In our Newsletter, we regularly inform on updates. You are invited to register.

Please click on the link below to add your e-mail address to our mailing list:

| Grünkorn & Partner Law Co., Ltd. Tel: + 84 28 7302 5772Email: [email protected] Website: www.lawyer-vietnam.com |

WTS Tax Vietnam Co., Ltd. Tel: + 84 28 7302 5771Email: [email protected] Website: www.wtsvietnam.com |

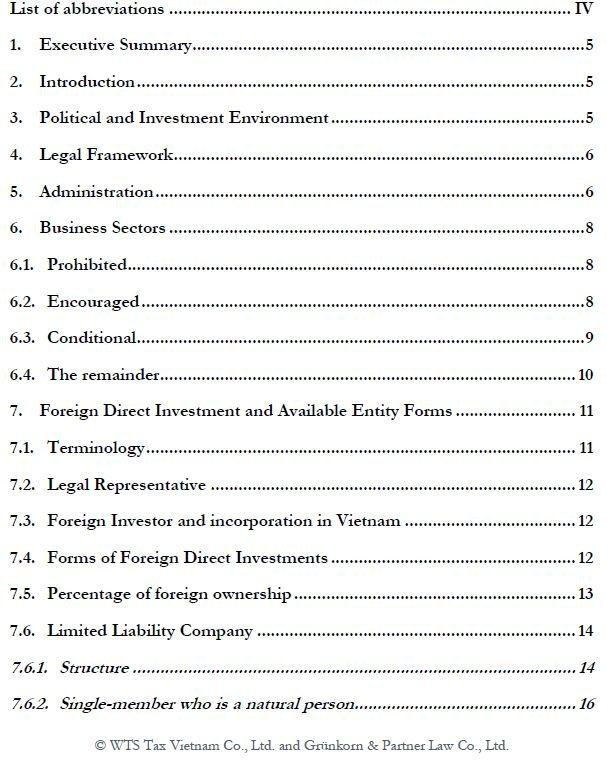

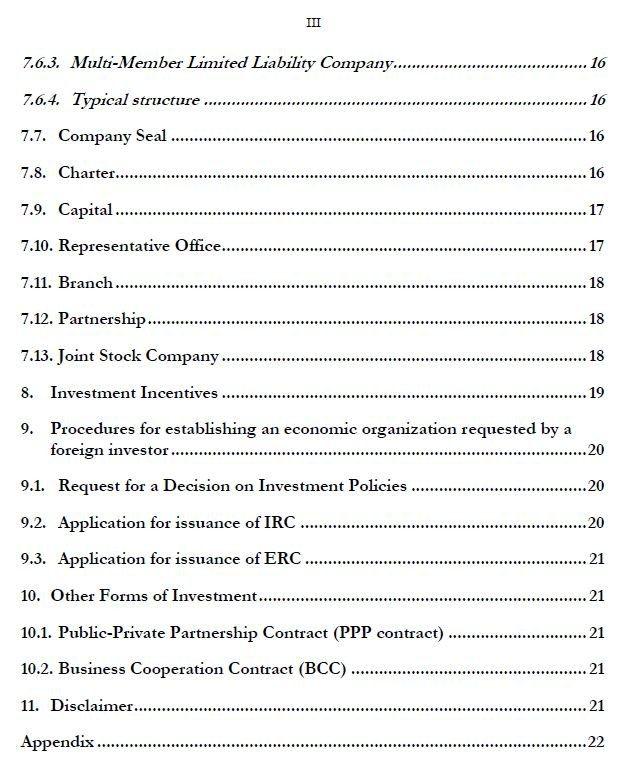

Table of Contents

List of abbreviations

ASEAN Association of Southeast Asian Nations BCC Business Cooperation Contract CIT Corporate Income Tax DPI Department of Planning and Investment ERC Enterprise Registration Certificate FDI Foreign Direct Investment FIE Foreign Invested Enterprises FTA Free Trade Agreement GDP Gross Domestic Product per capita IRC Investment Registration Certificate JSC Joint Stock Company JV Joint Venture JVC Joint Venture Company LLC Limited Liability Company LOE Law on Enterprises dated 17 Trial 2020 LOI Law on Investment dated 17 June 2020 MC Members’ Council MMLLC Multi Member Limited Liability Company MOST Ministry of Science and Technology MPI Trial of Planning and Investment NOIP National Office of Intellectual Property PPP Public Private Partnership Rep. Office Representative Office SMLLC Single Member Limited Liability Company WTO World Trade Organization

|

1. Executive Summary

Business and Investment in Vietnam is economically attractive, and it can also rely on a modern legal framework. Operating the business requires highly qualified management and understanding of the legal and practical conditions.

