Thailand legal news

- 23 March 2020:

– The office of the Judicial Administration Commission allowed all courts to postpone all general court hearings between 24 Match and 31 May 2020 until the appropriate date, except some specific cases (e.g. criminal cases confession hearing, inheritance, disappearance, or other cases that do not pose health threat to the parties but the postponement may cause damages).

– The Revenue Department took the following tax relief measures to mitigate the impacts of COVID-19:

SMEs

- 150% deduction for interest expenses

- 300% deduction for expenses for employees’ wages

Others

- Extend the deadline for PIT submission (PorNgorDor.90 and PorNgorDor.91) for the 2019 accounting year to 31 August 2020

- Extend the deadline for CIT submission (PhorNgorDor.50) for the 2019 accounting year to 31 August 2020

- Extend the deadline for CIT submission (PhorNgorDor.51) for the 2020 accounting year to 30 September 2020

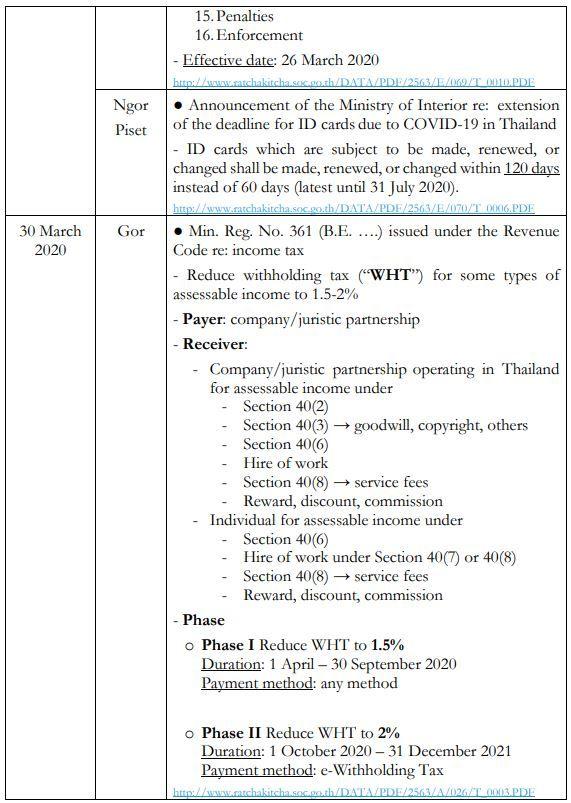

- Reduce withholding tax from 3% to 1.5-2% (see Royal Gazette below)

- VAT refund within 15 days

- Tax deduction up to THB 200,000 for investment in SSF

- Deduct expenses for e-donation (5 Mar 2020 – 5 Mar 2021)

- Individuals: up to 10% of income after expenses deduction

- Juristic persons: up to 2% of net profit

- 23 March 2020:

- The Department of Rail Transport mandated all train passengers to wear face masks when using any rail transport, which includes BTS, MRT, Airport Rail Link, and trains, to protect themselves and prevent the spread of COVID-19.

- 25 March 2020:

