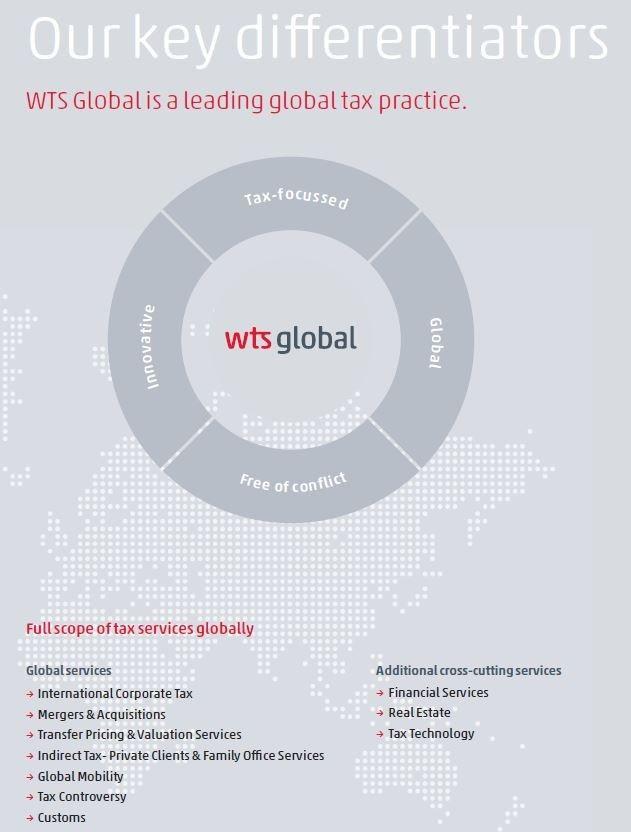

WTS Global at a glance

- Founded in 2003 by WTS Germany

- Locally rooted – Globally connected: Present in more than

100 countries with more than 3,500 tax professionals - Tax-focused: Coverage of the entire range of tax advisory services

- Independent & free of conflict: No audit

- Quality assurance: Stringent quality reviews

- Diverse customer base: From multinationals to private clients

- Central management & coordination: Centrally managed global tax practice

About WTS Global

With representation in over 100 countries, WTS Global has already grown to a leadership position as a global tax practice offering the full range of tax services and aspires to become the preeminent non-audit tax practice worldwide. WTS Global deliberately refrains from conducting annual audits in order to avoid any conflicts of interest and to be the long- term trusted advisor for its international clients. Clients of WTS Global include multinational companies, international mid-size companies as well as private clients and family offices.

The member firms of WTS Global are carefully selected through stringent quality reviews. They are strong local players in their home market who are united by the ambition of building a truly global practice that develops the tax leaders of the future and anticipates the new digital tax world.

WTS Global effectively combines senior tax expertise from different cultures and backgrounds and offers world-class skills in advisory, in-house, regulatory and digital, coupled with the ability to think like experienced business people in a constantly changing world.

For more information please visit: wts.com

Through resilience to recovery

Tax executives lead the way to resilience and recovery.

Since the publication of our first WTS Global in Asia Pacific brochure in 2019, the sense of continued business optimism has been replaced by economic disruption and devastation brought about by the COVID-19 pandemic. Now, more than a year into the pandemic that crippled the world, the extent of the impact reverberates across sectors and industries in the Asia Pacific region. As governments contend with deficits and slowdowns, businesses,

meanwhile, are exposed to risks arising from disrupted supply chains, evolving tax policies and fiscal stimulus measures.

The World Bank’s latest report states that, amongst Asian economies, only China and Vietnam are poised for growth in 2021. As sustainable recovery for most Asian economies remains elusive, key developments in the region and globally are considered at play in helping shape how soon economies and businesses can fully bounce back:

→→Tax policies have become a focal point in every government’s pandemic response mechanism to help spur economic confidence and support groups most affected by the volatile business climate. On the other hand, businesses need to brace for aggressive tax policies and implementation that would be put in place by tax authorities at a later stage.

→→The OECD BEPS2.0 final report will be one of the most widely anticipated developments for international tax and transfer pricing practitioners globally. Regardless of the details of the report, all multinational enterprises will need to reassess global tax strategies and structures.