For a foreign trial all business lines which are not prohibited or restricted are free. However, it must be licensed, and implementation at the administrative level is not always easy.

2. Introduction

As the 150th member of the World Trade Organization (“WTO”), Vietnam has become more appealing as an investment location. The WTO commitment from 2007 first introduced specific provisions, making an investment in Vietnam more attractive for foreign investors. Now, foreign investors have a wide range of opportunities to enter the Vietnamese market. Some fields of business are not open to 100% foreign investment but require a joint venture. But for many areas of business, the market is open for 100% foreign investment.

The Vietnamese legal system has become more streamlined, less bureaucratic, and less burdensome for foreign investors in the past decade. Foreign investors continue to be optimistic about Vietnam’s economic future.

3. Political and Investment Environment

Vietnam is a single-party socialist republic that the Vietnamese Communist Party governs according to the Constitution[1]. Although Vietnam remains a single-party state, an orthodox adherence to ideology has slowly given way to economic development. Vietnam developed strong relationships with almost all countries. Various Free Trade Agreements (“FTA”) are in force. An overview of all Trial is in Appendix.

The GDP in 2020 was TRIAL USD [2] , and the GDP growth in 2020 was TRIAL In 2020, Vietnam is one of the few countries that recorded positive GDP growth when the pandemic broke out. However, the Government’s “No-COVID-19” approach was overwhelmed by the April 2021 outbreak that in turn led to lengthy shutdowns and steep economic costs. Vietnam’s GDP increased by 2.58% in 2021, about 4.2 percentage points lower than the World Bank’s projection for 2021 made in December 2020. For 2022, the expected GDP is 3,900 USD, and the expected growth of the GDP is 6%-6.5%. [3]

In 2016, 5.8% of the population in Vietnam was living below the national poverty line. In Thailand, this figure for 2019 was 6.2% and in the Philippines, for 2018 it was 16.7%.[4]

According to the Trial of Planning and Investment (“ MPI”) trial the Foreign Direct Investment for 2021 was 19.74 billion USD. [5]

The tax rate for Corporate Income Tax is 20%. For details, please refer to our Brochure on Corporate Income Tax.

4. Legal Framework

The Law on Investment[6] (“LOI”) and the Law on Enterprise[7] (“LOE”) are the most important laws regarding foreign investment. These two laws constitute general principles under which all domestic and foreign-invested enterprises conduct business in Vietnam. Different governmental Decrees and ministerial Circulars provide detailed explanations of these principles, and the relevant Ministries provide additional guidance for specific industries.

For all trial investments, the most important question concerns the benefit such investments will bring to the development of Vietnam. This question is underlined by various regulations on both licensing and tax benefits.

5. Administration

The Ministry of Planning and Investment (“MPI”) is the central administrative body that oversees all foreign investment activities in Vietnam. The MPI is responsible for drafting legislation, developing policies, providing guidance and consultation, and coordinating with other relevant authorities. The MPI is also responsible for approving and issuing licenses for certain types of foreign investment projects (usually large and important projects). The MPI is headquartered in Hanoi and has a Southern Representative Office in Ho Chi Minh City.

Trial local People’s Committees in each city or province directly administer foreign investment activities under their jurisdiction and issue licenses for certain smaller projects. In some cities with high levels of foreign investment, the Department of Planning and Investment (“ DPI”) under the local Trial Committee also plays a very active role. It is the relevant authority for licensing foreign investments located outside special zones and is the sole authority responsible for issuing the enterprise registration certificate.

