Although Lorenz & Partners always pays great attention on updating information provided in newsletters and brochures, we cannot take responsibility for the completeness, correctness or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation with a qualified lawyer. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent.

I. Introduction

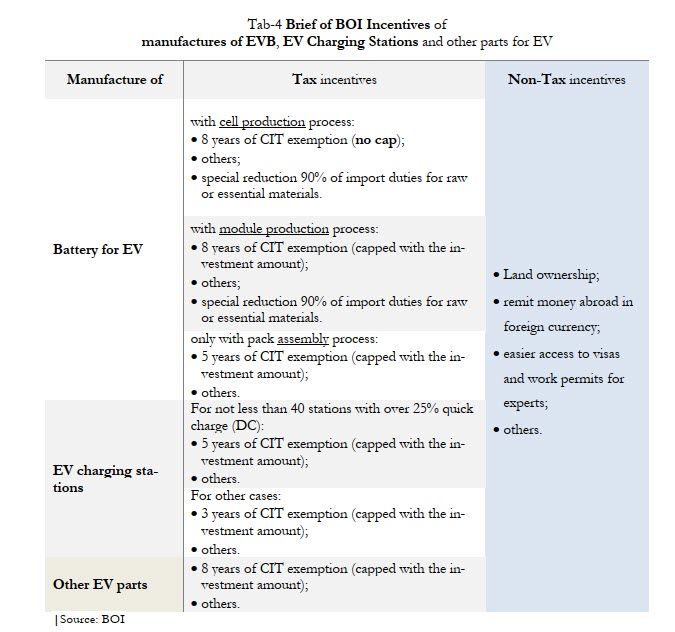

China’s electric vehicle (EV) market is projected to generate approximately US$ 377 billion in revenue in 2025, further solidifying its dominant role in the industry. It is noteworthy that in 2024, BYD alone generated revenue of US$ 107 billion. In perspective, BMW’s total automotive segment (including electric vehicles and combustion vehicles) generated approximately US$ 145 billion in turnover worldwide in 2024.

Tab-1 below shows China’s dominance in the EV market was already evident in 2021.

|Tab-1 Electric vehicles (EV) market revenue in the Asia-Pacific region in 2021 (in million U.S. dollars)

Source: Statista

Relying on the geographical location in Southeast Asia, Thailand is implementing policies to become Southeast Asia’s EV manufacturing hub. Already a leading manufacturer of pick-up trucks on a global scale for many years, Thailand is now also seeking to enhance its appeal in the EV market. The 30/30 policy aims to ensure that, by 2030, at least 30% of all vehicles produced in Thailand are electric. On 13 June 2022, the Thai Board of Investment (BOI) approved projects with a total investment of US$ 1 billion (approx. THB 36.1 billion to manufacture battery electric vehicles (BEV). The applicant is a joint

venture between Taiwan’s Foxconn, a key supplier for Apple, and Thailand’s partially state-owned oil and gas giant PTT. In August 2024, the BOI approved a BEV and battery assembly project with an investment volume of around US$ 28 million (approx. THB 911,4 million). The applicant is a joint venture between Hyundai Mobility Manufacturing (Thailand) Co., Ltd., and Thonburi Automotive Assembly Plant Co., Ltd.

The BOI periodically revises its incentive policies with respect to investment in electric vehicles, their associated accessories, and the infrastructure required for their utilisation. This newsletter will provide a synopsis of the projects that have been granted BOI promotion benefits for the production of electric vehicles and electric vehicle batteries, and the BOI incentives to which they are eligible.

II. BOI-approved projects for EV manufacturing and BOI incentives

1. BOI-approved projects for EV manufacturing

The following automotive manufacturers have been granted benefits under the BOI promotion scheme: BMW, Mercedes-Benz, Hyundai, BYD, Changan Automobile, Chery Automobile, Great Wall Motors, Saic Motor and the joint venture of Ford and Mazda. Kia and Tesla are currently engaged in negotiations concerning projects related to the production of electric vehicles (EVs) and batteries in Thailand.

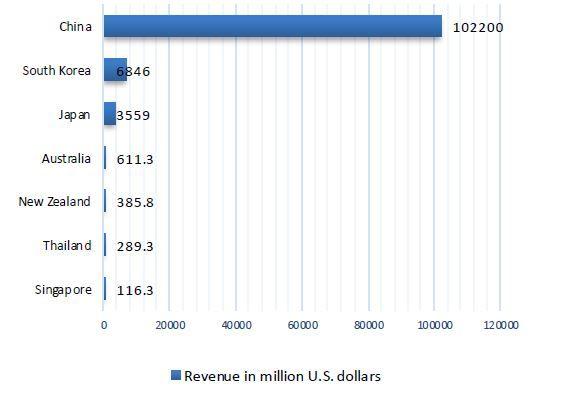

By the end of 2023, the BOI had approved 32 EV-related projects. This includes:

- 19 projects wholly or partly manufacturing BEV;

- 13 projects wholly or partly manufacturing Plug-In Hybrid Electric Vehicle (PHEV) or Hybrid Electric Vehicle (HEV).