→→Free trade agreements such as the Regional Comprehensive Economic Partnership Agreement (RCEP) provide possibilities for cross-border businesses to implement tax and duty-savings strategies in their supply chains.

→→With the adoption of digital taxes by a growing number of Asia Pacific jurisdictions, concerns abound including double taxation issues arising from unilateral tax measures.

→→US President Joe Biden’s tax and trade policies such as the country’s potential return to the Trans-Pacific Partnership would be favourable to export-oriented Asian economies.

→→The Biden administration’s trade policies vis-à-vis China will also determine whether there will be a reprieve to trade tensions or whether companies will need to continue to walk the tight rope of complying with two increasingly extra-territorial and potentially conflicting set of trade rules.

→→The effectiveness of vaccines will also determine how quickly the global economy is able to recover to pre-COVID levels or whether businesses will need to deal with a new norm of permanent impediments to global trade and commerce.

Businesses with significant Asian footprints need long term and conflict-free tax advisors who can work with their tax executives to develop resilient and agile responses to the volatile regulatory landscape. We, at WTS Global in Asia Pacific, can help international businesses thrive and recover through sustainable tax strategies and compliance. We draw our strength and expertise from our highly collaborative Asian network of tax experts with

presence in 14 jurisdictions across the region, enabling us to assemble a team for all areas of tax including:

→→Global value chains

→→Transfer pricing

→→International and regional tax planning

→→International tax and permanent establishments

→→Mergers & acquisitions

→→Regional tax controversies

→→Dispute resolution via competent authority processes

– APA & MAP

→→Digital taxation

→→Financial services

→→Private equity

→→Indirect tax

→→International trade

→→Private clients

→→Tax technology

We have the expertise and experience to provide global businesses with insights and advice to navigate an increasingly complex and changing tax and trade landscape in the region. We hope businesses will find our second Asia Pacific brochure useful as they plot their way through resilience to recovery.

Priority topics for Asia Pacific Tax Leaders

Global value chains

In recent years, global value chains (GVCs) have been growing in terms of length and complexity. By organising complex networks of factories and logistics providers, businesses have been able to minimise costs while maximising efficiency. However, this operating model exposes businesses to increased risks in terms of disruptions to their GVCs.

The advent of the COVID-19 pandemic has revealed the fragility of existing global value

chains… Business leaders are rethinking long-distance, complex and overly-concentrated

GVCs.

The advent of the COVID-19 pandemic has revealed the fragility of existing GVCs. Since the early days of the pandemic, many economies have entered into either full or partial lockdown. Consequently, manufacturing and international transport activities were disrupted, forcing businesses to either relocate or reshore their production activities. In addition to the growing trade tensions between the US and China, further disruptions in GVCs were also triggered by unforeseen events such as the recent Myanmar coup and the US-imposed sanctions on Myanmar.

These events have revealed the drawbacks of longdistance and complex GVCs. As such, we expect multinational corporations to begin rethinking and

reassessing their strategies in order to ensure the resiliency of their GVCs. Doing so would be essential to ensuring competitiveness in the market. We expect to see businesses begin to employ strategies such as the shortening of GVCs, and the automation of production activities. These strategies will allow for companies to mitigate the risk of disruption to their GVCs, which have been proven to be costly.

BEPS 2.0 and unilateral measures maintained by various tax authorities as well as the proliferation of free trade agreements will also figure prominent in business and tax strategies of multinational enterprises as they seek to achieve the optimal balance between optimisation, resilience and sustainability in their GVCs.

Transfer pricing

With the advent of the G20 OECD Inclusive framework – Pillars 1 and 2 (“BEPS 2.0”), transfer pricing is playing a more pivotal role than ever before as taxpayers and tax administrators deal with the new proposals to reallocate more profits to market jurisdictions. The different elements of the GloBE global minimum tax mechanism in Pillar 2 is also largely implemented within MNE groups and on related party payments. Transfer pricing country by country reports and thresholds are also expected to be important elements and an integral part of the Pillars 1 and 2 design.

Together with the disruption wrought by the COVID-19 pandemic which has yet to play itself out, this year will see tax directors and tax administers having their hands full in dealing with the changes in functional analyses and benchmarking as they adjust their transfer pricing policies and documentation to reflect the new post-COVID global value and supply chains.

