for the production of the vehicles themselves: Any BOI-approved project of EV manufacture must start the manufactures of following items within 3 years of BOI promotion certification granted:

- electric batteries from the module production process (own project or other manufacturer’s project);

- minimum 1-2 key parts of EV as below:

- traction motor;

- battery management system (BMS); and

- drive control unit (DCU).

2. BOI incentives and requirements

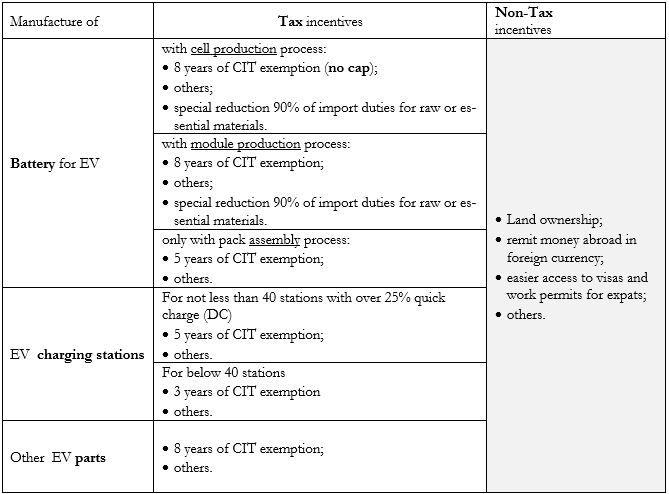

For the projects that are manufacturing batteries for electric vehicle (EVB), EV charging stations and other parts for EV’s, the BOI provides different incentives as shown in Tab-4 below.

Among EV parts and equipment, manufacturing EVB with cell production process and/or module production process is subject to the highest level of incentives. For example, a BOI-approved project to manufacture EVB with cell production process is CIT-exempted for minimum 8 years.

Apart from other parts for EV, the producer of EV charging stations is committed to obtain ISO 18000 certification within 3 years after the BOI promotion certification granted.

A guideline of the preparation of BOI application at: BR 006 E – Guide to BOI Applications.

Automotive suppliers interested in investing in Thailand may find our industrial study in Chinese language at: N214 Automotive supplier in Thailand and Vietnam — Legal framework for production and export.