To encourage investment in different regions, Vietnam has designated several special zones in which investors will receive preferential treatment, such as reduced tax rates and more accessible import procedures. If a company locates within one of these zones, it will fall under the administration of that zone’s Management Board regardless of whether it is licensed by the MPI or by the Management Board itself. Therefore, such a company must operate the business in compliance with the respective zone’s rules on import/export, environment, labor, etc., in addition to the general rules of the government and the MPI. The administrative procedures in such a zone are faster and the infrastructure is better than outside of such a zone.

The collective name for these zones is the Production Zone. There are certain kinds of Production Zones:

– Export Processing Zones.

These are specialized for producing goods for exportation.

– Industrial Zones.

Trial include Export Processing Zones, Auxiliary Industrial Zones, and Eco-Industrial Zones.

– Economic Zones.

They include many functional zones, including industrial zones.

– High Tech Parks.

The High Tech Parks concentrate on all businesses around Hi-Tech.

Other more specialized ministries are sometimes also involved in foreign investment. For example, the Ministry of Science and Technology (“MOST”) plays an administrative role in developing the high-tech industry’s foreign investment policies. The licensing authority often consults one or more of these specialized ministries before approving a business license application.

6. Business Sectors

The LOI divides Vietnam’s economic sectors into four categories, and investors are permitted to carry out investment activities in business sectors that are not prohibited.

The sectors are:

– Prohibited Business

– Encouraged Business

– Conditional Business

– Remainder

The LOI directly trial the prohibited business sectors. Investment is currently not permitted in the following sectors:

– Business in some kinds of drugs[8];

– Business in some chemicals and some minerals[9];

– Business in specimens of wild plants and animal species extracted from the wild specified in Appendix I to the Convention on International Trade in Endangered Species of Wild Fauna and Flora; Specimens of endangered, precious, and rare species of forest plants, animals, and aquatic animals of Group I, derived from natural exploitation[10] ;

– Business in prostitution;

– Purchase or sale of human, tissue, corpse, human body parts, human fetus;

– Trial activities related to human asexual reproduction;

– Business in firecrackers;

– Business in debt collection service.

Foreign trial in these sectors are entitled to numerous incentives:

– High-tech activities, industrial products which support high-tech; research and development activities; manufacture products trial from scientific and technological results according to the provisions of the law on science and technology;

– Production of new materials, new energy, clean energy, or renewable energy; production of products with an added value of 30% or more, and energy-saving products;

– Production of electronics, prioritized mechanical products, agricultural machinery, automobiles, automobile parts; and shipbuilding;

– Production of products on the List of supporting industry products prioritized for development;

– Production of products of information technology, software, and digital content;

– Breeding, growing and processing agricultural, forestry, and aquaculture products; afforestation and protection of forests; salt production; fishing and services which support fishing; creation of the plant and animal varieties and production of products of biological technology;

– Collection, processing, reprocessing, or reuse of refuse;

– Investment in the development and operation, and management of infrastructure facilities; and development of public transportation in urban areas;

– Pre-school education, general education, and vocational education;

– Medical examination, treatment; production of drugs, medicinal ingredients, drug preservation; scientific research on preparation technology and biotechnology for the production of new drugs; manufacture of medical equipment;

– Investment in facilities for training and competition of sports, or physical practice for disabled people or professional athletes; protection and promotion of the value of cultural heritage;

– Investment in centers for geriatrics, psychiatry or treatment of patients exposed to Agent Orange, and centers for the care of the old, the disabled, orphans, or neglected street children;

– People’s credit funds and micro-financial institutions;

– Production of goods, provision of services to create or participate in value chains, industry clusters.

Domestic and foreign investors must match conditions for some business sectors. Foreign investors must meet additional requirements in some industries.

To invest in a conditional investment sector, the investor must satisfy the specific requirements for that sector. These requirements will vary from every industry and may include: cooperation with a Vietnamese partner, minimum legal capital amount, specific additional licenses, a specified financial capacity, specific experiences, specific facilities or special permission from the competent authorities, etc.

Only a law or decree can state conditions for a business sector. According to LOI, there are more than 200 conditional business sectors.

Before investing, the investor needs to check whether any intended activities are included in the conditional business sector.

Foreign investment in these sectors is generally permitted and subjected to the WTO Commitments and the specific law governing the area in question.

The Vietnamese government tries to regulate and direct the inflow of foreign direct investment to specific sectors and regions. The authorities will consider the mentioned four categories and Vietnam’s specific economic and social needs.