The twin forces of change of BEPS 2.0 and COVID-19 are anticipated to bring about a future wave of audit enquiry and controversy as tax administrations, necessitated by the revenue raising imperative, examine and seek to challenge taxpayers in their transfer pricing arrangements in the coming years. Taxpayers are well advised to invest in performing thorough transfer pricing analyses and shoring up their documentation to prepare for this anticipated increase in controversy.

The twin forces of change of BEPS 2.0 and COVID-19 are anticipated to bring about a future wave of audit enquiry and controversy as tax administrations, necessitated by the revenue raising imperative, examine and seek to challenge taxpayers in their transfer pricing arrangements in the coming years.

International tax and permanent establishments

The Covid-19 pandemic has caused massive disruption to cross-border activities and project timelines, and has resulted in unintended taxable presence and consequences for businesses in respect of their cross-border projects and activities. As highlighted in our Asia Pacific webinar in November 2020, each Asia-Pacific jurisdiction has dealt with the matter in its own way. Businesses with projects in Asia Pacific should not assume that the OECD approach is applied across the board, but instead take into account the local interpretation, concessions and practical approaches in each jurisdiction.

At the same time, most jurisdictions in Asia Pacific have also rolled out economic stimulus packages that include various tax incentives to promote foreign direct investment as well as domestic investment. Businesses may wish to make use of the opportunity to tap on these COVID-19 related measures to support the growth of their investments in the region and to put themselves in a position of strength for the post-pandemic economic recovery.

Separately, with the advent of BEPS 2.0, all eyes will be on the extent to which jurisdictions, including those in the region, will follow the conclusions and recommendation thereunder, and whether further unilateral domestic measures will be adopted by jurisdictions to address the perceived inadequacies of BEPS 2.0.

Country highlights

Australia

The Australian Tax Office (ATO) is introducing a new compliance program called “Next 5,000”, which will be rolled out Australia-wide over the next four years. It will target private wealth groups with a wealth pool of over A$50 million and focus on consolidations, sales and acquisitions, and international-related party transactions.

The ATO recognises that the COVID-19 pandemic may have had an impact on transfer pricing arrangements because of the economic downturn. As a result, greater focus will be on the evidence of the impact of COVID-19 to the taxpayer, rather than benchmarking and comparable analysis for the short term. Important to note is that the ATO will continue to use the risk assessment framework of practical compliance guidelines (PCG); in particular, PCG 2019/1 (inbound distribution arrangements) to inform how the ATO audit teams will be deployed.

Finally, a draft PCG is being prepared to set out a proposed compliance approach to international arrangements connected with the development, enhancement, maintenance, protection and exploitation of intangible assets. This framework, scheduled to be completed by mid-2021, may enliven the ATO’s transfer pricing, diverted profits and anti-avoidance powers.

The Australian Taxation Office (ATO) continues to be a global leader in the area of justified trust and tax risk assessment. Upon dealing with the challenges of COVID-19, the ATO have announced they will increasingly focus on tax risk in high wealth individuals and businesses that engage in cross border intellectual property and distribution arrangements.

Craig Silverwood

China

The COVID-19 pandemic has started disrupting business operations in early 2020. The Chinese tax authority has released a series of tax reliefs to ease taxpayers’ burden, including exemption or reduction of taxes and social security funds and extension of filing deadline, etc. Aided by these tax relief policies and other measures, China’s economy has bounced back strongly in the post-COVID-19 period, with a GDP growth of 2.3 % in 2020 and a forecast growth of over 6% in 2021. Some existing tax reliefs granted in 2020 continue to be made effective in 2021 and new incentives are additionally offered, e.g. tariff exemption to chip and software companies, higher R&D expense deduction rate, and lower income tax rate to small businesses.

Other notable developments:

→→“Regional Comprehensive Economic Partnership Agreement” signed by 15 Asia- Pacific nations in late 2020; several countries, including China, Singapore, Thailand, and Japan, have completed the domestic legislative procedures in early 2021.

