Welcome back to the second issue of our Legal News Update (Thailand) in 2015.

I. Stamp Duty:

The Revenue Department (RD) has released the Announcement of the Director General Notification on Stamp Duty No. 54, which became effective and enforceable since 5

April 2015. This new regulation requires taxpayers to pay stamp duty with cash, instead of affixing the stamp duty, for the following documents:

Rental (lease) agreements for land, buildings, other constructions, or floating houses with a contract value of not less than THB 1 million;

For service agreements (hire of work) with a service fee of not less than THB 1 million.

In the past, it was a common practice to affix the stamp duty only when a contract should be used as evidence in the court of law or to be presented to any public authorities.

This is no longer possible for the aforementioned types of agreements because the stamp duty now needs to be paid within 15 days after the date of the contract. Since the

stamp duty needs to be paid by cash, the taxpayer has to go to the RD to pay it, so the RD can monitor the compliance with the required timeline.

Previously, it was only required for lease and service agreements with the government or other public authorities as the lessee or hirer to pay the stamp duty by cash but this new Director General Notification extends the scope to cover high value private contracts as well.

II. Wages for Daily Employees:

Many business operators, employers and even lawyers are still confused about the calculation of wages and overtime payments for daily workers.

To avoid misunderstandings, here are some basic rules:

Daily workers are entitled to wages during leaves under the law (i.e. sick leave, vacation leave);

Daily workers are entitled to wages during public/national holidays;

Daily workers are not entitled to weekly holidays or weekend (usually Saturday and Sunday or only Sunday depending on the working regulation).

III. Passport Issuance:

The Department of Consular Affairs now offers an express service to issue Thai passports. There are 2 types of services:

1. Passport issuance within the next working day (service charge THB 2,000).The offices offering this service are:

Bangna-Srinakarin, Pinklao, the Government Complex Building at Cheangwattana and the 14 provincial Passport offices.

2. Passport issuance within the same day (service charge THB 3,000). For this type of service, the applicant must submit the application and pay the fee before 12 pm. The passport will be ready during 3.30 pm. to 4.30 pm. on the Although Lorenz & Partners always pays greatest attention on updating the information provided in this newsletter

we cannot take responsibility for the topicality, completeness or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is

incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent.

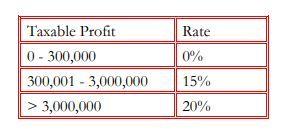

V. IHQ and ITC:

The Revenue Department has announced the Royal Decree number 586 and 587 regarding tax incentives for International The qualifications and criteria to be met by

A company registered in Thailand;

More than THB 10 Mio paid up capital;

At least THB 15 Mio operating expenses per fiscal year;

IHQ: provide administration or technical service, supporting service or financial management for its affiliates;

ITC: carry out business of purchasing and selling goods, materials, and parts or providing services in international trades to its affiliates.

The incentives for IHQ:

15% personal income flat tax rate for expats working full-time for the IHQ;

10% tax rate for specific domestic incomes (e.g. service, royalty);

Tax exemption for specific foreign incomes (e.g. service, royalty, dividend, share transfer, sale of goods);

Withholding tax exemption for dividends paid by IHQ to foreign affiliates;

Withholding tax exemption for loan interest, borrowed by IHQ from its foreign affiliate, to be used for financial management for its other affiliate;

Special business tax exemption for loan made to its affiliates for financial management.

The incentives for ITC:

15% personal income flat tax rate for expats working full-time for the ITC;

Tax exemption for incomes related to foreign sales and purchasing of goods;

Withholding tax exemption for dividends paid by ITC to foreign affiliates. Basically, the tax incentives under the new regulations are applicable for 15 years, which

are longer than the previous Regional Operating Headquarter scheme (ROH).

VI. Inheritance Tax:

On 22 May 2015, the National Legislation Assembly (NLA) has approved the draft Inheritance Tax Act. This legislation will impose a 10% tax rate

on the part of inheritances exceeding THB 100 million. In case the inheritance is received by the parents or descendants, the tax rate is reduced to 5%. Legal, Tax and Business Consultants Legal News Update (EN) L&P

Inheritances which fall under the scope of this law are:

Immovable properties;

Securities under the Securities and Exchange law;

Deposits or other monies which can be withdrawn from any financial institute;

Vehicles with registration;

Other assets to be announced by the Royal Decree. The payable tax can be paid in instalments for a maximum period of 5 years.

There are penalties, imposed under the law, for:

Default of tax filing, fine up to THB 500,000;

Destruction, removal or hiding of the inheritance, imprisonment up to 2 years and/or fine up to THB 400,000;

Giving falsify statement or tax avoidance, imprisonment up to 1 year and/or fine up to THB 200,000. This law will be enacted and published in the

Royal Gazette at the later stage. Then it will

be effective within 180 days thereafter, expectedly within the beginning of the next

year. We will keep you updated.

VII. Amendment of the Civil and Commercial Code on Guarantee and Mortgage:

In the attempt to help individual guarantors and mortgagers, especially the person who guarantees or mortgages his/her asset against the debt of others, the Cabinet proposed the amendment of the guarantee and mortgage law in the Civil and Commercial Code (CCC). Despite many concerns and suggestions from the banks and private sector regarding the major effects on bank guarantees and applications for credit by juristic persons which may cause more harm than benefits, the National Legislative Assembly (NLA) enacted and announced the amendment of the CCC (no. 20) on 13 November 2014 which took effect on 12 February 2015.

Thereafter, the Cabinet and the NLA were trying to close such loopholes of the newly enacted law to avoid any major effect on guarantee and mortgage issues for the banks

and juristic persons. This amendment of the CCC (no. 21) has been approved by the Cabinet and sent to the NLA in February 2015, almost immediately after the former

Amendment (no. 20) became effective. The NLA passed the proposed new amendment in May 2015 and later the Amendment of the CCC (no. 21) has been announced in the Royal Gazette on 14 July 2015.

The main point of the new amendment (no. 21) is to lessen the impacts on the bank guarantor by allowing the guarantors who

are juristic person to be able to agree to be liable as a co-debtor and allows the banks to agree in advance for all extension of time for the debt payment, which otherwise release other guarantors from the guarantee duty.

Moreover, the amendment also permits the director of the company who mortgages his/her asset against the company’s debt, so that they can agree to be liable for more than the mortgaged asset value if such person enters into a separate guarantee agreement. It is a common practice of the bank in Thailand to ask the director of the company to give a guarantee, on top of the mortgage, against the debt of his/her company.

See you next issue!