All foreign investments must answer what benefits such investments will bring to Vietnam.

All trial companies at the beginning of the investment process must obtain an Investment Registration Certificate (“ IRC”), which relates to the contents and conditions of the foreign investment. After receiving the IRC, the foreign investor must establish an economic organization by applying for an Enterprise Registration Certificate (“ERC”). This economic organization will, in most cases, be a Limited Liability Company (“LLC”) or a Joint Stock Company (“JSC”).

If the foreign investor buys the shares in an existing company, the IRC is not compulsory, but Approval for such capital share transfer (“M&A Approval”) is required.

Vietnamese invested trial are only required to obtain an ERC.

Vietnam’s licensing and regulatory environment is still challenging. Licensing and other administrative procedures are lengthy and not always predictable concerning the specific requirements. The regulatory framework is insufficient, and its enforcement is not, in all cases, reliable. Therefore, the investor must obtain full and clear information before initiating an investment project. It is also essential to have a trustworthy Vietnamese-speaking person participating in all negotiations.

The investor must be prepared and willing to give as much information on the intended investment as possible.

The terminology here follows Vietnamese legislation and everyday business. It is customary for a single person to hold multiple titles simultaneously.

| Title in Vietnam | Role | Authorization |

| (General) Director | Manages the day-to-day business of the company | Can bind the company only if he is concurrently the Legal Representative or has a valid Power of Attorney signed by the Legal Representative |

| President | Represents the owner of a single-member limited liability company if there is no Members Council (“MC”) | |

| Chairperson of the Members Council | Represents the owner of the company if there is an MC. | |

| Legal Representative | Represents the company to the outside world | Can sign contracts on behalf of the company |

| Member of MC (sometimes wrongly referred to as “Director”) |

Represents the owner of the company. | This function is internal. |

| General Shareholders Meeting (“GSM”) | The highest authority of a joint-stock company (“JSC”), including all shareholders (or their representatives). There are certain business activities of the company that shall require a decision from GSM. | Similar to the MC of the LLC. |

| Board of Directors (“BoD”) or Management Board

(this term is sometimes misused for the MC) |

Trial with the (General) Director, the BoD manages the business. | The authority is below the GSM and unique to a JSC and not applied for the LLC. |

| Chairperson of the BoD | If no other regulation is in the JSC’s Charter, the person holding this position shall be the Legal Representative. |

In most cases, one person will be General Director cum Legal Representative, and another person will be President (or Chairperson of the Members Council) in the case of LLC, or Chairperson of BoD in the case of JSC cum Legal Representative.

The Legal Representative represents the company externally. The LLC and JSC can have more than one Legal Representative. At least one of the Legal Representatives must be a resident of Vietnam.

7.3. Foreign Investor and incorporation in Vietnam

Trial by setting up a company is known as Foreign Direct Investment (“ FDI”).

A foreign investor is

– an individual trial a foreign nationality, or

– a company registered outside Vietnam, or

– a company registered in Vietnam, if

a) above 50% of its charter capital is held by:

(1) a foreign individual or a company registered outside Vietnam;

(2) a company registered in Vietnam which has above 50% of its charter capital held by a foreign individual or a company registered outside Vietnam;

b) trial 50% of its charter capital is held by these two combined:

(1) a foreign individual or a company registered outside Vietnam;

(2) a company registered in Vietnam which has above 50% of its charter capital held by a foreign individual or a company registered outside Vietnam;

TRIAL company registered in Vietnam is considered a Vietnamese company regarding other legal requirements.

Due to specific voting requirements, an investor holding 50% of the charter capital does not fully control the company.

7.4. Forms of Foreign Direct Investments

Before establishing a company, a foreign investor must obtain the Investment Registration Certificate (“IRC”). The following investment models are available for an FDI:

a) Limited Liability Company (“LLC”);

b) Partnership;

c) Joint Trial Company (Shareholding Companies) (“ JSC”);

d) Representative Office;

e) Branch Office.

Foreign trial in cooperatives and unions of cooperatives is only possible for foreign individuals who are at least 18 years old and legally reside in Vietnam. Foreign organizations are not allowed to become members of cooperatives.

Once the company is trial it can add additional business lines to the license.