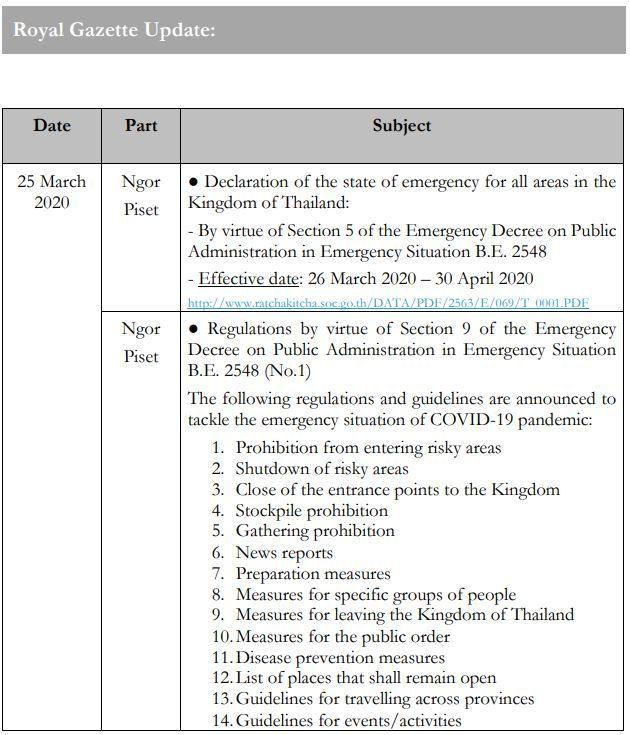

- The government declared a state of emergency for all areas in Thailand between 26 March 2020 – 30 April 2020 and imposed the following regulations and guidelines to tackle the emergency situation of COVID-19 pandemic (for more information, see Royal Gazette below):

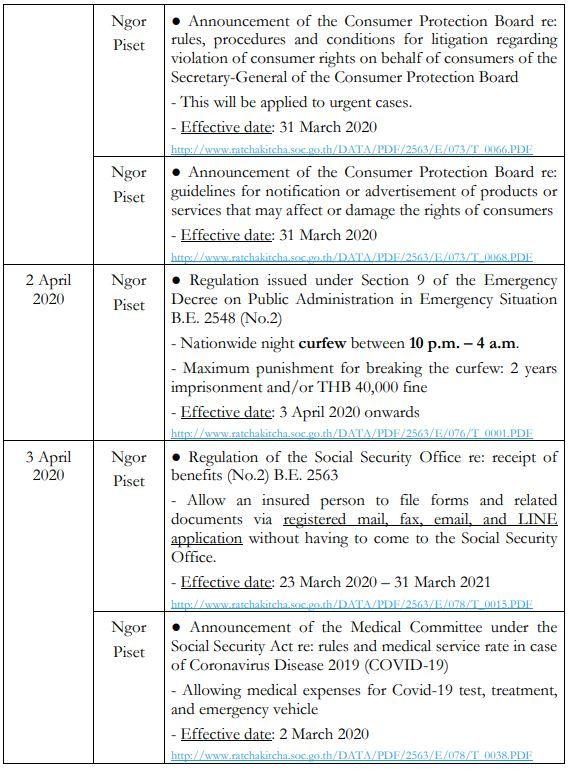

- Nationwide night curfew between 10 p.m. – 4 a.m.

- Ban all incoming flights to Thailand between 7 April – 18 April 2020; passengers on board an aircraft leaving the departure airport prior to this notification are subject to 14-day quarantine.

- Shut down specific places such as shopping malls, restaurants, schools/universities, sports facilities/arenas, barber shops etc. while some provinces close tourist attractions, beaches, hotels. Several provinces are on lockdown, i.e. basically no travelling in or out of the province (18 provinces as of 9 April 2020).

- 31 March 2020:

- The Office of the Board of Investment imposed the following measures to be in line with the government’s rules under the recent emergency decree regarding COVID-19 pandemic to ease business operators:

- Extend the application deadline for CIT exemption privileges to 31 July 2020, or not less than 30 days before the CIT filing date

- Offer a new online document submission service (e-submission), from 30 March 2020 onwards via the official website https://doc.boi.go.th/

- 1 April 2020:

- The Department of Land Transport has extended the deadline for any registration in connection with vehicles for 15 days from the end date specified in the emergency decree. Moreover, buses and taxis are exempt from vehicle inspections and fines.

- 3 April 2020:

- The Department of Highways announced temporary shutdown of motorway number 7 (Bangkok – Chonburi – Pattaya) and motorway number 9 (Bang Pa In – Bang Phli and Suk Sawat – Bang Khun Tien) between 10 p.m. – 4 a.m. in accordance with the government curfew.

