Dr Constantin Frank-Fahle LLM

Senior Associate, Lorenz & Partners Co Ltd

Till Morstadt

Managing Partner, Lorenz & Partners Co Ltd

Energy policy; Feed-in tariffs; Foreign investment; Renewable energy; Thailand

I. Introduction

Thailand is an important hub for foreign investors within the Association of Southeast Asian Nations (ASEAN). The continuous growth of GDP (3.5% expected in 2017) and the ambitious plans of the Thai Government to expand the infrastructure, especially the public transport, will lead to an increase of energy consumption. With a ratio of 36% of the total energy consumption, the industrial and transportation sectors are the largest sources of demand.

According to the Ministry of Energy, the energy consumption of Thailand has a current growth of 2.67%

p.a. and is expected to grow by 75% in the next two decades. The current energy consumption is mainly covered by fossil fuels, in particular gas and coal. While gas is produced in vast quantities within the country, coal and oil are mostly imported. Due to the dependency on imports, Thailand’s energy supply is highly subjected to regional political developments.

Regarding the increasing demand for energy, Thailand plans to make a big step towards renewable energies. Apart from climate protection, renewable energy produced in Thailand is also interesting for political reasons as global climate protection has gained the government’s attention. Therefore, Thailand intends to replace the old power fleet with renewable energies.

The following article will focus on the situation of Thailand’s energy sector, in particular the recently published Energy Plan 2036 (II.). The Energy Plan 2036—and accordingly this article—mainly focuses on renewable energies. Furthermore, the article provides a detailed overview of the investment promotions provided by the Thai Government (III.). The article outlines the restrictions that apply to foreign investors and discusses

II. Energy Plan 2036

The Thai Government aims to raise the ratio of renewable energy from 12.94% in 2015 to 30% by 2036. Furthermore, the Thai Prime Minister has promised to reduce the emission of greenhouse gases by 25% by 2036.

1. Political plans

To attain these goals the Thai Government has outlined the Thailand Integrated Energy Blueprint (TIEB). The TIEB is a comprehensive framework for the development of the energy sector by 2036. It contains the following objectives:

- renewable energies shall become a major part of the national energy supply in order to replace fossil fuels and oil imports;

- strengthening of the national energy security;

- establishing facilities for alternate energy production on the communal level;

- nationwide support for the production of renewable energy; and

- promotion of competitiveness through research and

Moreover, the TIEB contains the following independent plans:

- the Power Development Plan 2015–2036 (PDP);

- the Alternative Energy Development Plan 2015–2036 (AEDP);

- the Energy Efficiency Plan 2015–2036 (EEP);

- the Gas Plan 2015–2036; and

- the Oil Plan 2015–2036.

The PDP came into force on 30 June 2015, after it was approved by the National Energy Policy Council. The PDP focuses on improving the power system reliability by reducing dependence on natural gas power generation; increasing the share of coal power generation through clean coal technology; importing power from neighboring countries and developing renewable energy. It outlines the strategic goals for Thailand’s energy sector, such as:

- energy security: less dependence on natural gas and more on renewable energies;

- economy: less impact on cost of living;

- ASEAN regional integration: cooperation on energy security and development of renewable and alternative energy; and

- ecology: releasing 37% less carbon

The AEDP was adopted by the National Energy Policy Council on 17 September 2015 and focuses on promoting energy production within the full potential of domestic renewable energy resources. The AEDP intention is to increase the dependence on renewable energy by 30% by 2036. It defines goals for the increase of electricity from renewable energy from approximately 8,000MW in 2015 to approximately 20,000MW by 2036. Among others, the following capacities are envisaged for the respective sectors:

- waste-to-energy: approximately 550MW (2015 approximately 65MW);

- biomass: approximately 5,570MW (2015 approximately 2,730MW);

- biogas from waste/wastewater: approximately 600MW (2015 approximately 372MW);

- biogas from plants: approximately 680MW;

- wind energy: approximately 3,000MW (2015 approximately 234MW);

- solar energy: approximately 6,000MW (2015 approximately 1,400MW);

- hydropower (small): approximately 376MW (2015 approximately 172MW); and

- h y d r o p o w e r ( l a r g e ) : unchanged—approximately 3,000MW (2015 approximately 3,000MW).

Moreover, the EEP aims at reducing the energy intensity (consumption divided by GDP) by 30% by 2036 in comparison with 2010 and to reduce 7% of the emissions from the transport and energy sector by 2020 in comparison with 2005.