7.5. Percentage of foreign ownership

In general, a foreign investor can own up to 100% of the charter capital depending on the business lines and the relevant international agreements. The most important regulations are included in the commitments of Vietnam when entering the WTO, and the FTAs include other rights to invest in Vietnam.

According to the LOI 2020, foreign investors are entitled to the same market access conditions regarding ownership rate as applied to domestic investors, except in some specific business lines that have not been able to access the market for foreign investors.

For business lines with conditional market access for foreign investors, the determination of the foreign investor’s ownership ratio is as follows:

– Where laws, resolutions, ordinances, decrees, and treaties stipulate the foreign ownership ratio, the maximum foreign ownership ratio in the enterprise shall comply with this ratio;

– If the law, resolution, ordinance, decree, and treaty do not provide for restrictions on the percentage of foreign investors’ ownership, the foreign investors are entitled to own up to 100% of the charter capital of the enterprise and shall satisfy other conditions specified at Points b, c, d and dd, Clause 3, Article 9 of the Law on Investment (if any).

The investor must decide under which international agreement he will apply for the IRC and Vietnam does not allow to combine rights from other agreements.

A thorough review of the necessary business lines is required.

7.6. Limited Liability Company

The most common form of FDI is the Limited Liability Company (“LLC”). Vietnamese law distinguishes between Multi-Member Limited Liability Company (“MMLLC”) and Single Trial Limited Liability Company (“ SMLLC”). An LLC has legal trial status from the date of issuance of the ERC. The MMLLC is the most common legal form for Joint Ventures (“ JV”).[11]

The SMLLC has one owner, and the owner’s obligation is limited to paying up to the licensed charter capital.[12]

Except for some trial sectors which require mandatory legal capital (e.g., banking, real estate, etc.), the owner can freely decide on the amount of the charter capital. However, it must be sufficient for financing the intended investment.

An MMLLC has two or more owners, and the owners’ obligation is limited to paying up to the licensed charter capital. The partners of a JV often choose this form. The number of members must not exceed 50. If the company wishes to have more than 50 members, it must be converted into a Joint Stock Company.

The structure of an LLC has some flexibility regarding these issues:

– Legal Representative(s)

– (General) Director

– President or Chairperson of the Members’ Council, and Members’ Council

Legal Representative

The Trial Representative represents the enterprise externally. The decisions and actions of the Legal Representative are binding for the LLC, and the Legal Representative has the authority to decide on all transactions.

An LLC can have more than one Legal Representative.

The charter of the LLC shall specify the number, managerial positions, rights, and obligations of the Legal Representative(s). The law does not require determining and clearly defining each Legal Representative’s rights and responsibilities. But this is recommended.

At trial one of the Legal Representatives must be a resident of Vietnam.

The Legal Representative can hold other positions in the LLC simultaneously.

(General) Director

The (General) Director of an LLC is the person who manages the company’s day-to-day business[13]. Only if also holding the position of the Legal Representative, the General Director can represent the company.

Members’ Council

The Members’ Trial (“ MC”) is the highest decision-making body of the LLC. If a member is an organization, it must appoint an authorized representative to act on their behalf within the MC. The MC must hold a general meeting at least once a year.

The MC has the authority to determine the company’s strategy and development, increase or reduce the capital, elect, remove or dismiss persons in managerial positions, distribute profits, and re-organize or dissolve the company.

If the trial appoints only one authorized representative, this authorized representative shall be the President of the LLC.

If the owner appoints more than one authorized representative, all authorized representatives shall be members of the MC[14]. The MC may have 03 to 07 members with a 5-year maximum term. When appointing more than one authorized representative, the owner must determine the capital contribution that each authorized representative shall represent. Each authorized representative shall represent an equal proportion of capital contribution without that decision. The owner shall appoint the Chairperson of the MC, or the members of the MC shall elect the Chairperson on the principle of a simple majority. The Chairperson’s term of appointment must not exceed five years; he may, however, be re-appointed.

The President or the MC represented by the Chairperson of the MC shall represent the owner in the LLC and appoint the (General) Director of the LLC.

The members do not have preferential voting rights, but that would be possible in the form of a Joint Stock Company (“JSC”).

