Although Lorenz & Partners take great care to ensure that the information provided in these newsletters is up to date, we would like to point out that it cannot replace individual advice. Lorenz & Partners accepts no responsibility for the topicality, correctness or completeness of the information provided. Liability claims against Lorenz & Partners relating to material or immaterial damage caused by the use or non-use of the information provided or by the use of incorrect or incomplete information are excluded, unless Lorenz & Partners acted with intent or gross negligence.

1. Introduction

Drop shipping in the context of Thai VAT law refers to a transaction where a VAT-registered operator in Thailand sells goods to a foreign buyer, procures those goods from a supplier (either in Thailand or abroad), and instructs the supplier to deliver the goods directly to the foreign buyer outside Thailand, without the goods entering or leaving Thailand through Thai customs.

2. The Thai VAT System at a Glance

Thailand introduced its VAT system in 1992. Ultimately, the Thai VAT is an “all-phase net sales tax with input tax deduction authorisation”, similar to the system originally invented in Germany in 1916.

The rate of Thai Value Added Tax is currently at 7 %. These 7 percent are split into 6.3% Federal VAT and 0.7% Local Tax. While in Sec. 80 of the Revenue Code a rate of 10% is stipulated, it has “temporarily” been reduced to 7% since 1999 to improve the economy by stimulating consumption. However, it has been prolonged ever since. The latest extension was issued in September 2025 with a provisional end date of 30 September 2026. However, for the time being there are no signs of this practice changing.

In principle, any sale of goods or services within Thailand is subject to VAT, provided that the (natural or juristic) person issuing the invoice is registered in the VAT system.

For invoices to foreign customers, the matter is a bit more complex.

The following combinations are possible:

- Service or work performed abroad, which is used abroad: VAT exempt

- Service or work performed in Thailand but used abroad: 0% Thai VAT

- Service or work performed abroad but used in Thailand: 7% Thai VAT

- Service or work performed in Thailand and used in Thailand: 7% Thai VAT

The general calculation of the amount that has to be paid to the Revenue Department on a monthly basis is as follows:

Output Tax – Input Tax = tax debt

Whereas “Output Tax” is the received VAT amount (received from customers) and “Input Tax” is the paid VAT amount (paid to suppliers).

In case the tax debt is negative, the tax debtor can claim this negative amount from the Revenue Department or may use as a tax credit.

However, it is important to distinguish between normal VAT (7%), 0% VAT business and VAT-exempted business.

“0% VAT” business has no impact on the claimability of input tax, while VAT-exempted business may lead to some input VAT not being claimable:

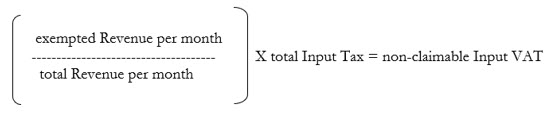

If more than 10% of the company’s revenue is VAT-exempted, the company’s claimable input tax has to be reduced proportionally:

3. VAT Treatment of Drop Shipping Transactions

a) Sale of Goods Outside the Kingdom

If a Thai VAT-registered operator sells goods to a buyer outside Thailand, orders the goods from a supplier outside Thailand, and instructs the supplier to deliver directly to the foreign buyer (with no import/export through Thailand), the transaction is considered to occur outside Thailand.

Such a transaction is not subject to Thai VAT under Section 77/2 of the Revenue Code.

As outlined above, the sales value from this VAT-exempt transaction should not be included in the VAT calculation. Any input VAT which is directly related to such VAT exempt business cannot be claimed.

Example:

Company A (Thailand) sells to Company B (Vietnam), orders from Company C (Japan), and instructs Company C to deliver directly to Company B. No import/export through Thailand. No Thai VAT applies.

Any input VAT paid in connection with such sale (e.g. a broker based in Thailand assists with the deal and writes an invoice for his work) is not claimable and has to be booked as cost.

b ) Multi-Tier Drop Shipping

If a Thai VAT-registered operator sells to a foreign buyer, procures goods from another Thai VAT-registered operator, who in turn procures from an overseas supplier and instructs direct delivery to the foreign buyer (with no import/export through Thailand), both the sale to the foreign buyer and the

domestic sale between the two Thai operators are considered to occur outside Thailand.

Neither transaction is subject to Thai VAT.

