Welcome back to the third issue of our Legal/Tax News Update (Thailand) in 2015.

I. Amendment of the Civil Procedure Code on class action

On 8 April 2015, the amendment of the Civil Procedure Code (CPC) has been enacted and proclaimed in the Royal Gazette. The new chapter, named “Class Action

Case” has been added to the CPC, with 49 new sections (Section 222/1-222/49).

This amendment is a product of the consultation of the Security Exchange Commission of Thailand (SEC) submitted to the Office of the Council of State 14 years ago, trying

to enact the right to file legal cases on behalf of injured stakeholders.

The amended CPC allows the group of persons (called “Group Members”) who have the same interests or rights, originated from the same facts or same legal principle, to file a class action to the Court of First Instance, but not to the sub-district Court (Kwaeng Court).

The type of cases which can be filed as a class action case have to be related to:

– Tort case;

– Breach of contract case; or

– Claim for any right under other laws, e.g. Environment, Consumer Protection, Labour, Security Exchange, Trade Competition (Anti-trust).

After the case is filed by the Plaintiff (the first group of plaintiffs who initiate the case) the case will be notified to the Group Members. An individual Group Member can

choose to opt-out (and no longer be a Group Member) and file an individual case.

The judgment is binding to all Group Members. The case can be appealed and, if approved, “dika” appealed to the Supreme Court, regardless of the claim amount, but in

general the case cannot be appealed by only one individual Group Member.

The Court may order the Defendant to pay for the Plaintiff’s attorney fees, but not exceeding 30% of the judgement amount payable to the Plaintiff, subject to the complexity of the case, attorney expenses and discretion of the Court itself.

The law will be effective from December 2015 onwards. This will open a new era of class action cases in Thailand.

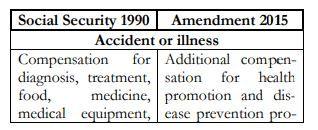

II. New Social Security Act (No. 4) B.E. 2558 (2015)

The 4th amendment of the Social Security Act was announced in the Royal Gazette on 22 June 2015. The law will take effect within 120 days after the publication, or on 20 October 2015 to be exact.

This amendment adds more benefits, increases compensations and expands the scope of eligible persons, compared to the previous scheme.

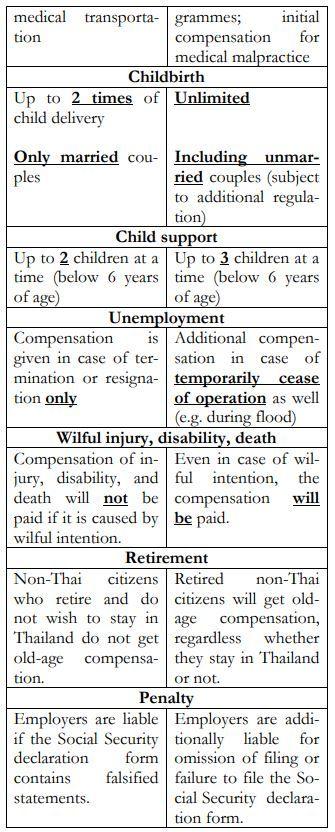

Please find below the summary of the major changes:

It should be expressly noted that the failure to file the Social Security declaration form within due time can be penalised by up to 6 months imprisonment or a fine of up to

THB 20,000 or both.

Additionally, under the newly amended law all temporary government employees, private school teachers and employees who regularly travel to work abroad are eligible to

participate in social security, while the old law prohibited these employees from participation.

It should be expressly noted that the failure to file the Social Security declaration form within due time can be penalised by up to 6 months imprisonment or a fine of up to THB 20,000 or both.

III. Real Estate

Foreigners who inherit a condominium unit in principle have to dispose it within 1 year unless such foreigners are granted a residence permit in Thailand or are allowed to

enter into Thailand according to the Investment Promotion Law. The same conditions will be applied to foreigners who accept the transfer of a condominium unit by giving.

IV. DTA Thailand – Ireland

The Double Taxation Agreement between Thailand and Ireland was signed on 11 March 2015. For more details, please follow the below link.

https://download.rd.go.th/fileadmin/download/nation/ireland_e_22042515.pdf

V. Customs Duty

The Customs Department has announced to exempt the import duty (Duty Free/Quota Free: DFQF) for goods imported from “Least Developed Countries (LDCs)”, effective from 9 April 2015 until 31 December 2020.

The importer needs to present the certificate of origin issued in accordance with the regulation of the origin for LDCs by DFQF before taking the goods out from the Customs

warehouse. In case of not being able to present the certificate of origin, the importer has to pay duty in advance and request a refund later, or pay a collateral security to the

Customs Department.

VI. Court Jurisdiction

The Office of Court Of Justice (OCOJ) announced on 15 June 2015 to set up 3 new divisions in the Criminal Court, namely 1) Human Trafficking Division, 2) Narcotics

Division and 3) Public Sector Corruption Division. Due to the facts that these types of cases are complicated and usually involve high-profile persons, specialised judges in

each area are required to handle these cases.

