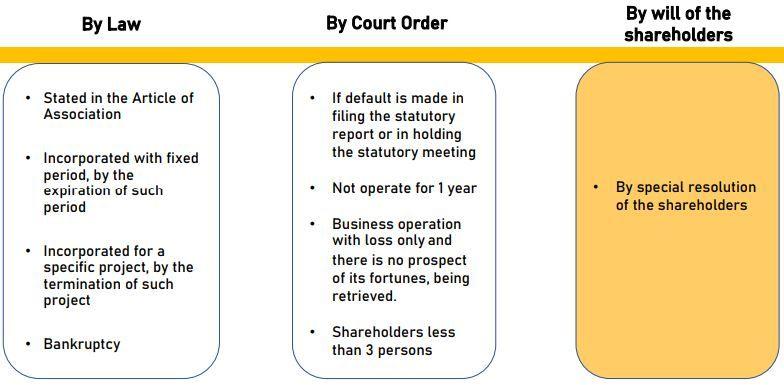

Cause of Dissolution

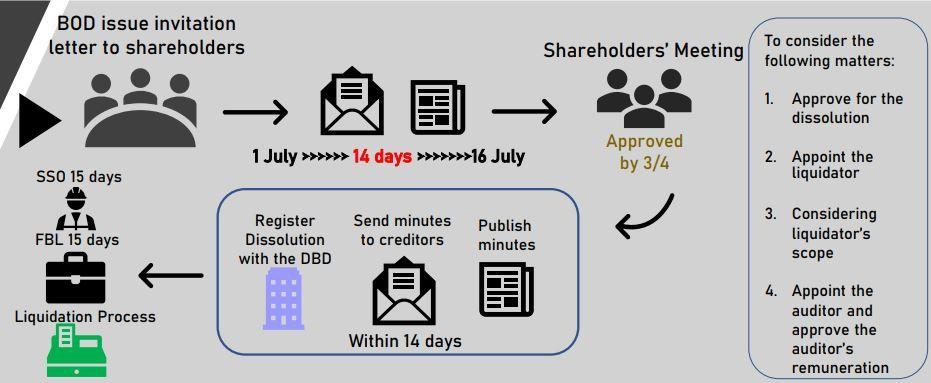

Process of Dissolution for

Company Limited that Established in Thailand

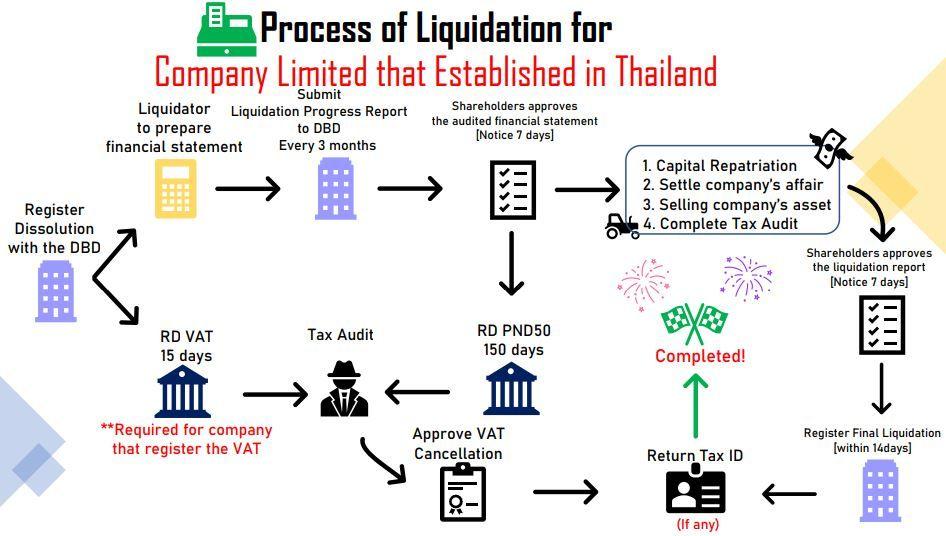

Process of Liquidation for

Company Limited that Established in Thailand

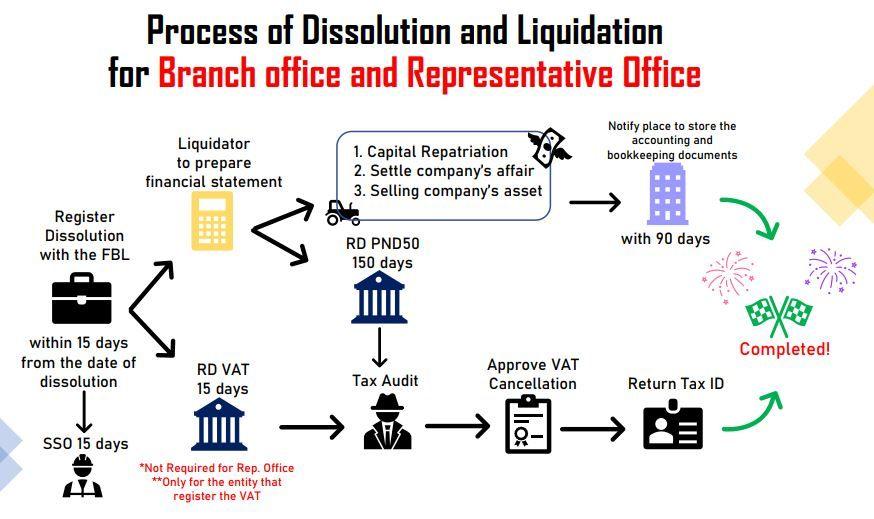

Process of Dissolution and Liquidation

for Branch office and Representative Office

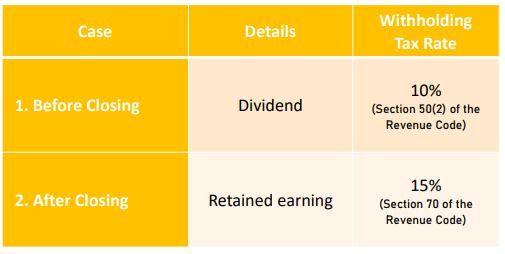

Capital Repatriation

• Bank of Thailand – Supporting documents stating the purpose of money transfer shall be provided for the amount from USD 200,000 onward

• Tax issue – Withholding tax

• Capital reserved – at least one-twentieth of the profits arising from the business of the company, until the reserve fund reaches one-tenth part of the capital of the company or such higher proportion thereof as may be stipulated in the regulations of the company

In practice – Paying dividend out before commence the dissolution process

Tax Audit by The Revenue Department

After company submit liquidation form (PP09) to cancel VAT with the Revenue Department

The Revenue department will:

➢ check the financial statements for five years backward for tax auditing

➢ Requesting for the supporting documents such as

1. Corporate income tax (PND50)

2. VAT (PP30) (including Output and Input tax report)

3. Financial reports (including trial balance, general ledger)

Tax point (Need to do and make them trust in our information)

PND50 and VAT (PP30) :- we have to prepare the reconciliation of revenue between PND50 (GL) and PP.30 (VAT submission). If there are any differences, we have to find out and clarify the difference balance such as :

Tax point (Need to do and make them trust in our information)

• PND 50

if the company has a big loss, the Revenue Department will ask us to clarify Answer: The reason can be wrong estimation of income and cost, Problem with