Example:

Company A (Thailand) sells to Company B (Vietnam), orders from Company C (Thailand), who orders from Company D (Japan) and instructs direct delivery to Company B. No import/export through Thailand. No Thai VAT applies to either sale.

4. Input VAT Deduction Rules

a) Input VAT related to Non-VAT-liable Activities

Input VAT incurred in connection with sales occurring outside Thailand (as described above) cannot be deducted from output VAT.

If input VAT is incurred for both VAT-liable and non-VAT-liable activities, it must be apportioned according to the proportion of revenue from each activity.

b) Apportionment Method

The taxpayer should calculate the proportion of revenue from non-VAT-liable activities (e.g. drop shipping sales outside Thailand) to total revenue, and then allocate input VAT accordingly.

Only the portion of input VAT attributable to VAT-liable activities may be deducted from output VAT.

- Total revenue: THB 20 million (THB 16 million domestic VAT-liable, THB 4 million overseas drop shipping).

- Input VAT incurred (not directly attributable): THB 1 million.

- Proportion of non-VAT-liable revenue: 20% (THB 4 million / THB 20 million).

- Allocate 20% of input VAT (THB 200,000) to non-VAT-liable activities (not deductible).

- Remaining 80% (THB 800,000) may be deducted from output VAT.

c) Multiple Activity Types

If the operator has VAT-liable, VAT-exempt, and non-VAT-liable (outside scope) activities, input VAT must first be allocated to non-VAT-liable activities, then the remainder apportioned between VAT-liable and VAT-exempt activities based on prior year revenue ratios.

Example:

- Revenue of the previous year: THB 8 million exports (VAT-liable), THB 8 million domestic sales (VAT-exempt), THB 4 million overseas drop shipping (non-VAT-liable).

- Revenue: THB 6 million exports (VAT-liable), THB 10 million domestic sales (VAT-exempt), THB 4 million overseas drop shipping (non-VAT-liable).

- Input VAT incurred: THB 1 million.

- Allocate 20% (THB 200,000) to non-VAT-liable activities.

- Remaining THB 800,000: allocate 50% (THB 400,000) to VAT-liable, 50% (THB 400,000) to VAT-exempt (based on prior year ratio).

- Only THB 400,000 may be deducted from output VAT.

- In the following year, Input VAT incurred THB 2 million.

- Allocate 20% (THB 400,000) to activities that are not subject to VAT.

- Remaining THB 1,600,000: allocate 37.5% (THB 600,000) to VAT-liable, 62.5% (THB 1,000,000) to VAT-exempt (based on prior year ratio).

- Only THB 600,000 may be deducted from output VAT.

5. Revenue Definitions for Apportionment

- “VAT-liable revenue” means any sales subject to VAT, including exports.

- “VAT-exempt revenue” means any sales exempt from VAT or subject to specific business tax.

- “Non-VAT-liable revenue” means any sales not subject to VAT (e.g. drop shipping sales outside Thailand as per Section 77/2).

It is important to distinguish between VAT-exempt revenue and non-VAT-liable revenue (subject to 0% VAT). Revenue subject to 0% VAT has no impact on the claimability of input tax, while VAT-exempt revenue may lead to some input VAT not being claimable.

6. Compliance and Documentation

Maintain clear records of all drop shipping transactions, including contracts, purchase orders, shipping instructions, and evidence that goods never entered or left Thailand.

Ensure proper calculation and apportionment of input VAT in monthly VAT returns.

Apply the apportionment method consistently, unless a change is approved by the Director-General.

7. Conclusion

Drop shipping transactions by Thai VAT-registered operators, where goods are sold and delivered entirely outside Thailand without import/export through Thailand, are not subject to Thai VAT. However, Input VAT related to such transactions cannot be deducted. If input VAT is incurred for both VAT-liable and non-VAT-liable activities, it must be apportioned according to revenue proportions of the previous year. Accurate record-keeping and correct apportionment are essential for compliance.

Drop shipping operators should implement robust internal controls to clearly document the flow of goods and ensure that no import or export occurs through Thailand for these transactions. They should maintain comprehensive records, including contracts, purchase orders, shipping instructions, and proof of delivery outside Thailand. Drop shipping operators should regularly review and correctly apportion input VAT in line with the latest Revenue Department Orders and Notifications, and consult with qualified tax professionals to ensure ongoing compliance and to adapt to any regulatory changes affecting VAT treatment of drop shipping activities.