→→“Export Control Law” issued

→→A concessional view on COVID-19-affected tax treaty terms issued

→→“Foreign Investment Law” and its “Implementation Regulations” promulgated

→→Four free trade zones launched in Beijing, Anhui, Hunan and Zhejiang

→→“Guidelines on Foreign Exchange Businesses under Current Accounts” issued

→→ “Further promotion and development of Integrated Circuit Industry and Software Industry in the New Era” issued

→→“Simplification on Individual Foreign Exchange under Current Accounts” issued

→→“Administration Measures on Export Tax Exemption and Reduction” updated

→→“Administration Measures on Processing Trade Goods”

→→“Customs Implementation Rules on Import Tax Exemption for Encouraged Sectors (2020 version)” rolled out

China remains the powerhouse of production and investment amid the COVID-19 pandemic. The trend is expected to continue in 2021 with a recovery of GDP growth expected. China also has been adjusting its domestic regulatory environment to support businesses. Companies in China, local or foreign, can enjoy the same tax and customs treatments.

Business operators envisaging China playing a major part in their business value chain should plan ahead and lay the foundation now to catch up with the growth.

Martin Ng

India

Given the challenging times on account of the pandemic, the Government announced a slew of tax measures to provide relief to taxpayers. The key measures announced in this regard are listed below:

→→Several compliance related due dates are continuously being extended to avoid any undue hardship for the taxpayers.

→→The Government has expedited issuance of tax refunds in several cases to assuage the liquidity concerns.

→→Furthermore, interest rates for delay in payment of taxes has also been reduced considerably.

→→Withholding tax rates for all domestic payments reduced by 25%

→→Clarifications issued with respect to residential status of individuals who could not leave India on account of the lockdown restrictions, etc.

→→To encourage individuals and corporates to donate for strengthening the fight against COVID-19, 100% tax exemption is provided for donations made to specified relief funds.

Other notable developments include:

→→Scope of equalisation levy (digital tax) expanded to cover several cross- border e-commerce transactions

→→Shift to a faceless tax administration with an intent to completely eliminate the physical interface between the taxpayers and the Revenue to impart greater efficiency, transparency and accountability

→→Abolishment of Dividend Distribution Tax and re-introduction of classical system of taxing dividends in the hands of the shareholders

→→Multilateral Instrument has entered into effect for around 40 bilateral tax treaties.

→→Tax Amnesty Scheme (called as Vivad se Vishwas scheme) introduced, providing for a one-time opportunity to taxpayers to settle tax disputes with Revenue basis the prescribed parameters.

→→Mandatory issuance of e-invoice by select category of suppliers crossing a specified turnover threshold limit

→→Income-tax exemption granted to sovereign wealth funds on capital gains, interest and dividend income arising from investments made in India.

India has rolled out an ambitious ‘Made in India’ program. The idea is to make India a manufacturing hub. Towards this end, various production-linked incentives have been rolled out. There is a reduction of corporate tax rates in India and moving to the classical regime of taxation of dividend is beneficial for foreign investors. This would improve the effective tax rate in India as well as reduce the cost of repatriating funds for foreign investors. These measures encourage inflow of increased foreign investments into the country.

Dinesh Kanabar

Indonesia

The Indonesian government granted various COVID-19 tax reliefs in 2020. These included employee income tax borne by the government, tax exemption on certain importation, reduction of monthly income tax instalment, and speeding up of the VAT refund process. Additionally, CIT rate was reduced to 22% for FY 2020 and 2021, and to 20% for 2022 onwards.

Other notable developments:

→→Implementation of 10% digital VAT on the electronic transaction of services and intangible goods

→→Plan to implement electronic transaction tax on digital business

→→Enactment of Omnibus Law, amending various taxation laws: income tax law, VAT law, and general tax provision and procedures law. The amendments include exclusion of foreign-sourced income for expatriates, tax exemption for dividends and certain foreign-sourced income, and updated method in calculation of penalty.

→→Implementing regulation of the Omnibus Law, including provisions on: limited territorial taxation system for foreign taxpayers; amended definition of tax subject for individual, reinvestment requirement for dividend to be tax-exempted.

→→Kriteria Keahlian Tertentu serta Tata Cara Pengenaan Pajak Penghasilan bagi Warga Negara Asing.

→→Updated procedures of Advance Pricing Agreement and Mutual Agreement Procedure

The impact of the COVID-19 pandemic to the government budget triggers two opposites measures: tax reliefs and simultaneously expansion on new tax basis. The everchanging tax regulations in Indonesia demand robust processes to ensure compliance with prevailing regulations and sound practices in mitigating tax risks. We strongly believe that the ability to embrace challenges and adapt inevitable changes toward strategy is undoubtedly pivotal.