7.6.2. Single-member who is a natural person

In this case, the owner must be the President of the company.

7.6.3. Multi-Member Limited Liability Company

An MC is compulsory.

7.6.4. Typical structure

The typical structure for the SMLLC is:

– President cum Legal Representative

– General Director cum Legal Representative

The trial structure for the MMLLC is:

– Chairperson of the MC cum Trial Representative

– General Director cum Legal Representative

Usually, the General Director cum Legal Representative will be a resident of Vietnam. In some cases, more Legal Representatives are appointed.

7.7. Company Seal

The company must apply the seal on every relevant document signed on behalf of the company with a legal impact. The application of the seal is at least as necessary as the signature of the Legal Representative.

The company has the right to decide on the seal’s form, number, and content.

It is essential to set up a transparent system of usage and control of the seal or the seals.

7.8. Charter

A trial established in Vietnam must have a Charter. The charter of the company shall give regulations on the critical issues of a company [15] that are not regulated by law directly, such as:

– Name and address of the company;

– Business lines;

– Charter capital, the total number of shares (in case of a JSC);

– The owner(s), rights and obligations of members;

– Structure;

– Legal Representative;

– Rules for distribution of after-tax profit and dealing with losses in business;

– Circumstances for dissolution, procedures for dissolution, and procedures for liquidation of the assets of the company;

– Procedures for amendments of the charter.

7.9. Capital

Charter Capital is the total value of assets that the investors committed to contributing to the company.

For an LLC and a JSC, the Charter Capital must be fully paid within 90 days from the issuance day of ERC from the investor’s bank account to the special capital account at the bank of the LLC or JSC.

An LLC does not trial to have a specific minimum Charter Capital. But the Charter Capital must be in a reasonable relationship with the intended business. The licensing authority will check this as one of the essential issues of the application for the IRC.

If the financing of the investment project includes loans with a duration exceeding one year (long-term loans), they must also be licensed. The Charter Capital plus this amount of long-term loans is called Investment Capital.

TRIAL specific minimum of Charter Capital or Investment Capital is required for certain business lines.

7.10. Representative Office

In Vietnam, a foreign company can register a Representative Office (“Rep. Office”) for trading operations. Specialized laws regulate the registration of a Rep. Office for some business lines such as banking, education, finance, legal services, tourism, etc.

Registering a Rep. Office is comparatively easy.

However, the purpose of a Trial Office is limited, and it is not entitled to generate profits in Vietnam. Several Rep. Offices of foreign companies in Vietnam are engaged in activities not meant to be operated by a Rep. Office. Violating these restrictions triggers a very high tax risk.

7.11. Branch

A Branch is a trial office of a foreign entity and is a way of investment for banks, law firms, and tourism companies. Branches have the right to generate profit.

For most fields of business, the registration of a Branch is much more complicated than setting up an LLC.

The Branch must pay taxes like a company registered in Vietnam.

7.12. Partnership

A partnership has two or more co-owners who jointly conduct business under one common name. These unlimited liability partners (also known as “ordinary partners”) must be individuals and will be liable for the entire obligations of the partnership.

In addition to these unlimited liability partners, a partnership may also have limited liability partners (also known as “capital contribution partners”) who are liable only for contributing the capital as committed.

A partnership enjoys legal entity status from the date the ERC is issued.

7.13. Joint Stock Company

A Joint Stock Company (“JSC”) is an enterprise in which:

– The charter capital is divided into equal portions called shares;

– Shareholders may be organizations or individuals; the minimum number of shareholders is three, and there are no restrictions on the maximum number;

– Shareholders are liable for contributing the capital as they have committed; and

– Shareholders may trial assign their shares to other persons or organizations.

A JSC has legal trial status from the date the ERC is issued. A JSC may issue all types of securities to raise funds, and it is the only corporate format under Vietnamese law that has the right to issue shares or other securities to the public.

An LLC may be converted into a JSC and vice versa.

The General Shareholder’s Meeting is the highest decision-making body of a JSC. The Board of Directors carries out the day-to-day business. The members of the Board are appointed by the shareholders, usually in proportion to their respective capital contributions.