Lastly, the Gas Plan 2015–2036 focuses on the reduction of the reliance on natural gas, whereas the Oil Plan 2015–2036 is a long-term plan to support fuel management.

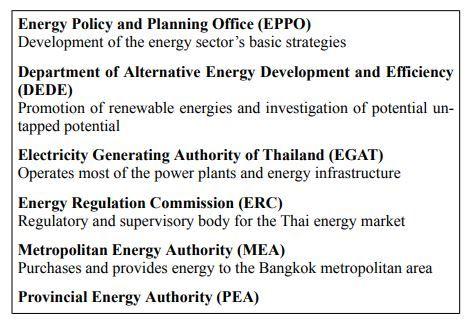

2. Authorities

The Ministry of Energy and the Prime Minister are responsible for the implementation of the country’s energy policy. The following authorities have been assigned responsibilities in this respect:

III. Investment promotion

Thailand currently provides two different promotion schemes: the Feed-in-tariff (FiT) and promotions through the Board of Investment (BOI).

Thailand was the first ASEAN country to implement a FiT on renewable energies. On 15 December 2015, the National Energy Policy Council announced new FiT figures. The FiT provides that energy producers receive a fixed price for energy they sell to the MEA or PEA. The MEA or PEA conclude a so-called Power Purchase Agreement (PPA) with the energy producer which guarantees the FiT for a fixed period of time. The FiT is granted for 20 years, except for power systems fuelled by landfill gas will be granted only 10 years. Thus, investment in renewable energies can be secured.

Moreover, the BOI offers various investment promotions, e.g. the exemption of corporate income tax for up to eight years; exemption from import duties on machines and raw materials as well as some non-tax incentives, such as the possibility for foreigners to own land and to facilitate the employment of foreign experts. The following table gives an overview of selected incentives:

* These include, amongst others, the possibility for foreigners to own land and easier employment of foreign experts.

** The amount of granted corporate income tax exemption is capped at the amount of total initial investment excluding cost of land and working capital.

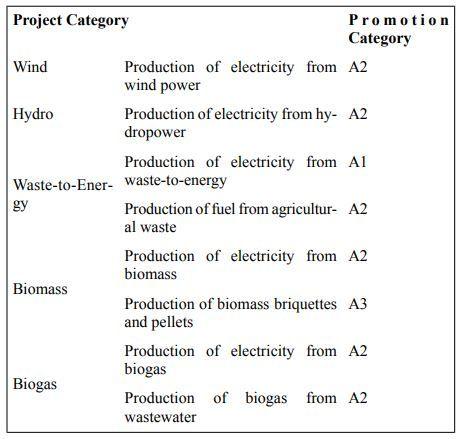

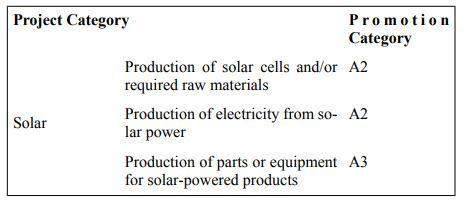

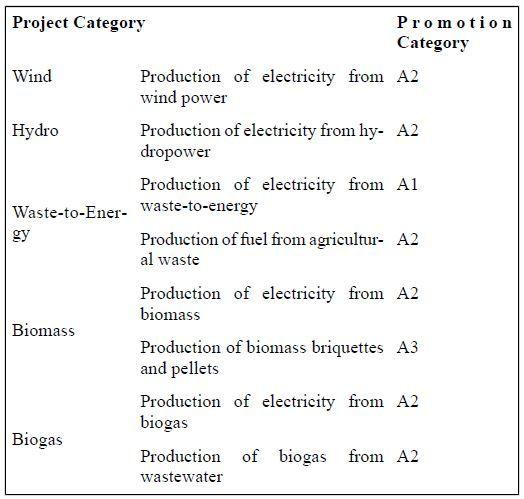

Listed below are the respective investment project categories for the various kinds of renewable energies:

1. Solar energy

Solar power is a resource abundantly available in Thailand but its potential is so far mostly untapped. The potential of 1% of possible installation in Thailand would be approximately 42,356MW. While there was an installed capacity in 2015 of approximately 1,400MW, Thailand aspires to a total production of approximately 6,000MW by 2036.

(a) FiT for Solar Energy

In 2013, the EPPO decided to promote rooftop photovoltaic facilities with a total capacity of up to 200MW, whereof 100MW were reserved for industrial production and 100MW for private buildings. A FiT of THB 6.85 per KWh is available for private rooftop photovoltaic facilities with a capacity of up to 10KWp, THB 6.40 per KWh for industrial facilities with a peak performance of 10–250KWp, and THB 6.01 per KWh for industrial facilities with a peak performance between 250 and 1,000KWp. Facilities in the Southern border provinces receive an additional bonus of THB 0.50 per KWh.

On 22 October 2014, the Ministry of Industry adopted a guideline whereby rooftop photovoltaic facilities no longer require a Factory Permit in order to reduce administrative restrictions especially for private investors.

(b) Investment promotions by the Board of Investment

Manufacturers of solar cells and/or related raw materials receive up to eight years of corporate income tax exemption (however, capped at the amount of total investment), as well as exemption from import duties on machines and raw materials.

The same investment promotions are available for the production of electricity from solar energy.

The manufacture of parts and/or equipment of solar-powered products receives a corporate income tax exemption for five years, as well as exemption from import duties on machines and raw materials.

(c) Public–private partnerships

In 2014, the Thai Government announced the Governmental Agency and Agricultural Cooperatives Programme (Agro-Solar). Agro-Solar has an overall target of 800MW. The target of the programme is to realize solar farms with a capacity up to 5MW in the form of Public-Private Partnerships (PPP) with the governmental sector or agricultural cooperatives as public partners. The ERC published the details and regulations first in March 2015 and after approval, the ERC announced the detailed application process on 17 September 2015.

The Agro-Solar promotion is split into two phases:

- in the first phase, projects receive a FiT of THB 66 per KWh. A PPA shall be concluded with the MEA or PEA which guarantees the power purchase and the FiT for up to 25 years; and

- in the second phase, projects will receive a FiT rate of THB 12 per KWh for the same duration.

The parties to the PPA are the MEA/PEA and the government authority or the municipality who also acts as the project owner, whereas each authority or municipality shall only be entitled to own one project per district. Private investors can participate in the project through a PPP via a company registered in Thailand. They can participate in more than one project (however, limited to a total capacity of 50MW).

During the term of the PPA, a transfer of the project is only possible in limited cases and requires the ERC’s approval. In practice, this means that the PPP is committed for a period of 25 years, after which the project may be transferred to one of the partners, as is commonly the case with BOT projects (Build—Operate—Transfer).

2. Wind energy

The total installed capacity of wind energy in Thailand was 234MW in 2015. The AEDP envisages 3,000MW by 2036.

(a) FiT

The FiT for wind energy is THB 6.06 per KWh, guaranteed for up to 20 years. Facilities in the Southern border provinces receive an additional bonus of THB

0.50 per KWh.

(b) Investment promotions by the Board of Investment

The BOI promotes the production of electricity from wind power with eight years of corporate income tax exemption (capped at the amount of total investment), as well as exemption from import duties on machines and raw materials.

3. Hydropower

Hydropower is currently the world’s largest renewable energy source and Thailand has plenty of water resources that can be used to generate electricity.

In 2015, facilities for the production of energy from hydropower with a total capacity of approximately 3,172MW were installed in Thailand (including large power plants operated by the EGAT with a capacity of approximately 3,000MW).

The AEDP foresees a capacity increase of small-scale hydropower plants from 172MW in 2015 to 376MW by 2036. An increase of large power plants is not planned at the moment.

(a) FiT

The FiT for small-scale producers of energy from hydropower (capacity of up to 200KW) is THB 4.90 per KWh, guaranteed for up to 20 years. Facilities in the Southern border provinces receive an additional bonus of THB 0.50 per KWh.

(b) Investment promotions by the Board of Investment

The production of electricity from hydropower receives eight years of corporate income tax exemption (capped at the amount of total investment), as well as exemption from import duties on machines and raw materials.

4. Waste-to-energy

Due to its growing population and urbanisation, Thailand has an increasing waste problem. More than half of the waste produced per day could be reused for energy or recycling.

In 2015, approximately 65MW of energy was produced by waste-to-energy projects. This capacity shall be increased to 550MW by 2036 according to the AEDP.

(a) FiT

The FiT for an installed capacity of up to 1MW of waste-to-energy consists of a fixed amount of THB 3.13 per KWh, for an installed capacity between 1 and 3MW THB 2.61 per KWh and for an installed capacity above 3MW THB 2.39 per KWh, guaranteed for up to 20 years. Furthermore, there is a variable part that is fixed at THB 2.69–3.21 per KWh (depending on capacity) until 2017

and shall be adjusted in accordance with inflation thereafter. Facilities in the Southern border provinces receive an additional bonus of THB 0.50 per KWh.