engineering, Disease, etc.

• PND53 and PND3

They would cross check with balance from service and rental expenses to see the completeness of our submission.

• PND 1

They would cross check with balance from salary, OT, allowance, all benefit of staff expenses

• Duty Stamp

They would ask us to provide all contracts, PO, Email. We have to check and ensure that duty stamp duly affixed for all service contract, Purchase Order and Email.

Financial Reports

• Asset

➢ Cash and Bank:

1. Closing bank account before closing company with MOC

2. The client to transfer the remaining bank balance to our trust account first

➢ Balance of the following items has to be “zero” before closing down

1. Goods, Inventories

2. Account receivable

3. All Advance and Prepaid:

4. Loan to… – It can be repayment or waiving loan (having waiver letter)

5. Fixed asset

Recommend “Don’t forget to submit VAT for Goods, Inventories and Fixed Asset”

Financial Reports

• Liability

➢ Balance of the following items has to be “zero” before closing down (write off and submit PND.50)

1. Account payable

2. Interest payable (additionally submit PND 54 or PND 53 including waiving letter)

3. All Advance and Prepaid

4. All Advance from client

➢ Accrual expenses: May have the audit fee or some expenses which are required for closing down

process.

➢ Loan from…:

1. Repayment or Write off and submit PND 50 (Waiver Letter)

2. If money not sufficient – increase share capital for repayment of loan

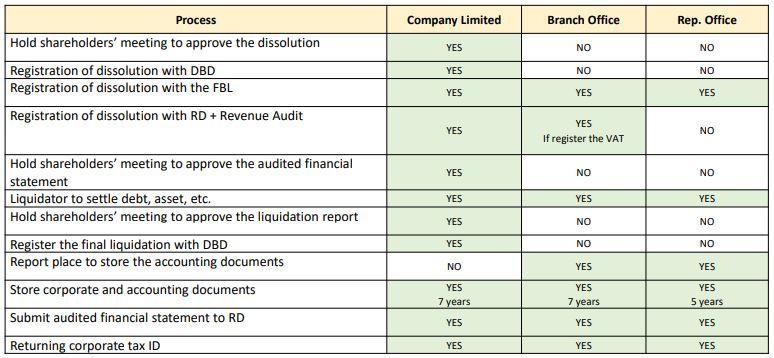

Post Liquidation Process

1. Shareholders’ book, corporate documents, and accounting documents to be kept with the company for at least 7 years from the date of final liquidation

2. Returning corporate tax id to RD

Comparison of the Dissolution Process

for Each Type of Entities

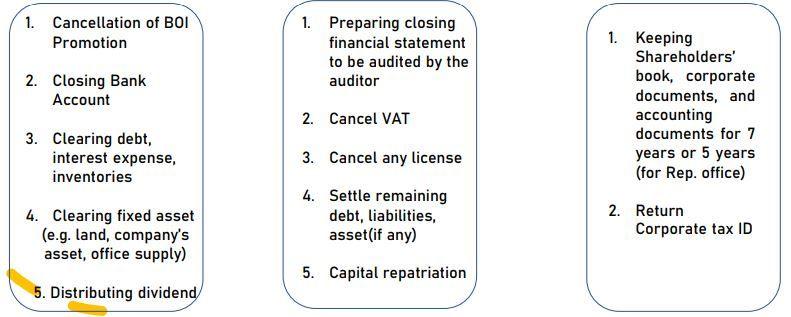

To-Do List for Each Process Pre-Dissolution After Registering the Post-Liquidation

Dissolution