24 March 2020:

- Approved Principle: 8 draft subordinate laws issued under the Expropriation and Acquisition of Immovable Property Act B.E. 2562

- Draft Min. Reg. prescribing rules and methods for determining preliminary price for land expropriation B.E. …

- Draft Min. Reg. prescribing rules, procedures, and conditions for determining the price of land remaining from expropriation (either higher or lower) and the action causing the land to change from the original state B.E. …

- Draft Min. Reg. prescribing criteria for reimbursement for special damages arising from possession or usage of an immovable property B.E. …

- Draft Min. Reg. prescribing rules and methods for determining the costs for demolishing, moving, building, and other immovable properties attached to the land, and other costs B.E. …

- Draft Min. Reg. prescribing rules and procedures for selling or destroying building or other immovable properties under the Expropriation and Acquisition of Immovable Property Act B.E. …

- Draft Min. Reg. prescribing rules and procedures for depositing compensation to the court or the deposit office or the Government Savings Bank under the Expropriation and Acquisition of Immovable Property Act B.E. …

- Draft Min. Reg. prescribing form and methods of requesting to return land that is not utilized in accordance with the purpose of expropriation to the original owner or heir B.E. …

- Draft Regulations of the Prime Minister’s Office on rules, procedures and conditions for usage of state properties or properties owned by state agencies due to expropriation B.E. …

- Approved Draft: Draft Min. Reg. prescribing the guaranteed amount B.E. …

- Since the spread of COVID-19 creates substantial impact on tourism businesses, the government agreed to reduce guarantees (cash/bank guarantees) under the Tourism Business and Guide Act that a tourism business entrepreneur must give to a registrar.

- Revoke the Reg. prescribing the guaranteed amount B.E. 2555

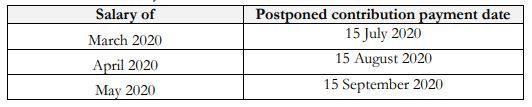

- Acknowledged Draft: Draft announcement of the Ministry of Labour re: extension of the deadline for filing a contribution payment form B.E. …

- Employers can postpone the Social Security contribution payment between March – May for 3 months as follows:

- Approved Draft: Draft announcement of the Ministry of Labour prescribing rules, procedures, and conditions to reduce the contribution of employers and insured persons due to COVID-19 B.E. …

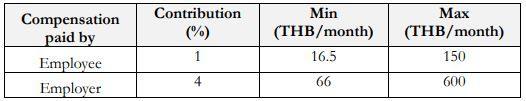

- The Ministry of Labour ordered the Social Security Office to reduce contributions paid by employers and employees under the Social Security Fund for 6 months until August at the rate/amount as per the table below:

- Approved Principle: Draft Min. Reg. No. .. (B.E. ….) issued under the Revenue Code re: tax reduction (measures to raise confidence in the capital market)

- Individuals can deduct the purchase price of investment units in SSF which has a policy to invest in securities listed on the Stock Exchange of Thailand at least 65% of the NAV between 1 April 2020 to 30 June 2020 as actually paid, but not more than THB 200,000.

- Acknowledged: Remedial measures due to impact of COVID-19 for the lessees (individuals/business operators) of the Treasury Department;

- Allowing them to postpone the payment of rental fees, exempt penalty;

- Acknowledged and approved: Remedial measures due to direct/indirect impact of COVID-19 to Thai economics (phase 2):

- Assign the relevant departments to consider and proceed with the following related tasks:

- Measures to compensate employees or other people affected from COVID-19 pandemic

- Knowledge enhancement measures

- Tax measures: postponement of PIT and CIT payment / postponement of tax filing and tax payment / PIT exemption for additional income of medical staff / increase deduction limit of health insurance premiums etc.

- Financial measures: loans for employees, self-employed people, and SMEs / soft loan to help the poor

31 March 2020:

- Approved: Revision on draft Min. Reg. re: unemployment benefits due to force majeure B.E. …

- Effective: 1 March 2020 – 31 August 2020

- Amend definition of “Force Majeure” to include pandemic

- Shutdown order by the government: the SSO will pay 62% of salary (max. THB 9,300) for up to 90

An employee cannot work due to Force Majeure approved by an employer / An employer is not allowed to work due to Force Majeure (COVID-19): the SSO will pay 62% of salary (max. THB 9,300) for up to 90

- For insured persons under Section 39, contribution is reduced from THB 211 to THB 86.

Royal Gazette Update: