Welcome back to the fourth issue of our Legal/Tax News Update (Thailand) in 2015.

I. Amendment (No. 27) of the Civil Procedure Code: Supreme Court Appeal requires Approval

It is common practice in Thailand for the losing party in a court case to delay the rendering of the final judgement by appealing the case to the Court of Appeal and the Supreme Court. Under the old law, any case with a dispute amount of more than THB 200,000 could be appealed to the Supreme Court. This low barrier led to a huge number of cases that were appealed to the Supreme Court, and currently, it may take several years to receive a final judgement.

The delayed final judgment affects the confidence and faith vested in the Thai justice system. The solution is to limit the number of cases that can be appealed to the Supreme Court.

Under the recently amended law, approval has to be requested from the Supreme Court in order to submit the case to the Supreme Court. This request should be lodged within one month after the judgment of the Court of Appeal has been rendered. The submitted requests will be reviewed and decided by majority vote of a panel of four Supreme Court judges. In case at least two of the judges vote ‘Yes’, the case can be appealed to the Supreme Court.

The judges’ decision to accept or decline the case shall be based on the question whether the case contains any crucial legal questions that require a decision of the Supreme Court.

The legal questions that should be considered as crucial include:

Questions related to the public interest or public moral;

The judgment or order of the Court of Appeal contradicts a norm previously set by a judgment or order of the Supreme Court;

Legal questions that have not been previously decided by the Supreme Court;

The judgment or order of the Court of Appeal contradicts a judgment or order of another court;

For the development of legal interpretation; and

Other crucial questions set forth by the Chief Justice of the Supreme Court.

The new law came into effect on 7 November 2015, but it will not affect legal cases that have been lodged in the Court of First Instance before this date. Such cases will be

conducted under the old law, including the right to appeal to the Supreme Court. Please note that this law only concerns civil cases, not criminal cases.

The amendment also specifies that the judgement or order of the Court of Appeal is final (unless it is approved to be appealed to the Supreme Court), which poses a problem to legal cases that have to be appealed from the Court of First Instance directly to the Supreme Court (e.g. labour, IP and international trade, bankruptcy, taxation cases).

To harmonise the appeal procedure, the Cabinet approved the establishment of a “Special Jurisdiction Court of Appeal”. Special jurisdiction cases (e.g. labour, IP and

international trade, bankruptcy, taxation cases) shall be appealed to this court instead of the Supreme Court. Details are still under review.

II. Maintaining VAT at 7% until 2016

Royal Decree No. 592 was announced on 26 September 2015 to maintain the VAT rate at 7% until 30 September 2016.

The VAT rate specified in the Revenue Code is 10%, comprising of actual VAT of 9% and local tax of 1%. Since 1992, all governments have been maintaining the reduced

7% rate VAT as a stimulus measure (except in 1997 due to the financial crisis). Royal Decree No. 592 is a continuation of this policy.

III. New Policies to boost Real Estate

Market In an attempt to boost the Thai economy, the Cabinet has approved a stimulus plan for the real estate sector by decreasing the transfer fee (normal rate 2%) and mortgage registration fee (normal rate 1%), both to 0.01%.

Both individuals and companies can benefit from the reduced rate, whether for new or old properties.

Types of Properties: The properties that are covered by this scheme can be separated into the following three categories:

Non-allotment properties (residential purpose only): 1) Building, and 2) land and building (this does not apply to land without building);

Allotment properties: 1) land and building, and 2) land without building;

Condominiums: 1) whole condominium building, and 2) condominium unit.

Mortgage Registration: The reduced rate only applies to mortgage registrations resulting from primary finance, e.g. to finance a building on the land, or the land itself; it

does not apply to the transfer of the mortgage right (refinance).

Please note, however, that the withholding tax (progressive personal income tax rate, or 1% for corporate taxpayers) and specific business tax (3.3%) remain unchanged.

Period: The reduced fees will apply for a period of 6 months, from 29 October 2015 until 28 April 2016.

Government Housing Bank Loans: Besides the reduction of fees at the Land Department, the government also approved a financial support scheme for persons with

low or medium income (less than THB 30,000 per month) in the form of residential loans through the Government Housing Bank.

The initial budget for this scheme is THB 10 billion. The scheme is valid from 19 October 2015 until 31 December 2016. The terms and conditions are subject to the announcement of the Government Housing Bank.

IV. New Bankruptcy Act Amendment (No. 8)

The 8th amendment of the Bankruptcy Act came into force on 27 August 2015. It aims to simplify and speed up the bankruptcy procedure. The newly imposed procedure is

as follows:

The official receiver has the authority to determine the validity of a claim for payment, and to give order for payment. The official receiver can issue a summons for persons who may have relevant information regarding the claim for payment. The old law vested these powers in the court;

The debtor’s proposal for a composition before bankruptcy should at least include:

o payment priority according to the law;

o settlement amount;

o procedural plan in compliance with the composition;

o payment terms;

o management plan for collateral (if any); and

o guarantor (if any).

If the composition does not contain the abovementioned details, the official receiver can notify the debtor to complete the composition;

A creditor who does not submit the claim for payment within the period of 2 months after the announcement of the absolute receivership can lodge the claim for payment only in case of force majeure;

The penalties under the Bankruptcy Act have been amended to be appropriate for the current economy and society. New penalties range from fines up to THB 20,000 –

200,000 and/or imprisonment up to 2 months – 2 years, depending on the nature of the violation of the law. These penalties are for several offences under the Bankruptcy Act, including:

o small offences, such as leaving the country without approval, not attending the creditor’s meeting, or not cooperating in selling the assets, etc.;

o more severe offences, such as not transferring money as ordered by the official receiver, transferring or hiding assets or documents, creating encumbrances on the assets,

etc.

These new procedures do not apply to bankruptcy cases that have been lodged with the court before 27 August 2015.

V. 2016 Excise Tax Rate will affect Car Prices

The new excise tax rate for cars and pick-up trucks will be effective and enforced from 1 January 2016.

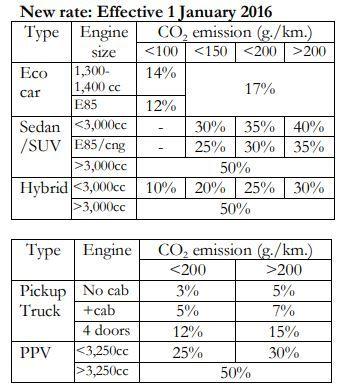

Unlike the old excise tax rate that was only based on the engine capacity and type of fuel, the new rate is based on engine capacity, fuel type and CO2 emission.

Eco Car: The excise tax on eco cars (1,300 – 1,400 cc. engine) will be reduced from 17% to 12-14% (if CO2 emission is less than 100 g./km). This will result in a reduction of excise tax of approx. THB 12,000 for a common eco car in the Thai market (price approx. THB 400,000).

Sedan/SUV: The new excise tax on sedans/SUVs depends on their CO2 emission (the rate may increase or decrease). If the vehicle supports E85 fuel, the rate is 5% lower than for vehicles that only support common fuel. For engines above 3,000 cc, the rate remains unchanged at 50%.

Truck: Most pickup trucks in Thailand emit more than 200 g. CO2 per km, so that excise tax will increase by 2-3% for next year.

PPV: Pickup-based Passenger Vehicles (e.g. Fortuner, Mu-X, Everest, etc.) will be subject to 10% more excise tax (most PPV in Thailand emit more than 200 g. CO2 per km).

Hybrid: Vehicles with low CO2 emission will be subject to the same excise tax rate of 10%. For some models that emit more than 100 g. CO2 per km., such as Mercedes-Benz S300 and BMW Active Hybrid, the tax will be increased by 10%.

Overall, the new rate will affect most cars in the market, and the tax will increase by 3- 10%.

VI. Important Supreme Court Decision

SCD 4308/2550: Warranty Clause Prescription Period: Under Section 601 of the Civil and Commercial Code (CCC), the prescription period for a claim for rectification

of defects under “hire of work” agreements is one year from the appearance of the defect.

This prescription period, however, only applies to claims under Section 600 CCC, i.e. if there is no special agreement between the parties regarding a warranty obligation.

In case the warranty obligation is specified in the contract, damages from defects can be claimed up to 10 years after the occurrence of the defect as long as the claimant can prove that the defect occurred during the warranty period (Section 193/30 CCC). In the worst case scenario, the claim can be made within 10 years after the last day of the warranty period (if the defect occurs on the last day).