The jurisdiction of the Public Sector Corruption Division, which is opened in the Court of First Instance, will not overlap with the Supreme Court’s Criminal Division for

Persons Holding Political Positions. The Public Sector Corruption Division will have jurisdiction over cases involving lowerranking government officers, while the Supreme Court’s Criminal Division for Persons Holding Political Positions will handle cases involving high-ranking officers or politicians.

VII. VAT exemption for sample goods

In case a company gives sample goods to customers for testing before buying the product, this transaction is not subject to VAT. However, this only applies under the

following conditions:

– Such goods are non-consumable goods;

– The goods must be intended for temporary use in order to test the quality or effectiveness of the product itself;

– The customer will have to return the goods to the company when their testing is complete.

VIII. Social Security:

Even if you are no longer employed, you may still exercise your benefits of the Security Programme under a self-insurance scheme, Section 40. The rates for contributions and the benefits under this Section are markedly different from those of the insured persons under Section 39. The rate of the contribution varies between THB 100 to 350 depending on your choice of coverage. The covered benefits apply in the events of accidents and ailments, death, invalidity and pension benefits.

IX. New amendment of the Provident Fund Act

A provident fund (PVD) is one of the most common employee’s benefits in Thailand, and is regulated by the Provident Fund Act B.E. 2530 (1987) (PFA). Normally, the employer and the employee make equal contributions to the PVD on the agreed percentage between 2-15% of the employee’s salary every month.

The new amendment No. 4 of the PFA was announced in the Royal Gazette on 11 August 2015, and will come into effect on 9 November 2015.

The main changes to the PFA are as follows:

– Allowing the employee to make a higher contribution than the employer: The old law compelled both parties to make equal contributions and the common contribution rate is relatively low at 3-5%, so the benefit at retirement is often not enough to cover the cost of living after retirement; the new law therefore allows higher contributions by the employee.

– Temporary cease of contribution: The Treasury Minister can order to temporarily cease contributions to the PVD, in areas affected by natural disaster or crisis, for a maximum of 1 year.

– Default investment policy: Previously, if an employee did not choose an investment plan, the lowest risk investment plan was used, which only generates minimum profits for the member. Now, the PVD can set up the “Default Policy” on investment for the PVD to generate more profits.

– Retirement or resignation after 55 years old: Under the old scheme, employees could only ask for retirement benefits (e.g. instalment payments) in case of retirement at the age of 55. The new amendment also allows employees who quit after turning 55 to be able to ask for the same benefits as retirement.

Continuous saving / contribution: In case the employee drops out of the membership of a PVD (e.g. resignation, PVD is revoked, etc.), the employee can transfer all contributions to a Retirement Fund (RMF) or other PVD. This regulation is enacted to solve the problem when an employee is out of the membership of the PVD and he/she has to withdraw all funds from the PVD, which can be completely spent, instead of saving.

The new amendment is aimed to enable PVD members to make continuous contributions in a sufficient amount to cover their cost of living after retirement. X. Licensing Facilitation Act The Licensing Facilitation Act (LFA) was announced at the beginning of this year and came into effect on 21 July 2015. The aim of this act is to impose rules and regulations for more transparency and timely fashion in licensing application processes.

The LFA requires the officer to set up a specific time frame for the license application, as well as to produce a manual for the applicant. Concrete criteria and specific procedures have to be fixed. Every 5 years, these rules and criteria have to be reviewed and changed if necessary by the authorities involved.

For the English version of this act, please follow the link below:

https://www.opdc.go.th/uploads/files/2558/LICENSING_FACILITATION_ACT_2015.pdf

On the effective date of the LFA (21 July 2015), the government announced that the Licensing Facilitation Centre shall be established to give advice to the public and to initially resolve basic problems.

XI. Interesting Supreme Court Decisions

Specific Business Tax (1691/2556): This decision concerns companies that buy debts from the Financial Sector Restructuring Authority (FSRA) to be collected and managed

(factoring business).

The Supreme Court ruled that such business is considered “similar to business of the commercial banking”, because such company can enjoy the right under the credit agreements and can collect the principal amount, as well as interest, like the creditor of the loan. This is considered as a business “similar to the business of commercial banking” which is subject to Specific Business Tax.

Labour (2403-2430/2543): In order to not be subject to severance pay, a fixed-term employment agreement has to be for one of the following types of work:

– Special project work;

– Work of temporary nature with definite ending date; or

– Seasonal work;

and “these works have to be finish within a period 2 years” (Section 118 Labour Protection Act).

The Supreme Court has ruled in this case that the period of 2 years does not refer to the period of the employment agreement but it refers to the period of the actual work to

be done.

In other words, if the employer hired the employee to work on a special project, and agreement, but the project which the employee is working on lasts for 3 years, this

employment does not fall into the exemption of the severance payment. The employee would be entitled to 90 days wage severance pay at the end of the employment,

because the project period lasted longer than 2 years. The period of less than 2 years under Section 118 of the LPA refers to the period of the temporary works/ special projects, rather than the actual period of the employment agreement.

See you in the next issue!