(b) Investment promotions by the Board of Investment

Waste-to-energy projects receive eight years of corporate income tax exemption (without being capped at the amount of total investment), as well as exemption from import duties on machines and raw materials.

The production of fuel from agricultural waste receives eight years of corporate income tax exemption (capped at the amount of total investment), as well as exemption from import duties on machines and raw materials.

5. Biomass

According to the AEDP, the production of energy from biomass shall be increased from approximately 2,730MW in 2015 to 5,570MW by 2036.

(a) FiT

The FiT for an installed capacity up to 1MW of electricity generated from biomass consists of a fixed amount of THB 3.13 per KWh, for an installed capacity between 1 and 3MW THB 2.61 per KWh and for an installed capacity above 3MW THB 2.39 per KWh, guaranteed for up to 20 years. Furthermore, there is a variable part that is fixed at THB 1.85–2.21 per KWh (depending on capacity) until 2017 and shall be adjusted in accordance with inflation thereafter. Facilities in the Southern border provinces receive an additional bonus of THB 0.50 per KWh.

(b) Investment promotions by the Board of Investment

The production of electricity or fuel from biomass receives eight years of corporate income tax exemption (capped at the amount of total investment), as well as exemption from import duties on machines and raw materials.

The production of biomass briquettes and pellets receives five years of corporate income tax exemption (capped at the amount of total investment), as well as exemption from import duties on machines and raw materials.

6. Biogas

The production of energy from biogas was approximately 372MW in 2015. This capacity of electricity generated by biogas from waste/wastewater and plants shall be increased to 1,280MW by 2036 according to the AEDP.

(a) FiT

The FiT for producers of electricity generated from biogas (waste/wastewater) is THB 3.76 per KWh, guaranteed for up to 20 years. Facilities in the Southern border provinces receive an additional bonus of THB 0.50 per KWh.

The FiT for producers of electricity generated from biogas (plants) consists of a fixed amount of THB 2.79 per KWh, guaranteed for up to 20 years, as well as a variable part that is fixed at THB 2.55 per KWh until 2017 and shall be adjusted in accordance with inflation thereafter. Facilities in the Southern border provinces receive an additional bonus of THB 0.50 per KWh.

(b) Investment promotions by the Board of Investment

The production of electricity from biogas and the production of biogas from wastewater receive eight years of corporate income tax exemption (capped at the amount of total investment), as well as exemption from import duties on machines and raw materials.

II. Foreign investment law

Foreigners carrying on business in Thailand are subject to the Foreign Business Act B.E. 2542 (1999) (FBA). According to the FBA, foreigners are all natural persons not having Thai citizenship, juristic persons not registered in Thailand or juristic persons registered in Thailand but having 50% or more of their shares held by the two aforementioned kinds of persons.

However, BOI-promoted companies are exempted from most of the FBA’s restrictions. In particular, foreigners can hold 100% of the shares. In addition, BOI-promoted companies are allowed to buy and own land (as far as required for the project).

Furthermore, the BOI promotion facilitates the employment of foreign experts (as far as required for the project). Work permits will be granted without further

efforts. In contrary, non-BOI-promoted companies must fulfil certain capital requirements in order to employ foreigners, i.e. having a registered and fully paid-up capital of THB 2 million for each work permit and a specific amount of local staff.

One option to operate without BOI promotion is entering into a joint venture with a Thai partner who holds the majority of the company’s shares. In such case, the restrictions of the FBA do not apply since the company will not be regarded as “foreigner”. Whether or not a joint venture should be entered into, should be considered carefully.

If neither a joint venture nor a BOI promotion is an option, a Foreign Business License (FBL) may be applied for with the Ministry of Commerce for certain business activities. The application process is lengthy and complex.

III. Outlook

Thailand’s Energy Plan 2036 offers foreign investors attractive investment opportunities in the sector of renewable energies. During the last years, Thailand has put a remarkable effort into articulating a legal framework enhancing the development of renewable energies. This is particularly true for the Alternative Energy Development Plan 2015–2036 that—originally drafted in early 2015—was fundamentally revised and extended within half a year. In addition, the Thai Board of Investment grants investors a range of attractive investment promotions with regard to renewable energy projects.

Expansion of the power grid capacity will be crucial for the success of the implementation of the energy policy, for which the EGAT has allocated a budget of THB 300 billion for the next five years.

It remains to be seen if the ambitious goals of the Thai Government can be realised. However, it is already obvious that due to the extensive investment promotions and incentives Thailand offers attractive investment opportunities for foreign investors.