Tomy Harsono

Japan

The 2021 tax reform bill was passed by the ordinary Diet session on March 26, and promulgated on March 31. The main items of tax reform in 2021 are as follows:

Corporate tax

→→Tax incentive for promoting investment in digital transformation

›› Tax credit (5% / 3%) or special depreciation (30%) for investments for business transformation using cloud

computing, etc

→→Tax incentive for promoting investment for carbon neutrality

›› Tax credit (10% / 5%) or special depreciation (50%) for advanced investments with high decarbonisation effect

→→Tax incentive for R & D

›› Raise the upper limitation of tax credits for certain companies (25% – 30%) and revise the tax credit rate

→→Relaxation of the deduction limitation for loss carryforwards

›› Raise the deduction limitation for loss carryforwards within the investment amount based on the business adaptation plan (tentative name)

→→Tax incentive for M&A using own shares

Tax measures in the emergency economic measures against COVID-19 The main items of tax measures are set out below.

→→Grace system for national taxes Methods of tax payment are as follows:

(1) defer payment for one year; or

(2) make installment payment during the grace period

depending on the taxpayer’s financial resources.

→→Tax losses carry-back system

→→Tax incentive for SME’s investment of digital equipment for remote work

→→Extension of filing for corporate income tax, individual income tax and consumption tax

National Tax Agency reorganised the International Taxation Department in July 2020 due to accurate and efficient tax audit for international transactions. This shows that it will be focused more on the foreign-related transactions in tax audit against MNE than ever before. It will be more effective to prepare transfer pricing documentation due to dealing with the tax audit after COVID-19.

Eiichi Takao

Malaysia

Effective January 14, 2021 Malaysia has tightened the movement control in most states including the business and administrative capitals in Kuala Lumpur & Putrajaya. There has been some relaxation since January 15 although the nation remains under state emergency and parliament suspension. On taxation, the Malaysian tax authority announced several concessions to avoid unintended personal and business taxation due to travel restrictions. In addition to the incentives rolled out in stimulus packages in 2020, further stimulus package rolled out in 2021 with additional direct and indirect tax incentives to attract investment and spur the economic activities despite the next wave of Covid.

Technology and the pandemic have coupled to push forward innovation on many fronts that require constant reassessment of tax exposure from various facets to business operation supply chain management matters to WFH. It is vital to incorporate tax assessment in every business decision made.

Thenesh Kannaa

Pakistan

In response to the challenges posed by the COVID-19 pandemic, the Government of Pakistan introduced various relief measures including tax exemption on import and subsequent supply of certain medical supplies and drugs. In April 2020, a major stimulus package for the construction industries was announced, offering tax incentives to builders, constructors and the general public including temporary tax exemption on the source of investment, fixed tax rates of tax in lieu of corporate income tax, withholding tax exemptions on certain materials and exemptions from provincial taxes.

Additional in 2020 introductions:

→→Roshan Digital Account for non-resident Pakistanis to provide innovative banking solutions for payments and investments coupled with tax benefits

→→Special Technology Zone Ordinance offering 10-year tax exemptions (income tax, sales tax and customs duty)

and incentives to zone enterprises.

→→Federal Board of Revenue Anti Money Laundering and Countering Financing of Terrorism Regulations for Designated Non-Financial Businesses and Professions (DNFBP)

→→Rules for online integration of various business with the tax authority

→→Date for furnishing taxpayer’s profile (a new requirement) extended to March 31, 2021

→→Concessional rates of customs duty, VAT and income tax extended for 4 wheelers vehicles CBU, CKD and certain specific parts until June 30, 2026.

→→New sales tax rules for track and trace system for tobacco, cement and fertilizer industries

→→E-audit in sales tax

→→Income tax exemption for transmission line projects extended to June 30, 2022

→→Government to introduce Finance Bill in the next session of the National Assembly with a view to withdraw / streamline various tax exemptions in line with its ongoing negotiations with the IMF. Details to follow soon.

OECD’s MLI will be effective in Pakistan from April 1, 2021. In the aftermath, there will be a growing focus on the cross-border transactions of taxpayers and the volume of ongoing tax controversies involving Offshore Digital Services tax as well as transfer pricing will increase. Offshore assets of high-net worth resident individuals will remain another area of focus as the tax authority continues to receive data under the Automatic Exchange of Information arrangement.

