Thailand legal news

• 4 June 2019:

– The Department of Land Transport (“DLT”) planned to implement the digital road tax (tax sticker) feature in DLT QR Licence application in 2020,

under e-Service and digital government policy. *DLT QR Licence is a mobile application developed by the DLT. The digital driver license can be present to the police via this application from 19 September 2019 onwards.

– The Ministry of Transport (“MOT”) is researching and preparing a plan to induce motorcycle manufacturers to equip Anti-lock Braking System

(“ABS”) for safety. The long-term plan is to mandate ABS on all motorcycles within 2024.

*To support this scheme, BOI license will possibly be granted for the production of ABS.

• 10 June 2019:

– The National Broadcasting and Telecommunications Commission (“NBTC”) will pay compensation to Spring 26 (formerly, NOW26) channel and Spring News 19 channel for THB 1.175 billion in total due to the return of the digital TV licenses. Additionally, Spring News shall pay severance payment to its employees equal to labour law, plus special ex-gratia 1-3 times of wages (being negotiated).

• 13 June 2019:

– P.M. Prayut used Article 44 to regulate and bring 20,000 illegal/unlicensed hotels and accommodations nationwide into the system for safety of the

guests (including allowing to register their businesses, temporary waiving the town planning laws (until 18 Aug 2021), and requiring to comply with fire

extinguishing requirements within 90 days). *Reference: The Order of the Head of The National Council for Peace and Order No. 6/2562 on this link https://www.ratchakitcha.soc.go.th/DATA/PDF/2562/E/151/T_0017.PDF

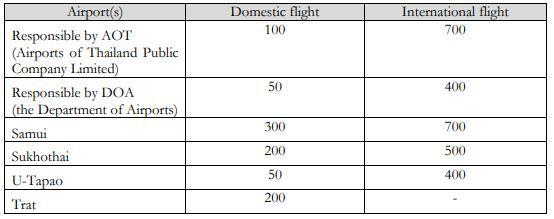

– The Civil Aviation Authority of Thailand (“CAAT”) informed that the Passenger Service Charge (“PSC”) can be refunded in case of an unused

flight ticket by proceeding through the airline or its agent (evidence for flight reservation is required). *PSC or Terminal Fee is a facilities fee charged by the government or the airport. *Please find the table below regarding current PSC rate:

• 14 June 2019:

– The administrative court issued several announcements to support the electronic administrative court system (e-Admincourt), which will commence on 30 May 2019. This system is developed to support legal proceeding from filing the case to the judgement and enforcement, via electronic method.

New Cabinet resolutions

4 June 2019:

• Approved Draft: Draft Royal Decree issued under the Revenue Code re: tax exemption (No. ..) B.E. …. [tax relief measure to support and promote

compostable bioplastic packaging]

– 1.5 times expense deductions for companies/juristic partnerships that purchase compostable bioplastic packaging certified by Ministry of Industry

– Duration: 1 January 2019 – 31 December 2021

• Approved Draft: Draft Royal Decree issued under the Revenue Code re: tax exemption (No. ..) B.E. …. [two-year extension of tax relief measure for SMEs]

– 2 times expense deductions for large companies that help SMEs

– Duration: Now – 31 December 2020

• Approved Draft: Draft Min. Reg. of the Finance Ministry No. .. (B.E. ….) issued under the Revenue Code re: tax exemption [tax relief measure to support

fundraising for the Government Housing Bank (“GHB”)]

– Personal Income Tax exemption for interests and prizes from GHB’s lottery

– Duration: 1 August 2019 onwards

*Three tax relief measures above will cause the government to lose approx. THB 2.5 billion in incomes.

11 June 2019:

• Approved Draft: Draft Royal Decree issued under the Revenue Code re: tax exemption (No. ..) B.E. …. [one-year extension of tax relief measure for contributions made to the Thai Sports Authorities]

– Duration: 1 January 2019 – 31 December 2019

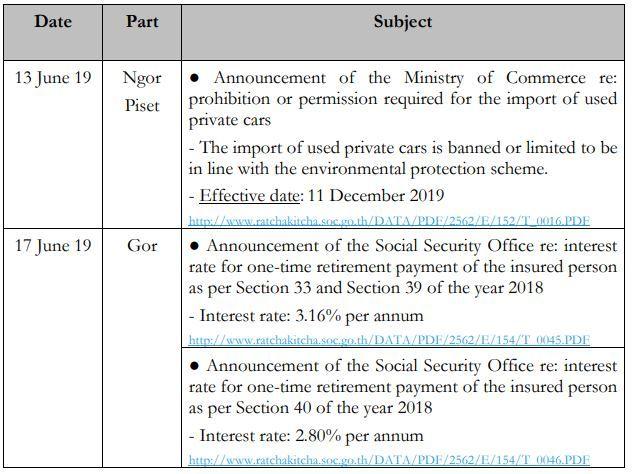

Royal Gazette Update: