Thailand Legal News

Long-Term Resident (LTR) Visa: BOI Eligibility Qualifications and Benefits (12 July 2022)

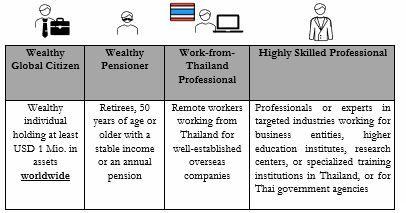

- In order to attract high-potential foreigners to stimulate domestic spending and investment, the Board of Investment (BOI) has introduced eligibility requirements for foreigners to apply for qualification endorsement for new types of visa, the “LTR” visa. The following list illustrates some qualifications and privileges associated with the LTR visa:

*Remark: all 4 targeted groups must have a health insurance with minimum coverage of USD 50,000, social security benefits insuring medical treatments in Thailand, or at least USD 100,000 deposit.

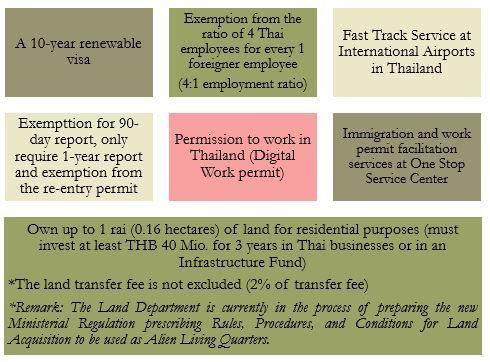

The privileges offered under the LTR visa are as follows:

The BOI will open to accept LTR applications on 1 September 2022

Cabinet Resolutions

5 July 2022

Draft Act on the Formation of Legal Codes and Rules for Convenient Access of the People:

- The Cabinet has approved the new Draft Act on the formation of legal codes and rules in order for people to access the laws conveniently. This new Act aims to create legal codes, by combining similar and/or related laws and rules, currently enforced, in a legal code system, without changing the underlying principles and intent of those legislations. By doing this, the provisions in the codes and rules will be easier to understand and more harmonized, such as combining several provisions into a single provision. This process will be done by expert committees.

https://www.thaigov.go.th/news/contents/details/56572 (item no. 4)

Thailand to join and sign the Asia Initiative Declaration:

- The Cabinet has approved Thailand to become a member of the Asia Initiative, which is a project established by the Global Forum on Transparency and Exchange of Information for Tax Purposes (the Global Forum). The significance of the Asia Initiative emphasizes adherence to international standards for tax transparency, in order to address problems of tax evasion and the conducts of illegal international financial transactions, through the cooperation between members in the Asian region. By becoming a member in this project, Thailand will participate in setting standards for tax transparency and will be able to enhance on its exchange of tax information to a level where it can be used to manage international tax collection in a way that is significantly more effective i.e., exchange of information on request (EOIR) and automatic exchange of financial information (AEOI).

The Asia Initiative project will be effective from 2022 until 2026.

*Remark: The following countries are members of the Asia Initiative: Brunei, Hong Kong, India, Indonesia, Korea, Japan, Macau, Malaysia, Maldives, Singapore, and Thailand.

Government Gazette

Exemption of the employer’s reporting obligation for hiring/terminating of foreign employees:

- The Department of Employment has issued a Notification on the Determination of the Type of Aliens whose Employers are Exempt from Notifying the Employment of Aliens, in order to add a new type of foreigner; temporary foreign employees (generally, the law requires the employer to notify the employment or termination of foreign employees to the competent official of the Department of Employment). Therefore, the employers who hire/terminate these types of foreigners will be exempted from reporting obligation under the law of foreigner’s working management:

- A foreigner who temporarily enters the Kingdom (under the law of immigration) to conduct necessary, urgent, or ad hoc work that must be completed within 15 days; or

- A foreigner who has been granted permission to enter and work in the Kingdom in accordance with the law on investment promotion, the law on petroleum, or other laws (under Section 62).

https://www.ratchakitcha.soc.go.th/DATA/PDF/2565/E/156/T_0025.PDF

Electronics Extension of Foreigners’ Temporary Stay in the Kingdom (e-Extension):

- To facilitate the submission process of application for extension of temporary stay in the Kingdom and to avoid the risk of human errors, electronic procedures for the preparation, submission, sending, receiving, maintaining, authorization, payment or other relevant matters are implemented for the aforementioned application. For example, in case the law requires any document or supporting evidence to be made in writing, it shall be deemed that the electronic data/file shall be considered as the written document or evidence, as required.

https://www.ratchakitcha.soc.go.th/DATA/PDF/2565/E/163/T_0046.PDF

Extension of Time for E-Tax Filing:

- The Revenue Department extends the deadline for filing of tax returns and paying taxes via e-filing system for 7 days from either the original due date or the previously extended date (as announced by the Minister of the Ministry of Finance). The requirement for eligibility for the deadline extension is that the late submission must not be due to the taxpayer’s fault. Such an extension is only applicable for specific types of tax return filing and payment of taxes i.e., income tax for companies operating under foreign laws that receive assessable income from Thailand (Section 70 of the Revenue Code) and etc.

A request for the deadline extension can be submitted to the Director-General of the Revenue Department at the Area Revenue Office or via the Revenue Department’s website. The deadline extension only applies to e-filing of tax returns and tax payments commencing from 1 January 2022 onwards.

https://www.ratchakitcha.soc.go.th/DATA/PDF/2565/E/162/T_0001.PDF