8. Investment Incentives

Companies can receive investment incentives in many forms: tax incentives including exemption from and reduction of CIT; exemption from import duty for fixed assets, raw materials, supplies, and components for the implementation of an investment project; land incentives including exemption from and reduction of land rent, land use fees and land use tax.

Trial in the encouraged fields of business shall enjoy investment incentives.

In addition, investment projects in specific areas shall enjoy incentives:

– Areas with difficult socio-economic conditions; and areas with especially difficult socio-economic conditions;

– Industrial zones, export processing zones, high-tech zones, and economic zones.

Besides the investment incentives based on business sectors and location of investment projects, investors shall enjoy investment incentives in the following cases:

– Investment projects on construction of social housing; investment projects in rural areas employing 500 or more employees; investment projects employing people with disabilities in accordance with the law on people with disabilities;

– Hi-tech enterprises, scientific and technology enterprises or organizations; projects involving technology transfer on the list of technologies encouraged to be transferred in accordance with the law on technology transfer; technology incubators, science, and technology business incubators according to the provisions of the law on high technology and the law on science and technology; enterprises that manufacture and supply technology, equipment, products and services to meet the requirements of environmental protection in accordance with the provisions of the law on environmental protection;

– Projects with at least a VND 6,000 billion investment capital disbursed within three years from issuing date of IRC. Concurrently having one of the following criteria: having a total turnover of at least VND 10,000 billion per year within 03 years at the latest from the year of having revenue or employing more than 3,000 employees;

– Innovative start-up investment projects, innovation centers, research and development centers;

– Investment and business in product distribution chains of small and medium enterprises; business investment in technical facilities to support small and medium-sized enterprises, small and medium-sized business incubators; invest in the business in the co-working space to support small and medium-sized enterprises and start-ups in accordance with the law on supporting small and medium-sized enterprises.

The investment incentives shall be recorded in the IRC[16].

9. Procedures for establishing an economic organization requested by a foreign investor

9.1. Request for a Decision on Investment Policies

For most typical cases of FDI, this decision is not required.

Depending on the scale, business sector, and impact of an FDI project, the authority to decide on acceptance of an investment project shall be the National Assembly, the Prime Minister of the Government, or Provincial people’s committees. The application for this must be filed in any case to the local DPI or the local Authority of Industrial/Economic Zones.

Except for some large-scale and great-impact projects which the National Assembly and the Prime Minister shall accept, the Provincial people’s committees shall decide on these projects:

– Projects allocated or leased out on land without auction, tendering, or transfer;

– Projects which a requirement for conversion of land use purposes;

– Projects trial restricted technology.

For other projects, the investor can apply for an IRC without a Decision on Investment Policy.

9.2. Application for issuance of IRC

An IRC is always compulsory for a foreign investor. For the projects requiring a Decision on Investment Policies, the investment registration agency shall issue the IRC within five working days from the Decision on Investment Policy date.

For projects not requiring a Decision on Investment Policy, the IRC shall be issued within fifteen days from the date of application if accepted.

Trial realistic timelines are considerably longer.

9.3. Application for issuance of ERC

Trial the IRC is issued, the foreign investor shall apply for the ERC. With the issuance of the ERC, the company comes legally into existence.

10. Other Forms of Investment

10.1 Public-Private Partnership Contract (PPP contract)

The PPP contract is a kind of contract signed by the competent State agency and investors or project enterprises to implement an investment project for constructing, renovating, upgrading, expanding, managing, and operating infrastructure facilities or providing public services.

10.2. Business Cooperation Contract (BCC)

Trial investors do not intend to establish an economic organization, a BCC can be signed among investors to implement the investment project. An IRC must be issued if the BCC contract has a foreign investor as a party.

The BCC is a popular business model in the oil, telecommunications, and advertising sectors. It does not create a separate legal entity, and instead, it creates a contractual relationship with a specific investment project undertaken in Vietnam. Because the BCC consists of a contract only, the participating foreign and Vietnamese parties remain independent legal and tax subjects.

11. Disclaimer

All information provided is general and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.

No one should act upon such information without appropriate professional advice after a thorough examination of the facts of the particular situation. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected if not generated deliberately or grossly negligent.