Muzammal Rasheed

Philippines

The second package of the government’s comprehensive tax reform program was signed into law in the first quarter of 2021. From a tax reform program, this was recalibrated to be more relevant and responsive to the needs of businesses amidst the COVID-19 pandemic. It was then renamed as the Corporate Recovery and Tax Incentives for Enterprise Act (CREATE).

With CREATE, income tax cuts were made across the board. Micro, small and medium enterprises registered as domestic enterprises will enjoy the largest ever corporate income tax rate cut in the country’s recent history, with an immediate 10% reduction for corporations with total assets of not more than PHP100 million and taxable income of PHP5 million and below. Other corporations, including foreign corporations will see a reduction of their income tax rate by 5%. Aside from the corporate income tax rate reduction, other changes, both permanent and temporary, were introduced in the new law. This includes elimination of the improperly accumulated earning taxes and the reduction of tax rates for the institutions, goods and services used in the fight against COVID-19. The other important part of the new law is the rationalisation of the tax incentives by providing incentivises for activities that will fulfill the strategic priorities of the government.

Other notable developments:

→→Financial Institutions Strategic Transfer (FIST) Act (Republic Act No. 11523) – the second of the government’s economic recovery measures, which is a

law allowing financial institutions to offload nonperforming assets and bad loans

→→Government Financial Institutions Unified Initiatives to Distressed Enterprises for Economic Recovery (GUIDE) – not yet a law but one of the bills pushed by the government as among its economic recovery measures and aimed at keeping the micro, small, and medium enterprises afloat during this pandemic

→→Bayanihan to Recover as One Act (Republic Act 11494) – an act proving for COVID-19 response and recovery interventions to accelerate the recovery of the economy

→→Department of Finance Revenue Regulations No. 19-2020, related circulars and memorandum orders, and its changes – requiring the filing and prescribing the manner of filing Information Return on Related Party Transactions and the submission of transfer pricingrelated documents

→→Digital Services Tax – proposed law still pending in Congress

The Philippines plans to stimulate the economy by reducing corporate income tax rates from 30% to 20% for small and medium enterprise and 25% for all other corporations under the recently passed CREATE Law. The government aims to encourage and support small and medium enterprises which is the backbone of the economy and attract foreign investments by giving income tax holiday of up to 7 years. The country has also passed measures for the mandatory compliance of transfer pricing rules in the hope that discovery of tax leaks will result in a broader tax base.

Irwin C. Nidea Jr.

Singapore

In light of the ongoing COVID-19 pandemic, many temporary tax measures have been introduced to support businesses, and to preserve existing jobs. For example, enhancements to the carry-back relief schemes have been extended to 2021. In addition, the Inland Revenue Authority of Singapore has launched a new, simplified Corporate Income Tax Return which allows smaller companies to save time and file taxes easily.

Other notable developments:

→→Extending the withholding tax exemption for the financial sector

→→Publication of guidelines on the tax treatment of Variable Capital Companies

→→Signing of a revised DTA with Indonesia

→→Signing of a protocol amending the DTA with Germany

→→Modification of Singapore’s DTAs with 17 countries further to its ratification of the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS have come into force since 1 January 2020

→→The following FTAs were signed in 2020: Regional Comprehensive Economic Partnership Agreement, United Kingdom-Singapore FTA

Global or regional tax directors will need a more holistic view of taxes, duties, and trade and regulatory developments to ensure that their organisations stay ahead in the current disruptive environment.

This will require tax directors to work with advisors who are able to pull together different disciplines such as direct tax, indirect tax, transfer pricing, customs & excise duties, tax treaties and free trade agreements and integrate them into a coherent and effective strategy to meet the needs of their businesses.

Such strategies will need to enable businesses to be optimised and efficient whilst ensuring that they do not incur unnecessary levels of risks.

Irving Aw

Taiwan

Taiwan’s government has taken a number of measures to absorb the economic shock that Covid-19 has caused. Eligible individuals and businesses may defer tax payments or make payments in installments. Tax filing and payment deadlines have also been extended in cases where an individual or a company’s responsible person tasked with filing a business’s taxes is under quarantine or otherwise isolated.