|Tab-3 Statistics of BOI-approved project for EV manufacturing

Source: BOI

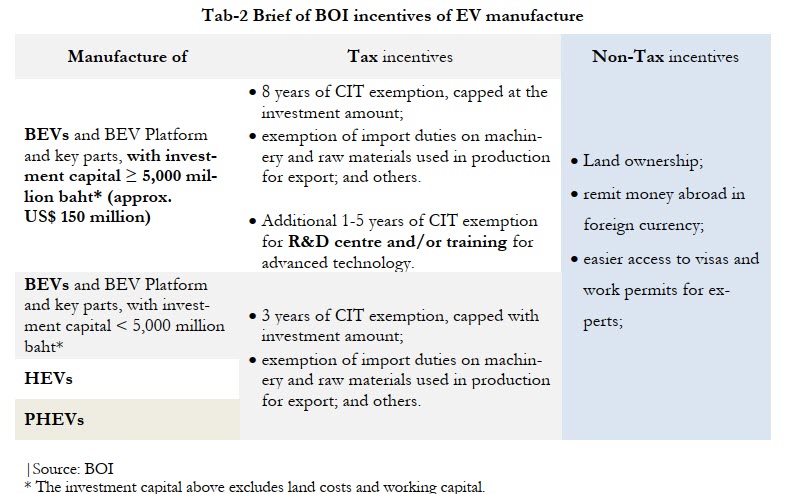

The BOI incentives depend on the type of

electric vehicles and investment capital as illustrated in Tab-2 above.

Any project that is approved by the BOI for the manufacture of electric vehicles (EVs) is required to initiate the production within three years of the date on which the BOI issues its promotional certification.

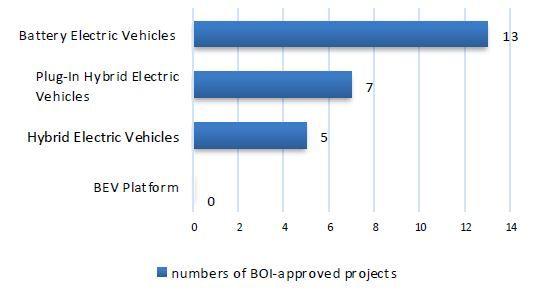

III. BOI-approved projects for EVB and spare parts manufacturing

BOI-approved manufactures of batteries for electric vehicles (EVB), EV charging stations and other EV parts include the ones from Saic Motor, Honda, Toyota, SWS Motors and, most recently, Sunwoda

Sunwoda’s project to invest more than US$ 1 billion in EV battery cell plants has been approved by BOI, with the aim of fostering and strengthening the supply chain This demonstrates the steady growth of Thailand’s EV component manufacturing industry, which is expected to continue expanding as the global transition to electric mobility progresses. The promotion’s terms and conditions are comparable to those that apply to the production of the vehicles themselves

- electric batteries from the module production process (own project or other manufacturer’s project);

- minimum 1-2 key parts of EV as below:

- traction motor;

- battery management system (BMS); and

- drive control unit (DCU).

The producer of EV charging stations must submit an EV smart charging system development plan or a plan to connect the charging system to an EV charging network operator platform or a central platform for the charging network management. Furthermore, the project must comply with the laws or safety standards of the relevant authorities.

IV. Further Non-BOI Incentives for EVs

In early 2024, the National Electric Vehicle Policy Committee (EV Board) approved the granting of tax deductions for the use of electric buses and lorries in addition to the EV3 and EV 3.5 incentives for private electric vehicles. Vehicles manufactured in Thailand are eligible for a deduction amounting to twice the purchase price, with no upper limit imposed. The subsidy is valid until 31 December 2025.

To be eligible for investment support under this programme, companies must meet the following criteria:

- they must be a leading and recognised battery manufacturer that supplies batteries to electric vehicle manufacturers;

- they must have a clear plan for the production of battery cells for electric vehicle batteries and, where possible, batteries for ESS;

- the batteries must have a high energy density of at least 150 watt hours per kilogram;

- the battery must have a lifetime of at least 1. 000 cycles, calculated from 70% of the nominal capacity at a depth of discharge of at least 80% at a test temperature of 20-25 °C. Interested companies can apply for such funding until the end of 2027.

V. Conclusion

It is evident that BOI incentives play a pivotal role in attracting foreign brands to establish factories within Thai territory, with the primary objective being the production of electric vehicles and batteries for such vehicles, in addition to other supporting components. Thus, it is anticipated that the demand to support R&D and manufacturing will gradually increase in line with the expansion of the consumer market for electric vehicles. Foreign investors should be aware that the BOI periodically revises the incentives for investment in manufacturing of all categories.

- In order to ensure a comprehensive and informed understanding of the current incentives and policies offered by the BOI, it is essential to carefully examine the latest updates pertaining to specific types of productions.

The additional non-BOI Incentives

A guideline of the preparation of BOI application can be found at: BR 006 E – Guide to BOI Applications.

Automotive suppliers interested in investing in Thailand may find our industrial study in Chinese language at: N214 Automotive supplier in Thailand and Vietnam — Legal framework for production and export.