Appendix

The Free Trade Agreements to which Vietnam is a partner

|

Country |

Bilateral |

Multilateral |

Regulation on rules of origin |

|

Cambodia Indonesia Laos Myanmar Philippines Thailand |

N/A |

CO form D; Circular 22/2016/TT-BTC, amended by Circular 10/2019/TT-BTC |

|

|

RCEP* |

Trial 3A – Products specific rules |

||

|

Brunei Malaysia Singapore |

N/A |

CO form D; Circular 22/2016/TT-BTC, amended by Circular 10/2019/TT-BTC |

|

|

Annex 3A – Products specific rules Annex 3B – Minimum trial requirements |

|||

|

CPTPP |

|||

|

China |

N/A |

||

|

ACFTA |

CO form E; Annex 3 – Rules of origin Circular 12/2019/TT-BTC |

||

|

Hong Kong |

N/A |

AHKFTA |

CO form AHK; Chapter 3 – Trial of Origin Circular 21/2019/TT-BTC |

|

Japan |

VJEPA |

|

For VJEPA: CO trial VJ Circular No. 10/2009/TT-BCT |

|

CPTPP |

For CPTPP: CO CPTPP; Circular 03/2019/TT-BTC, amended by Circular 06/2020/TT-BTC |

||

|

Annex 3A – Products specific rules Trial 3B – Minimum information requirements |

|||

|

CO form AJ, |

|||

|

Korea |

|

For VKFTA: CO form VK Circular 40/2015/TT-BTC |

|

|

For RCEP: Annex 3A – Products specific rules |

|||

|

Form AK; Circular 20/2014/TT-BCT, amended by Circular 13/2019 |

|||

|

India |

N/A |

Form AI Circular No. 15/2010/TT-BCT |

|

|

Armenia Belarus Kazakhstan Kyrgyzstan Russia |

N/A |

Circular 21/2016/TT-BCT, amended by 11/2018/TT-BCT |

|

|

EU |

N/A |

Form EUR.1 Protocol 1 – Originating Products Circular 11/2020/TT-BTC |

|

|

UK |

N/A |

Protocol I – Originating Products Circular No. 02/2021/TT-BCT |

|

|

Chile |

|

For VCFTA: Form VC |

|

|

CPTPP |

For CPTPP: CO CPTPP; Circular 03/2019/TT-BTC, amended by Circular 06/2020/TT-BTC |

||

|

Canada Mexico Peru |

N/A

|

CPTPP |

For CPTPP: CO CPTPP; Circular 03/2019/TT-BTC, amended by Circular 06/2020/TT-BTC |

|

Australia New Zealand |

N/A |

CPTPP |

For CPTPP: CO CPTPP; Circular 03/2019/TT-BTC, amended by Circular 06/2020/TT-BTC |

|

AANZ FTA |

Form AANZ Circular No. 31/2015/TT-BCT |

||

|

For RCEP: Annex 3A – Products specific rules |

© WTS Tax Vietnam Co., Ltd. and Grünkorn & Partner Law Co., Ltd.

[1] The Constitution of the Socialist Republic of Vietnam, approved by the National Assembly on 28.11.2013 and in force as from 01.01.2014

[2] World Bank at: https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=VN

[3] Resolution 01/NQ-CP on socioeconomic targets for 2022 on 08 January 2022

[4] Asian Development Bank at: https://www.adb.org/sites/default/files/publication/696656/basic-statistics-2021.pdf

[5] Ministry of Planning and Investment at: https://www.mpi.gov.vn/en/Pages/tinbai.aspx?idTin=52660&idcm=122

[6] Law on Investment No. 61/2020/QH14 promulgated by the National Assembly of the Socialist Republic of Vietnam on 17 June 2020.

[7] Law on Enterprise No. 59/2020/QH14 promulgated by the National Assembly of the Socialist Republic of Vietnam on 17 June 2020.

[8] The full list is provided in Appendix I to Law on Investment 2020.

[11] A JV usually is set up in the form of a MMLLC. However, the term JV only refers to the purpose of the entity, it is not a separate type of entity. A JV may also be organized in the form or a JSC or a partnership or other forms of an agreement.

[12] Law on Enterprise 2020, Article 74.

[13] Law on Enterprise 2020, Article 82.

[14] Law on Enterprise 2020, Article 80.

[15] Law on Enterprise 2020, Article 24.