Other notable developments:

→→Tax agreements signed between Taiwan and Saudi Arabia, Czech Republic

→→Basic allowance for individual income taxes was raised from TWD175,000 to TWD182,000

→→Two-year extension of the government’s energy efficient appliance rebate program from June 14, 2021

→→Foreign professionals who meet certain requirements can apply for income tax exemptions

→→Foreign electronic service providers that do not issue cloud Government Uniform Invoices can be fined

Think outside the box and be proactive – Taiwan has overcome many challenges in becoming a solid, reliable place of business for international clients. Even on first sight, tax law in Taiwan is easily managed. It is important not to be complacent – be compliant and stay ahead of the curve and on top of the tax regulations and requirements.

Taiwan’s tax administration follows international standards and agreements, and is up to date on the latest tax developments. Use the technology and digitisation for staying tax compliant and master the challenges of a digitalised tax world.

Michael Werner

Thailand

The Thailand Transfer Pricing Act came into effect on January 1, 2019 and has been supplemented by subsequent implementing regulations, giving clear guidelines on documentation requirements and accepted methods.

The major cross-border tax topic of the coming years will be transfer pricing and how international tax laws will develop amidst the increasing number of countries implementing instruments in line with the BEPS.

Thailand has extended its transfer pricing regulations and tax auditing practice by implementing more of the actions under the OECD BEPS action plan.

Thailand will extend its transfer pricing regulations and tax auditing practice by implementing more of the actions under the OECD BEPS action plan.

Till Morstadt

UAE

The year 2020 in the UAE was marked as “towards the next 50” through three major events, namely the inauguration of the Barakah Nuclear Plant, the launch of the Hope Probe and the hosting of the Expo 2020 Dubai. The UAE was also very proactive in its response to COVID-19.

Other notable developments:

→→The UAE implemented Economic Substance Regulations (‘ESR’) post resulting to its removal from the blacklist

issued by the EU.

→→In August 2020, the UAE became the third Arab country after Egypt and Jordan to formally normalise its

relationship with Israel.

→→The UAE is ranked first amongst the Arab Region to launch and use 5G.

→→The UAE Federal Supreme Court in October 2020 issued its first judgment on VAT which has a significant impact on penalties levied by the Federal Tax Authority for Companies registered under VAT.

→→In November 2020,the Government of Dubai – Dubai Customs, to alleviate the burden on businesses and help them navigate the challenges of COVID-19 pandemic, launched an initiative offering 80% discount on fines for customs cases and violations detected or committed before March 31, 2020.

→→Effective January 1, 2021, foreign nationals are now allowed to own 100 per cent of their companies as against the earlier requirement of 51% ownership being with a local emirati.

→→In January 2021, the UAE proposed to introduce relaxed residency and visa requirements and announced that its citizenship will be granted to foreigners, subject to certain conditions.

Tax and technology go hand in hand. Considering the recent developments, it is pretty clear that the UAE is heading towards a taxation economy. Being a technologically advanced country, reliance will be more on handling taxes in an automated manner using AI and machine learning.

Nimish Goel

Vietnam

2020 was a challenging year for the world due to the adverse impact of COVID-19. Despite this, Vietnam succeeded in maintaining a year-round positive growth. Other notable achievements of Vietnam’s economy, paving the way to become the key supply chain hub included:

→→The EU-Vietnam Free Trade Agreement (EVFTA) took effect on August 1, 2020 with elimination of nearly all

tariffs and wide-ranging commitments on services.

→→The Regional Comprehensive Economic Partnership (RCEP), hailed as the largest trading pact in which Vietnam is a member, was signed on 15 November 2020.

→→The new Law on Investment was passed and took effect on January 1, 2021, adopting “negative list” approach to attract foreign investments.

Amid this economic liberalisation, Vietnam has strengthened its tax management through the new Law on Tax Administration and detailing regulations, which took effect on July 1, 2020. The focus of the law is on enforcing more tax compliance, esp. viewing foreign invested companies. To be highlighted are regulations on transfer pricing and related party transactions with enhancement of international cooperation as well as on taxation of e-commerce activities. The commercial banks will be involved in enforcement of tax compliance.

To support businesses inovercoming the impact of the COVID-19 pandemic, corporate income tax in 2020 was reduced by 30% for enterprises whose total revenue in 2020 did not exceed VND200 bn (equivalent to USD8.5m).

Vietnam is emerging as a global manufacturing hub with high attractiveness to foreign investors. Tax administration has the clear plan to increase tax compliance and tax revenue.

Wolfram Gruenkorn